- The crypto market erased billions of dollars off its total market cap on January 3.

- Cardano’s price dropped by a staggering 18%.

- The crash followed reports projecting a bleak outlook for 2024.

As expectations soared for a potential Bitcoin Spot ETF approval, the crypto market spontaneously decided to take a brief dip, sending shockwaves through altcoins, particularly impacting the prices of Cardano, Solana, and Ethereum.

Amid mounting fears and uncertainty surrounding the SEC’s decision for January 10, market participants find themselves on edge, analyzing each candle, wondering if it’s best to buy or panic sell.

Cardano and Altcoin Markets Wipe Billions

December proved to be an exciting month for the crypto market, with altcoins like Cardano and Solana gaining up to 100% in value, stirring excitement among investors. However, while everyone celebrated, anticipating the new year to kick off the highly awaited bull run fueled by the potential approval of a Bitcoin Spot ETF, the market decided it was time to disappoint.

Sponsored

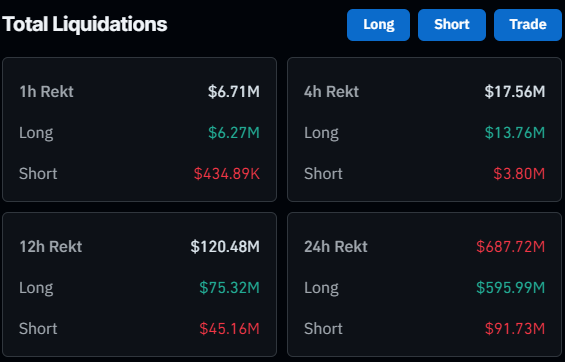

On Wednesday, the crypto market spontaneously wiped out approximately $687 million across crypto-tracked futures, primarily thanks to Bitcoin’s grand drop from the $45,000 price level to $40,800. Shortly after, altcoins, including Cardano, crashed by at least 18% to $0.49, marking its lowest point over the past 30 days.

The crash liquidated about $8 million worth of long positions across ADA-tracked futures, wiping $70 million in Cardano’s open interest. Still, due to the mounting anticipation of a bull run this year, ADA quickly returned from its fall, immediately surging by 14%. At press time, ADA exchanged hands at $0.56, with a trading volume exceeding $1.1 billion.

While it is uncertain what caused the crash, there was a lot of uncertainty and panic at the time of the decline, mainly revolving around the FOMC’s meeting and the SEC’s decision on the Bitcoin Spot ETF.

What Caused Cardano and the Market to Crash?

Earlier on Wednesday, reports surfaced suggesting that the FOMC was planning to dampen the festivities by hinting at potential interest rate hikes before its meeting on January 30. This development raised concerns, especially considering that the committee had laid the groundwork for rate cuts in 2024 on December 13, 2023.

Sponsored

While the FOMC December meeting minutes didn’t explicitly indicate any imminent rate hikes, they didn’t adopt a particularly dovish tone. According to the document, the committee noted a high level of uncertainty on how it would introduce rate cuts in 2024.

Adding to the prevailing fear and uncertainty, numerous news outlets cited a Matrixpoint report earlier on Wednesday. The crypto investment firm predicted that the SEC would reject the Spot ETF proposals on January 10, calling for Bitcoin’s impending descent to $36,000. This series of events triggered panic in the market, prompting many to close their positions.

On the Flipside

- Correlation doesn’t imply causation; multiple factors could contribute to the crash.

- The SEC reportedly held meetings with various exchanges, including NASDAQ, NYSE, and others, to formalize its stance on the decision regarding the Bitcoin Spot ETF.

- Bloomberg analysts forecast a 90% chance of the SEC approving the Bitcoin ETF.

- Matrixpoint’s recent report contradicts its other reports, predicting an imminent approval of the ETF by the SEC and a subsequent rise in Bitcoin’s value to $50,000.

Why This Matters

The recent market downturn underscores the crypto market’s sensitivity to regulatory developments and reports that evoke fear.

Read more about the Orbit Bridge Hack:

Orbit Cross-Chain Bridge Hit for $82 Million

Read how Whales splurged following this crash:

Whales Flip 95M SOL, MATIC Challenging The Market Correction