- Cardano and Terra have a high percentage of dead coins.

- Many other layer 1s were named as high failure rate ecosystems.

- 2023 was a tough period for survival.

Many projects aspire to become the next success story in the fiercely competitive crypto industry. However, a recent report by Alpha Quest highlighted the inherent challenges in making it, noting that two-thirds of crypto projects died in 2023. The research revealed that most defunct projects were built on the Cardano and Terra blockchains.

High Failure Rate on Cardano, Terra Ecosystems

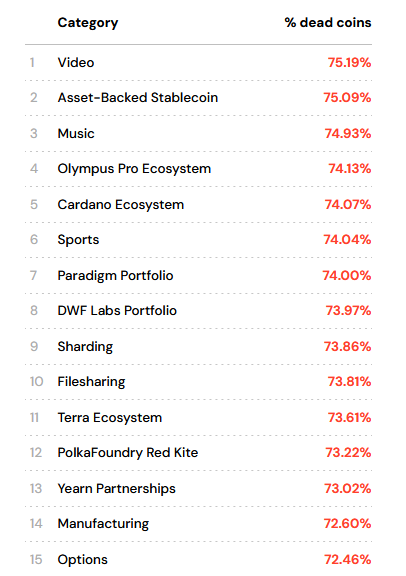

Research conducted by Alpha Quest found that Cardano and Terra were among the top ecosystems for dead coins. Cardano scored a 74.1% death rate for its projects, with Terra trailing closely behind at 73.6%. However, Olympus Pro scored highest for the ecosystem with the most dead coins, at 74.13%.

Olympus Pro rose to prominence off the back of its lofty returns in the thousands of percent. However, in late 2021, the project became embroiled in Ponzi accusations based on the sustainability of its high returns, leading to a significant fall in interest and price.

Sponsored

Alpha Quest research also spotlighted the Near Protocol, Celo, Harmony, Zilliqa, and Moonriver protocols, scoring 62.96%, 61.4%, 56%, 51.4%, and 51.2%, respectively, for dead coin projects.

The research methodology involved examining over 12,000 cryptocurrencies to derive the sobering statistics for dead coins.

Alpha Quest Methodology

Alpha Quest’s methodology involved compiling a database of 12,343 cryptocurrencies from CoinMarketCap. Each coin was tagged across 148 designations, including a particular blockchain ecosystem, niche sector, and core use case, enabling understandable groupings.

The final step involved determining whether each coin was dead based on meeting at least one of the following criteria: 24-hour trading volume below $1,000, liquidity lower than $50,000, no X activity for 3+ months, or a deleted X account, non-functional website, or delisting from CoinMarketCap.

Applying this methodology, Alpha Quest determined that 75.2% of the coins tagged “Video” were dead, 75.1% of coins tagged “Asset-Backed Stablecoin” were dead, and 74.1% of the coins tagged “Cardano Ecosystem” were dead.

Is Cardano Dead?

While Alpha Quest’s findings suggest that the Cardano ecosystem is struggling, Cardano Cube shows hundreds of ecosystem projects ranging the full gamut of applications, including DEX, wallet, AI, infrastructure, and community and DAO, to name a few.

Further dispelling the narrative that Cardano is dying, Santimant noted that Cardano developer activity is ranked second highest by GitHub submissions, being pipped by Internet Computer (ICP).

However, per Messari data, Active Addresses on Cardano have fallen significantly from the February 2022 high of 230k to 55.6k, indicating a notable drop in user activity.

On the Flipside

- Alpha Quest noted that the average lifespan of a crypto project is just three years, which is shorter than a typical market cycle.

- The high failure rate of projects in 2023 aligns with expectations around crypto winter.

- While Terra spun off into a community-driven project, the association with Do Kwon limits investor appeal.

Why This Matters

Alpha Quest’s findings illuminate the ruthless dynamics within the crypto industry and underscore the fickle nature of digital asset investors. The prevalent failure rate among crypto projects emphasizes the experimental nature of this burgeoning sector and draws attention to the overwhelming abundance of choices for investors.

Read about Cardano’s struggles to break key price resistance levels here:

Cardano (ADA) Slips Under $0.6 as Market Backtracks on Gains

Find out more on the Bitcoin miners’ pushback against the US government here:

Bitcoin Miners Sue US Agency Over “Invasive Data Demands”