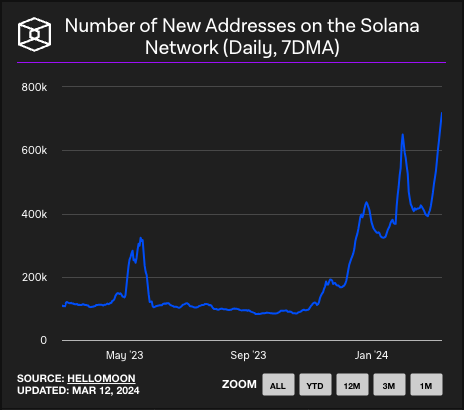

- Solana‘s daily new addresses reach an all-time high, highlighting network expansion.

- Surpassing Bitcoin and Ethereum in daily activity, Solana eyes the BNB Chain.

- Despite high transaction volumes, Solana’s figures are flawed.

Solana has carved out a niche as a high-performance platform capable of processing transactions swiftly and at lower costs. With its native token, SOL, hitting $150 amid a broader bull market, Solana’s network has seen a significant surge in activity.

The recent record-breaking number of daily new addresses on Solana suggests growing interest in the network. These figures have led traders to speculate on its future, including its potential to take fourth place as the largest crypto and surpass Binance’s BNB.

Solana’s Network Surge and How It Compares to BNB

The Solana blockchain has recently witnessed a remarkable increase in daily new addresses, reaching an all-time high. The number of new daily active addresses reached 717,000 on Tuesday, March 12, based on a seven-day moving average. This milestone demonstrates the platform’s growing appeal and the burgeoning activity within its ecosystem.

This activity was coupled with bullish momentum in the crypto market. As Bitcoin broke $71,000, Solana reached its two-year high of $150 on Tuesday. With rising activity, some have speculated that Solana could overtake the BNB Chain as the fourth-largest crypto. But what do the numbers say?

Sponsored

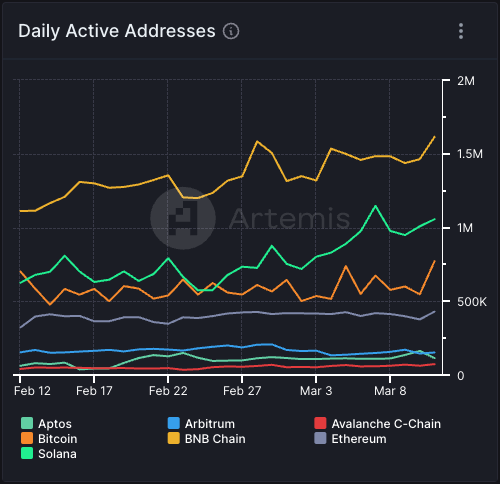

A surge in new daily active users puts the total number of Solana’s daily addresses ahead of Bitcoin and Ethereum. However, the network is still trailing behind BNB Chain by about half a million addresses. This is due to Binance’s position as a leader among crypto exchanges, attracting many users to its chain.

Moreover, the BNB chain and Bitcoin’s network have also seen a significant increase in daily active addresses. Therefore, if unique addresses indicate a token’s performance, Solana still has a long way to go before it can reliably outpace BNB.

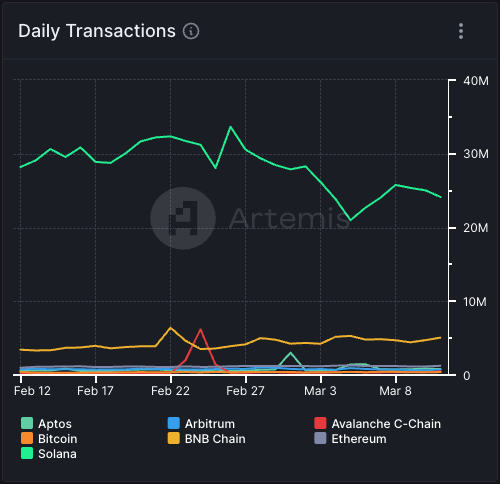

Solana Ahead in Transaction Volume: Or Is it?

Another seemingly impressive figure is Solana’s transaction volume, with daily transactions outpacing those of BNB Chain, Bitcoin, Ethereum, Arbitrum, and Avalanche combined. However, much of its volume originates from spam, as arbitrage bots use networks’ low fees to perform thousands of transactions daily.

In fact, experts speculate that only about 7% of Solana’s transactions can be attributed to real user activity. This would put Solana’s transaction volume below that of BNB’s.

These figures put Solana’s activity in perspective, showcasing that, despite its robust technology, the network is still trailing behind BNB in terms of user engagement.

On the Flipside

- While Solana’s daily transactions don’t reflect active user engagement, they strain the network. Spam transactions have been behind several major Solana outages in recent years.

- Solana briefly surpassed BNB in terms of market cap several times, most recently on February 14. However, in all instances, BNB quickly reclaimed its spot.

Why This Matters

Solana’s active wallets and transaction volume are key factors in assessing the token’s potential in market cap and value.

Read more about Solana’s rivalry with BNB:

Solana Takes 4th from BNB: What Happened and Will It Stick?

Read more about withdrawal issues on Coinbase: