Stablecoins have been in the crosshairs of regulators recently, with Binance’s BUSD drawing the ire of the SEC. Following the crackdown, Paxos, the issuer of BUSD, was ordered by the New York Department of Financial Services (NYDFS) to stop minting the coin.

Meanwhile, the TrueUSD (TUSD) stablecoin has become the fifth-largest stablecoin by market capitalization after Binance turned its attention to the coin, minting around $150 million worth of TUSD since Monday, February 27.

After witnessing the influx of TUSD, the price of TrueFi’s $TRU token rose from $0.064 to peak at $0.114 in 24 hours on Monday, February 27. However, investors buying up $TRU, believing it to be linked to TUSD, are mistaken as the two projects split in June 2022.

One-week market cap chart for TUSD. Source: CoinGecko

Sponsored

TUSD is a dollar-pegged stablecoin issued by ArchBlock. According to blockchain data provided by ChainLink’s proof-of-reserve monitoring tool, TUSD’s value is fully backed by fiat assets.

Binance Looking to Change Direction?

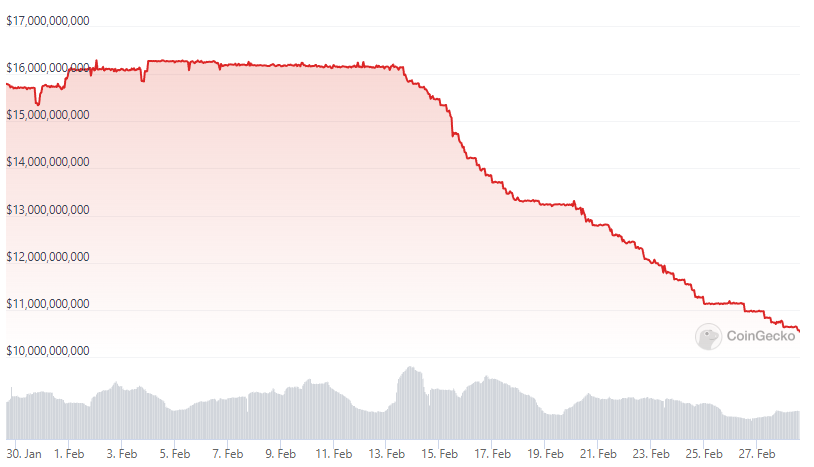

TUSD’s sudden surge in market cap following Binance’s minting spree also came at the expense of BUSD’s market cap. BUSD has seen a steady decline in market cap since February 13—the day the SEC served the Wells notice. The stablecoin’s market cap has fallen from $16.1 billion to depths of $10.6 billion at the time of publishing.

One-month market cap chart for BUSD. Source: CoinGecko

Sponsored

The stablecoin crackdown in the U.S., and the direct blow to Paxos as BUSD’s issuer, are seemingly at the heart of BUSD’s plummeting market cap. However, movements suggest that Binance is pivoting to TUSD as a potential new stablecoin to bolster its ecosystem while BUSD remains under fire.

Binance appears to be distancing itself from BUSD, stating it is “wholly owned and managed by Paxos.” The harsh regulation on BUSD could be a death knell for the stablecoin project, especially if the SEC decides stablecoins fall under its remit as securities.

The demise of BUSD may not be of much concern to Binance, as CEO Changpeng “CZ” Zhao said in a February 14 Twitter Space that the company would look to diversify its stablecoin holdings away from the Paxos-issued token.

On the Flipside

- TUSD is issued by Archblock, previously known as TrustToken, but TrustToken separated from TrueFi in June 2022—meaning there is no connection between the projects.

Why You Should Care

The SEC crackdown on Stablecoins shows that regulators are ready to police the crypto space. Still, there is yet to be any meaningful regulatory framework prepared in the U.S. Without a clear and all-encompassing framework, it will remain relatively simple for crypto companies to pivot and avoid lasting legislative implications.