- Bankrupt crypto lender BlockFi has to withdraw its restructuring plan.

- The court deemed the wind-down plan premature and unauthorized.

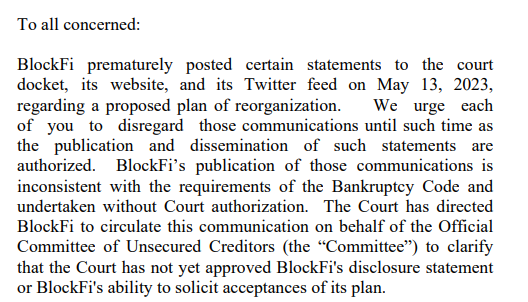

- The court ordered BlockFi to issue a corrective letter and stop soliciting support.

Just as lenders hoped the end would come soon, the BlockFi saga took another turn. A US bankruptcy court has issued a ruling ordering crypto lender BlockFi to withdraw its restructuring plan.

New Jersey Bankruptcy Court Judge Michael B. Kaplan found the firm’s restructuring plan was unauthorized and premature. In a May 18 emergency order, the judge clarified that the initial plan was prematurely posted without court approval.

BlockFi Restructuring Plan Halted

BlockFi’s “premature” statements pertained to a wind-down plan, highlighting around $1 billion in claims against commercial counterparts. On May 13, BlockFi posted its restructuring plan on its website and social media.

Sponsored

The plan highlighted claims against bankrupt crypto exchange FTX and its trading arm, Alameda. The firm said these claims were the “largest driver” in reimbursing creditors.

However, BlockFi had to withdraw these posts just a week after the posting. In addition, the judge prohibited BlockFi from issuing any further statements about their plan. Moreover, the company must update its website and Twitter with a disclaimer. The judge also ordered BlockFi to notify all their creditors with an email.

Following the court order, BlockFi posted an updated corrective letter on its official Twitter account with the required statements.

Sponsored

The creditors have been at odds with BlockFi since it filed for bankruptcy in November. They blamed the company’s poor management and subsequent restructuring plans for its downfall.

The unapproved restructuring plan has further stoked tensions. On May 17, the Official Committee of Unsecured Creditors claimed that the plan released BlockFi’s management of any legal responsibility for the crash.

On the Flipside

- According to leaked internal documents, crypto exchange FTX owes $1.2 million BlockFi. It is unclear whether BlockFi creditors will get any of that money, as FTX is also in bankruptcy.

- In January, a US bankruptcy court approved the sale of BlockFi’s mining rigs and $160 million in loans backed by them.

Why This Matters

The resolution of the BlockFi bankruptcy will have important implications for both BlockFi and FTX creditors. The amount of money creditors can recover from these firms is directly linked to the deal the court approves.

Read more about BlockFi’s links to FTX:

BlockFi Financial Records Reveal $1.2B Ties to FTX: Reports

Read more about the panic over MetaMask’s terms of service:

Crypto Twitter Panics Over False MetaMask Tax Withholding Rumors