- BlackRock has made a strategic move that could reshape Bitcoin’s role in traditional finance.

- The surge in popularity of spot Bitcoin ETFs, led by IBIT, has underscored a growing trend in the market.

- Analysts have speculated on the SEC’s imminent decision regarding options trading.

In a move that could further solidify Bitcoin’s place in traditional finance, BlackRock, the world’s largest asset manager, is seeking approval to offer options on its spot Bitcoin ETF. This comes just weeks after the SEC approved the first wave of spot Bitcoin ETFs, marking a significant milestone for the digital asset.

SEC to Consider Options for IBIT

Nasdaq, the exchange where BlackRock’s iShares Bitcoin Trust (IBIT) trades, filed a formal request with the SEC to list and trade options on the ETF. This opens up a 21-day public comment period, during which investors and other stakeholders can voice their opinions on the proposal.

Analysts believe the SEC could approve options trading as early as February, potentially paving the way for a new wave of Bitcoin investment strategies. Options contracts give investors the right, but not the obligation, to buy or sell Bitcoin at a set price by a specific date. This allows for more sophisticated hedging and speculation than traditional ETF shares. Nasdaq explained:

Sponsored

“The Exchange believes that offering options on the Trust [IBIT] will benefit investors by providing them with an additional, relatively lower cost investing tool to gain exposure to spot bitcoin as well as a hedging vehicle to meet their investment needs in connection with bitcoin products and positions.”

The move comes amidst the surging popularity of spot Bitcoin ETFs. Since its launch in January, IBIT and other similar funds have seen impressive trading volumes, with IBIT and Fidelity’s FBTC leading the pack.

BlackRock Bitcoin ETF Making Waves

Notably, Grayscale’s Bitcoin ETF, converted from the long-standing GBTC trust, has experienced significant outflows of Bitcoin, suggesting a shift towards newer, more accessible options.

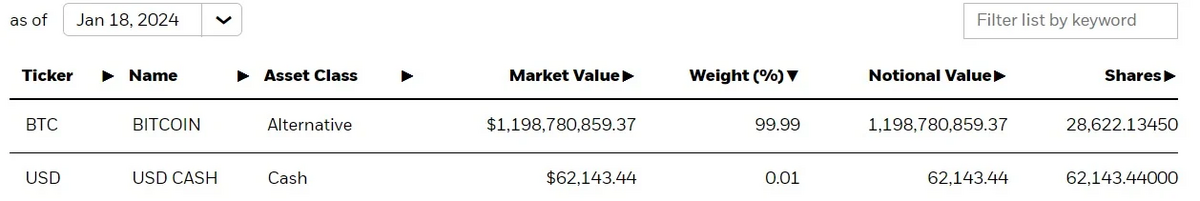

BlackRock’s IBIT currently holds over 28,000 Bitcoin, valued at nearly $1.2 billion, making it a major player in the rapidly evolving Bitcoin ETF landscape. If approved, adding options trading could further solidify its position and attract a wider range of investors to the digital asset.

On the Flipside

- Given the lingering regulatory uncertainties surrounding the cryptocurrency market, the rush to introduce options on Bitcoin ETFs might be premature.

- Despite the popularity of spot Bitcoin ETFs, the relatively short period since their January launch might not provide a comprehensive picture of their long-term sustainability.

Why This Matters

The SEC’s decision on Blackrock’s options request could be pivotal in shaping the future of Bitcoin investing in the US. With a 21-day comment period now underway, all eyes are on the regulatory body as the Bitcoin revolution unfolds.

Sponsored

To delve deeper into the remarkable surge of $4 billion in just six days within the realm of Bitcoin ETFs, explore the intricacies of this financial feat here:

Bitcoin ETFs Amass $4B in Assets in Six Days of Trading

To understand why BlackRock has opted to dismiss the XRP ETF noise and concentrate on Bitcoin for the time being, read here:

BlackRock Rejects XRP ETF Noise: Focusing on Bitcoin for Now