Coronavirus pandemic shook up the markets worldwide. And since the economic uncertainty still shades the economies, Bitcoin – the so-called digital gold – shows better results than the classic gold.

Comparing the yearly growth rate of Bitcoin vs gold, the world’s leading cryptocurrency shows much better results. The percentage of increase in Bitcoin’s price is twice bigger as gold’s.

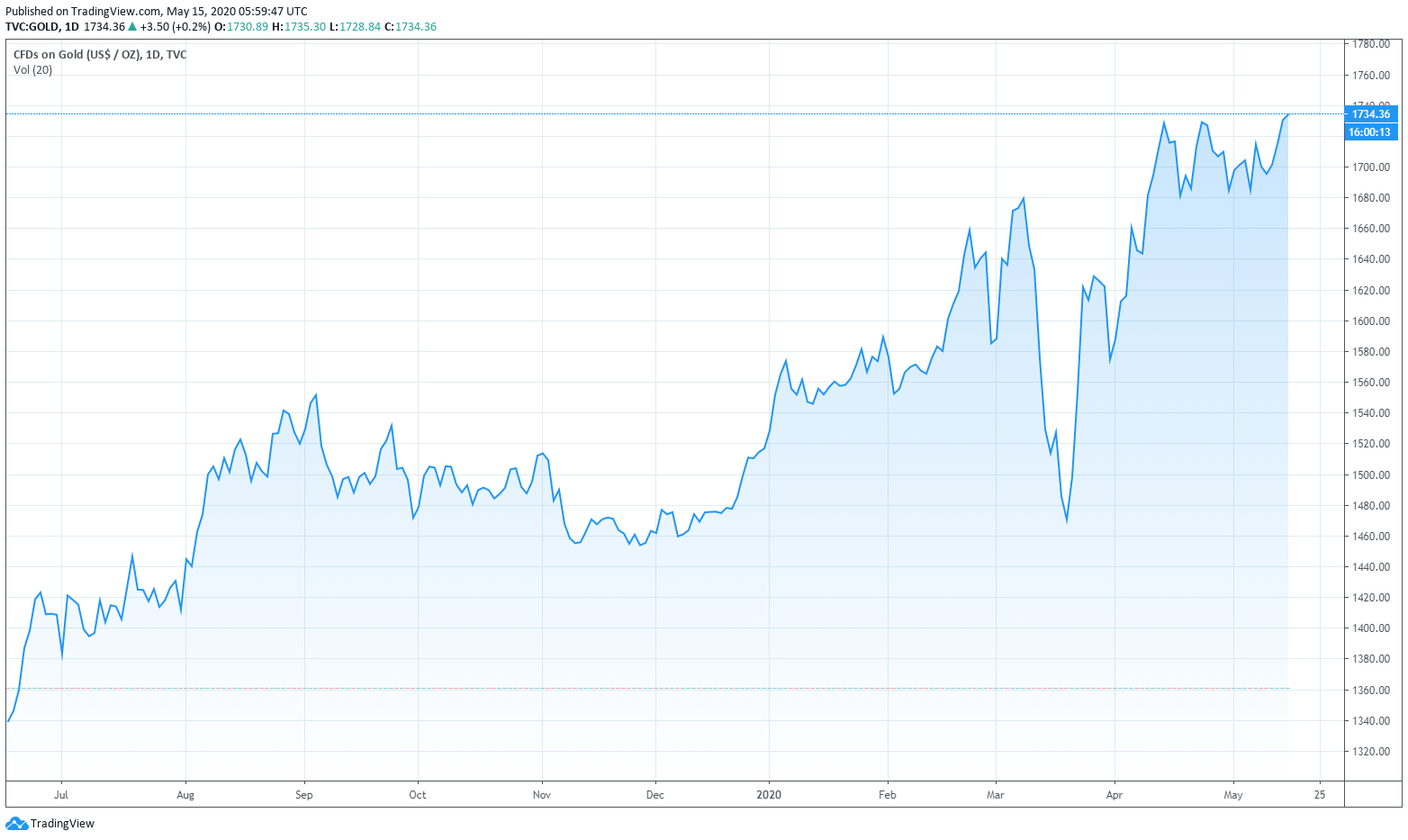

According to the data of Trading View, the price of gold increased by nearly 15% since the first days of the year. The price currently sits at around $1.736 per ounce, which is about $220 higher compared to $1.518 per ounce of the January 1.

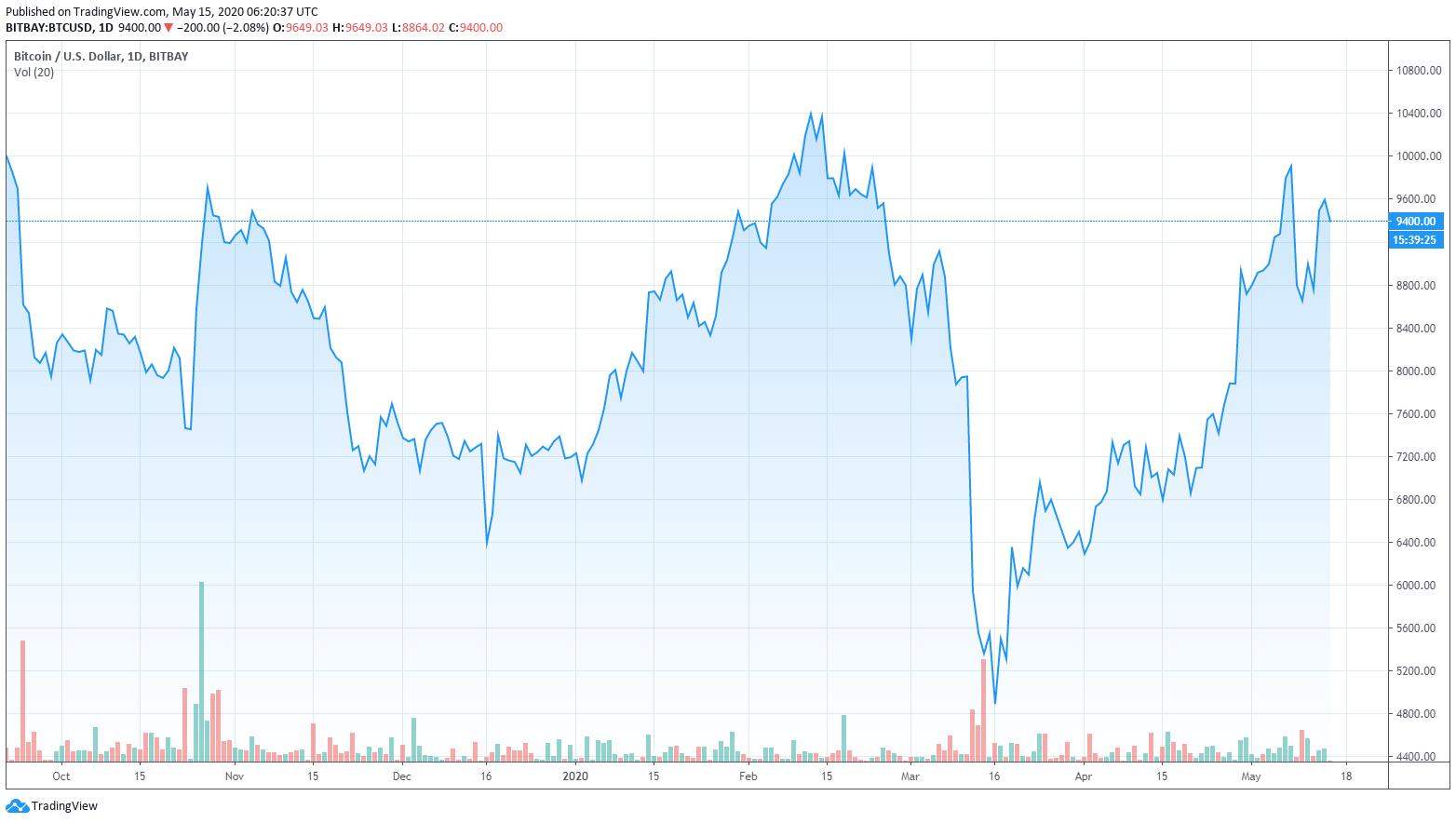

Meanwhile, the benchmark cryptocurrency – Bitcoin – climbed over 30% since the beginning of the year and became the best performing crypto asset of 2020 so far. The price floats around $9.400 at the time of publishing. Having in mind the historic short-term decrease, that appears right after the Bitcoin halving, Bitcoin is still nearly $2.270 more expensive than it was at the beginning of the year with a price of $7.136 per asset.

Both assets dropped during Black Thursday

However, both assets plummeted during the biggest economical crash on March 12. The day called Black Thursday was one of the most dramatic in a decades, as cryptocurrency markets crashed simultaneously with the traditional markets. The coronavirus outbreak and oil war between two OPEC members pushed global markets in panic and caused massive sell-offs.

The Bitcoin lost nearly half of its value when the price dropped from around $8.000 to below $3.700 overnight. The lows have not been seen since March 2019. Meanwhile, the price of gold decreased slightly to about 12% at a time.

Despite the turmoil, both assets regained their value since the darkest day for the markets. Gold’s price increased by over 17%, while Bitcoin recovered by nearly 150% having in mind it’s the current price of $9.400. Nevertheless, the digital currency asset surpassed the test of $10.000 a week before it halved on May 11.

Bitcoin as a digital gold

During the economic uncertainty investors usually turn from risk assets to the safe havens – the financial assets that help to protect themselves or even profit from the period of market turmoil. Gold has been historically conceived as one of those assets.

In a meantime, Bitcoin has long been referred to as digital gold – thus a safe haven – due to its decentralized nature and weak relationship with traditional S&P 500 index and gold.

However, during the March 12 market crash, it showed a positive correlation with traditional assets and fell down simultaneously. This means that both categories of assets are dependent and move in tandem with each other.

Although financial experts claim that Bitcoin is in its transition process from risky speculative asset to the gold-like one, that makes Bitcoin more immune to negative market shocks and decreases the price volatility.