With only three days left before the third halving, the world’s biggest cryptocurrency is rallying and showing impressive highs.

The highly anticipated Bitcoin halving is taking place on May 11. Meanwhile, all the key metrics of Bitcoin are on the rise and showing a positive market approach.

The price of Bitcoin came back to nearly $10.000, wiping out all the Black Thursday losses. The daily hashrate turned to the new all-time-highs, and even the number of daily active Bitcoin addresses increased within the previous months. And here is how.

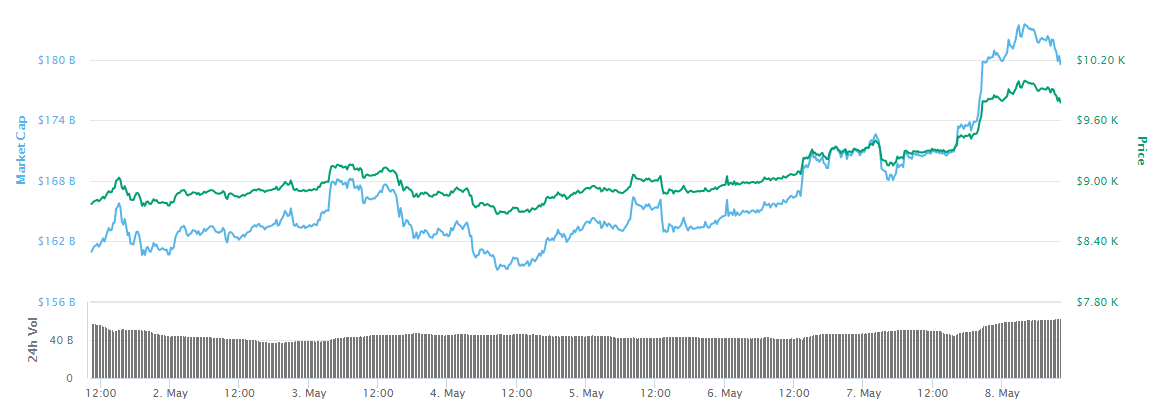

The recovery in price

The Bitcoin (BTC) price surpassed $10,000 on Thursday for the first time since the end of February. The move indicates the full recovery from its dramatic free fall below $4.000 back on March 12, when both global and crypto markets were crashing due to the massive sell-offs, caused by coronavirus outbreak.

However, the world’s largest crypto asset increased by more than $6,000 within a period of two months and became one of the best performing crypto assets this year. At the time of writing its price floats around $9.800, at a bit lower level compared to Thursday, when Bitcoin increased by nearly 7% within 24 hours.

The price of Bitcoin is expected to continue to rally up to the Bitcoin halving on May 11 when the reward for minting Bitcoins will be cut in half. The process that happens every four years directly affects the supply of Bitcoins, causing it to drop.

Meanwhile, historically the price of Bitcoin tended to grow both before halving and later after it. The market, however, usually sees the price drop right after halving, although in a longer (6-12 months) perspective Bitcoin leans to show impressive 1.200% – 6.000% growth results.

The hedge fund analyst Ed Hindi from hedge fund Tyr Capital told Forbes this week, that in long-term horizon Bitcoin will come extremely bullish. He even predicts the price surge over $100.000 within the nearest years.

We may see the market drop by 25% to 35% from the peak, but we expect it to be followed by a period of range-bound trading over a number of months and then a gradual move back up. The longer-term horizon for Bitcoin is extremely bullish.

The spike in hashrate

The Bitcoin miners are also enjoying the situation. Within the last week before halving, the Bitcoin hashrate jumped to the new highs of over 140 exahash per second (EH/s).

As blockchain data provider Glassnode reported, the new record even exceeded the previous one of 123 EH/s reached on March 8. The growth is impressive having in mind its nearly 40% fall amidst mid-March global market crash when the rate fell to nearly 75 EH/s.

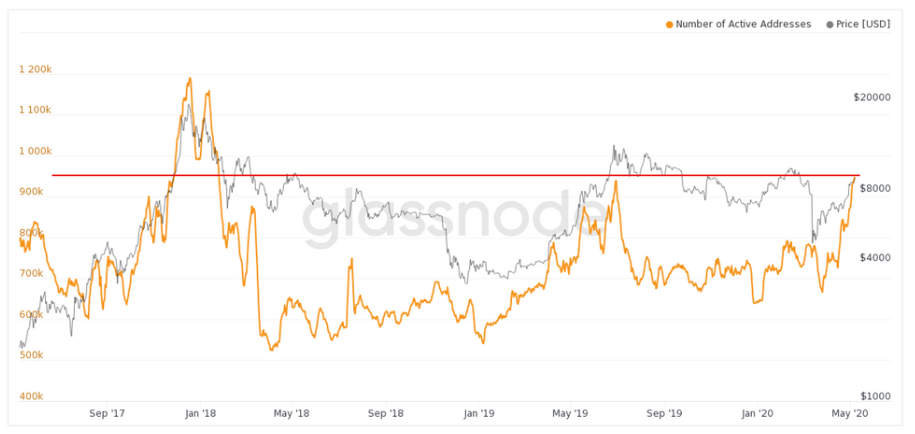

More new Bitcoin addresses

The interest in Bitcoin seems to be growing constantly despite the market crisis. The number of active Bitcoin addresses is surging. According to the Glassnode insights, there is a 47% increase in the number of daily active Bitcoin addresses since the beginning of 2020.

The number of addresses rose from 643.000 to 945.000 during the year, a growth rate last seen back in the highly bullish 2017. As demonstrate the data of Glassnode shared by CoinCorner CEO Dany Scott, the number of new addresses is approaching 500.000.

With the corresponding boom in Twitter mentions, all key metrics of Bitcoin show the increased interest in the world’s biggest crypto. Just days before the halving, it’s market capitalization is sits at nearly $180 billion, the same last seen before the mid-March market turmoil.