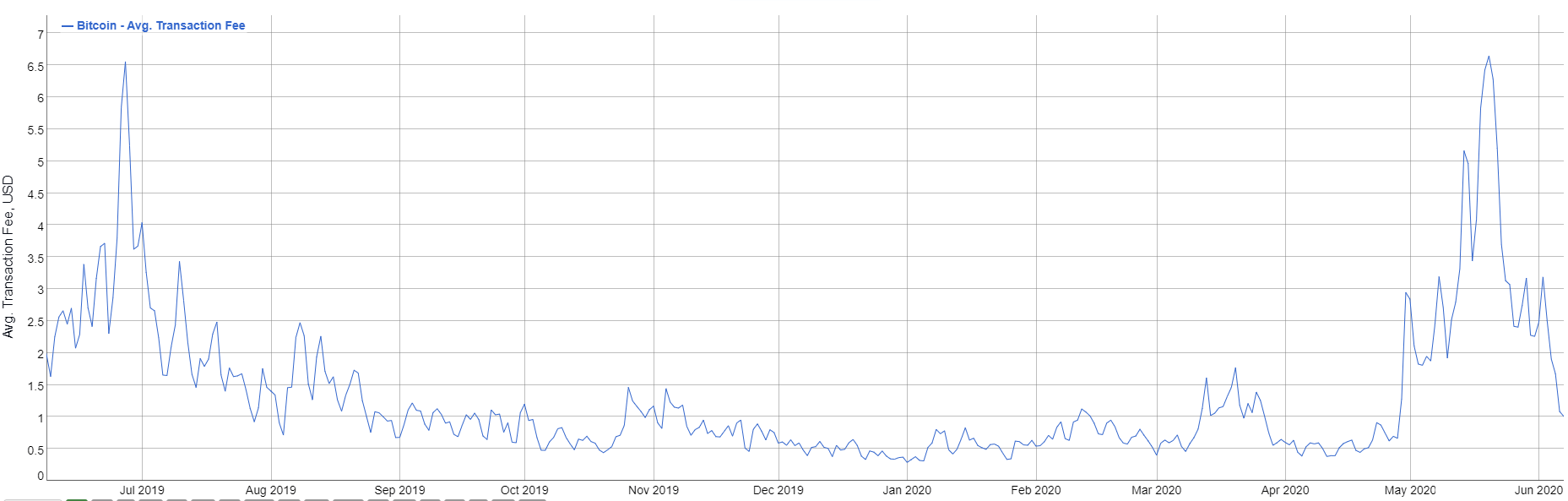

Nearly a month after the halving, the average cost of the Bitcoin transaction is far from the highs seen in May.

The average Bitcoin transaction fee has dropped significantly within the past weeks. According to the data of Bitcoin Info Charts, the current price for making a Bitcoin payment floats around $1.007. This is the lowest level since April 29.

The price of the world’s leading cryptocurrency increased enormously the days before the halving. Bitcoin halvings have been historically related to the sharp increases in transaction fees. Within a little more than a month – from April 12 to May 20 – the transaction fees rocketed by around 1.700%, from $0.39 to $6.64.

Bitcoin transaction fees are the fees that Bitcoin users pay to miners for processing and confirming transactions. They are the kind of revenue that miners get together with a block reward, which is currently 6.25 BTC.

Post-halving stabilization

However, the decrease shows that Bitcoin transaction fees are coming back to normal levels after the peak related to the halving process. The highs of over $6.6 per Bitcoin transaction were last seen back in June 2019.

Sponsored

The reason behind lower Bitcoin fees is the decrease in demand. As the Bitcoin block has a limited size of 1 MB, miners can process 1MB worth of transactions every 10 minutes. However, if there are more transactions competing to get in the block, the cost of transaction increases, as miners choose to confirm payments with the highest fees.

Sponsored

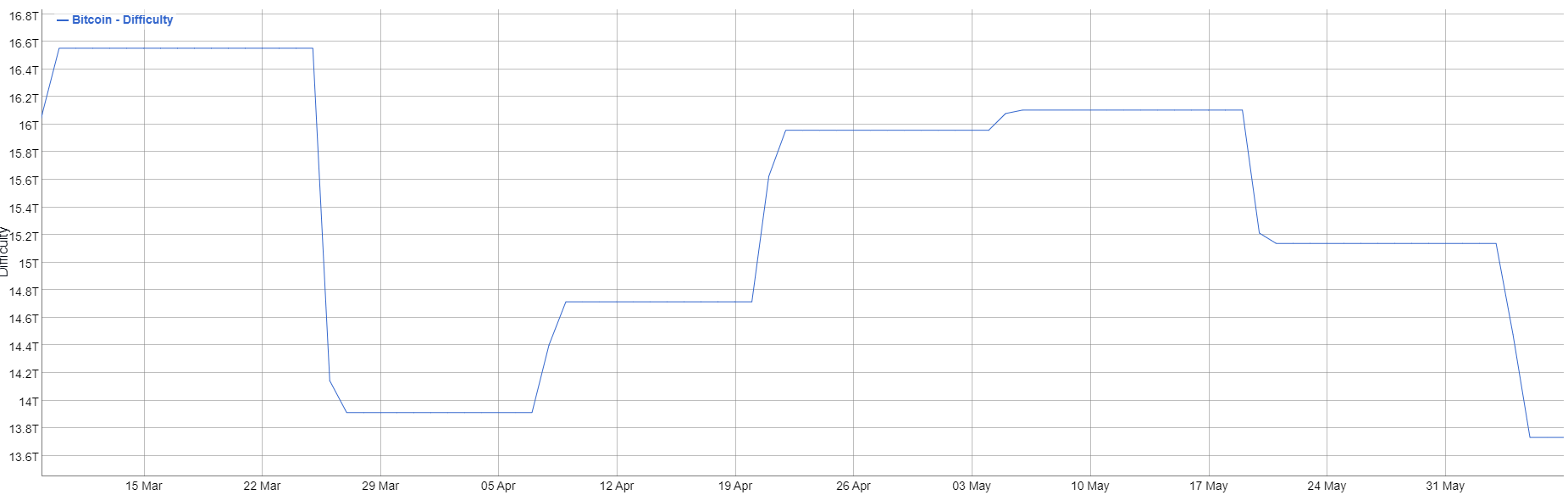

In the meantime, the lower fees signal the ease in the state of the Bitcoin network. The mining difficulty of the Bitcoin network has dropped to the April’s levels and currently sits at around 13.7 Trillion (T).

On the other hand, despite the decrease in network difficulty, the hash rate (or total computing power) of the Bitcoin network is increasing again and currently sits at 126.5 E. The level has last been seen only on May 11, when the Bitcoin block reward was cut in half.

The increase in total computing power is mainly related to the Chinese miners that have been switched to the more powerful Bitcoin mining hardware due to the lower electricity prices, caused by the rain season and the bigger usage of hydropower. China currently is one of the biggest crypto miners with nearly 65% of Bitcoin’s global computing power.