- Cryptocurrency has experienced a resurgence, injecting a new wave of enthusiasm after facing adversity.

- Market shifts, anomalies, and reduced activity have marked the cryptocurrency trading landscape.

- CZ, the leader, has maintained an unwavering stance amid dwindling participation.

The recent resurgence of cryptocurrencies has injected a newfound vitality and enthusiasm into an industry that previously weathered FTX’s collapse, regulatory scrutiny, and a spate of bankruptcies.

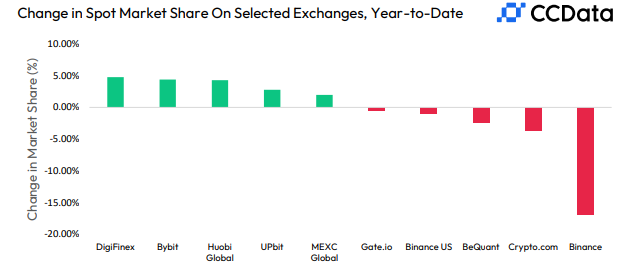

But the relief some feel in the wake of Bitcoin’s price surging past the $35,000 mark might not be universally embraced. Binance, in particular, comes to mind, as the exchange has witnessed a gradual erosion of its market share over the past year.

Bitcoin’s Rise Fails to Stem Binance’s Market Share Erosion

According to data from CCData, Binance’s market share among exchanges that do not support USD has dwindled from 74% in December 2022 to a meager 50% this month.

In addition to their personnel troubles, Binance is grappling with legal challenges from the Commodities Futures Trading Commission and the US Securities and Exchange Commission. This development has raised concerns among several trading firms, prompting them to curtail their trading activities on the exchange.

Traders Withdraw from Binance as Bitcoin Climbs

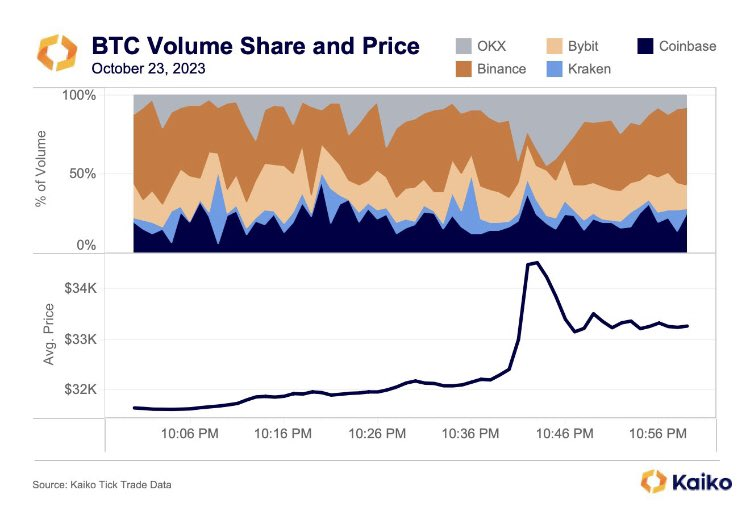

The withdrawal of traders from Binance was particularly conspicuous on October 23. While Bitcoin was experiencing an upswing, Binance’s market share virtually plummeted to zero, coinciding with Bitcoin’s rally to $34,000. In contrast, OKX saw its market share soar past 50%, according to data from Kaiko.

Changpeng ‘CZ’ Zhao, the leader of Binance, can say “4” all he wants, but it doesn’t alter the reality that fewer individuals are trading on his platform. The evidence is as basic as it gets.

On the Flipside

- The cryptocurrency market is vast and diverse, with numerous exchanges catering to different audiences. Traders have choices, and some may still find Binance’s offerings align with their needs and preferences.

- One day’s performance doesn’t necessarily predict long-term trends, and Binance may regain ground in the future.

Why This Matters

The recent challenges and dwindling market share faced by Binance, one of the crypto industry’s major players, signal a significant shift in the landscape. This development reflects broader concerns about regulatory pressures and institutional hesitancy, which could influence the future trajectory of the entire cryptocurrency market.

Sponsored

To learn more about the U.S. lawmakers’ push for swift action against Binance and its implications, read here:

U.S. Lawmakers Push for “Swift” DOJ Action Against Binance

For insights into how Binance’s CEO is reassuring users after a surprising withdrawal freeze, click here:

Binance CEO Reassures Users Amid Surprise Withdrawal Freeze