- Bitcoin has witnessed a modest 2.5% rise in a relatively calm market phase.

- Traders have been closely monitoring critical support and resistance levels.

- Favorable macro conditions and parallels with the S&P 500 have fueled optimism for Bitcoin.

In a relatively tranquil phase of market activity, Bitcoin has witnessed a modest rise of 2.5% over the past week. As investors patiently observe these developments, the keen insights of our resident Bitcoin analyst, Kyle Calvert, bring forth a comprehensive understanding of the intricate dynamics within the cryptocurrency market.

Current Outlook For Bitcoin

Bitcoin’s trading price at the time of writing is hovering around $27,120, with a modest 1% increase today and a commendable 2.5% gain over the past week.

It encountered resistance at a descending parallel channel and touched the crucial $26,700 support zone on May 31. Presently, it remains in this range. A breakdown could lead to a decline to $24,400, while a rebound may propel it to $30,500.

BTC Key Targets

In the ever-shifting landscape of the current market, the focal points of Bitcoin’s support and resistance levels have captured the attention of traders and investors alike. Navigating the intricate web of market dynamics, these crucial junctures have emerged as vital indicators for participants in the market.

Sponsored

At the apex of resistance, we find the third level at $28,200, closely followed by the second level, nestled comfortably at $27,630. Ascending further, we encounter the first resistance point, firmly established at $27,250. The pivot point resides at a critical junction, valued at $26,950, hovering closely around the current trading price.

Sponsored

Conversely, the downward journey commences with the first support point, fortifying Bitcoin’s position at $26,570. The second support point stands unwavering at $26,270, providing additional stability. Ultimately, the third pivot point is the ultimate safeguard, anchoring Bitcoin at $25,880.

It is worth noting that these levels, although relatively close to the levels provided in the DailyCoin Regular on May 19th, exhibit a slight upward trend, signifying potential shifts in the market dynamics.

Community Sentiment

In an analysis of the current market setup, esteemed trader Crypto Ed has contemplated the potential upside, suggesting a ceiling of $27,500. In a recent YouTube update, he cautiously speculated that a bullish surprise may still be possible if the crucial support level of $26,000 remains intact.

Crypto Ed emphasized that Bitcoin would need to breach the $27,600 threshold to overcome the current stalemate.

Anticipating a rebound, Crypto Ed believes that Bitcoin could potentially rally towards $27,500, which is the resistance level of the previous high range. From that point onwards, he intends to monitor the situation closely, considering the possibility of short positions towards $25,000.

Meanwhile, fellow trader Crypto Tony echoed the sentiment of exercising caution until the $27,500 level is reclaimed.

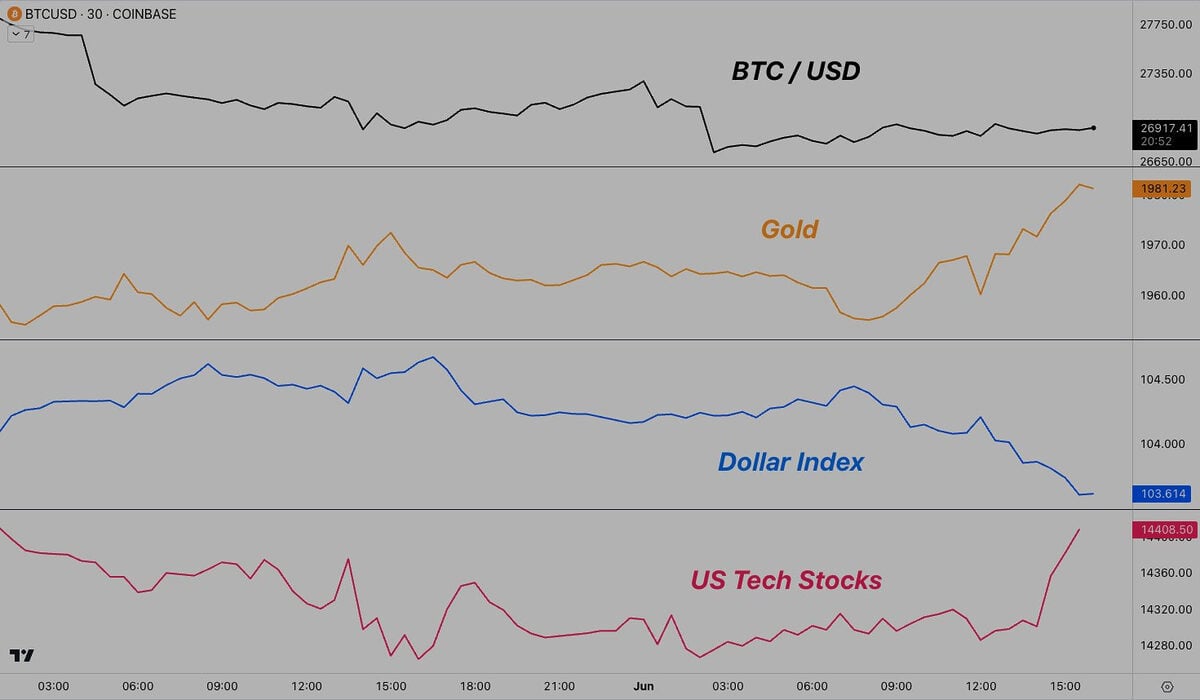

Financial commentator Tedtalksmacro drew attention to favorable macro conditions, showcasing a comparative performance chart on June 1st that indicated lower Treasury yields, the weakening of the U.S. dollar, and rising gold and equities.

Tedtalksmacro stated that this juncture might be the opportune moment for Bitcoin to make a significant move, with traditional finance (TradFi) increasingly shifting towards a risk-on approach.

Similarly, prominent trader Moustache expressed optimism about Bitcoin, drawing parallels with the S&P 500. He asserted that if the S&P 500 demonstrated a bullish outlook, Bitcoin would likely follow suit.

Moustache’s analysis built upon previous findings from January, where he had correctly predicted similar price movements in Bitcoin when the S&P 500 staged a comeback.

Bitcoin Fear and Greed

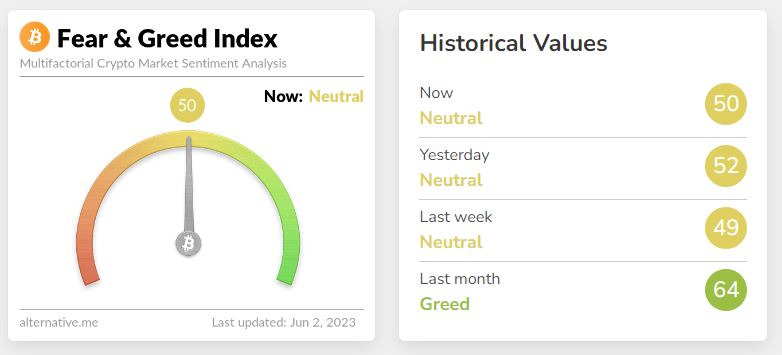

The way people feel dramatically affects the cryptocurrency market. When the market is doing well, people feel greedy and fear missing out on the action. This leads them to make impulsive decisions and buy more. On the other hand, when the market is going down, people often panic and sell their coins without overthinking.

The Fear and Greed Index is based on two important ideas:

- If investors are extremely fearful, it suggests they are overly worried. This could actually be a good time to buy because prices may be lower than they should be.

- When investors become excessively greedy, it’s a sign that the market is getting overheated. This usually means a correction or a price drop is on the horizon.

The index ranges from zero to 100. A score of zero means the market is filled with extreme fear, while a score of 100 means extreme greed dominates.

On the Flipside

- The analysis provided by Crypto Ed and other traders should be taken with a grain of salt, as their predictions may not always align with actual market outcomes.

- It is important to consider alternative perspectives and opinions when evaluating the potential future performance of Bitcoin, as market dynamics can be unpredictable.

- Although informative, the Fear and Greed Index should not be the sole basis for making investment decisions, as market sentiment can change rapidly.

Why This Matters

Bitcoin’s current outlook, key targets, and community sentiment provide crucial insights into the ongoing market dynamics. These observations offer valuable guidance to traders and investors, aiding them in making informed decisions and navigating the complex landscape of the cryptocurrency market.

FAQs

The decision to buy Bitcoin or any other investment should be based on thorough research and consideration of your financial situation and risk tolerance. It’s important to consult a qualified financial professional before making investment decisions.

The price of Bitcoin can change rapidly and is subject to market fluctuations. It’s best to check a reliable cryptocurrency exchange for the most up-to-date and accurate price of Bitcoin. At the time of writing, the price of Bitcoin is approximately $27,050, but it can change within a short period.

The price of BTC, like any other cryptocurrency or asset, is subject to various factors, including market demand, regulatory changes, technological advancements, economic conditions, and investor sentiment, among others. It’s always advisable to seek professional financial advice and not rely solely on speculative predictions when considering investing in cryptocurrencies.

The first known transaction involving Bitcoin occurred on January 12, 2009, but Bitcoin did not have a market price until later that year. The exact price of one Bitcoin in 2009 is difficult to determine as it was not traded on exchanges then. However, it is widely believed that the first price of one Bitcoin was effectively $0.

To learn more about the growing competition between Bitcoin and Ethereum in NFT sales, read here:

Bitcoin Threatens Ethereum as It Claims 2nd Spot in NFT Sales

For the latest updates on Ripple Labs unlocking 1 billion XRP tokens in their monthly distribution, click here:

Ripple Labs Unlocks 1 Billion XRP Tokens in Monthly Distribution