Within 10 days after the third Bitcoin halving, the key metrics like – block mining speed, hash rate, and difficulty – show the signs of decrease. Meanwhile, the costs of transactions beat the two-year heights.

The latest Bitcoin news in terms of statistics shows that only 95 Bitcoin blocks were generated on the network just 6 days after the Bitcoin halving. As Bitcoin analyst posted on Twitter, such amount of blocks was minted last Sunday.

Previous day had only 95 blocks.

— digitalik.net (@digitalikNet) May 18, 2020

In last 10 years we had only 8 days with less than 100 blocks.#bitcoin #btc #crypto #halving #stocktoflow https://t.co/3KiXf1nDv6 pic.twitter.com/Z1s9dgwRKD

The number is so low, that it falls between the other 8 times in 10 years when less than 100 blocks were processed within a day. Meanwhile, the average post-halving Bitcoin block generation amount varies between 100-200 blocks per day.

The low block generating metric is usually related to the decrease of the Bitcoin mining hash rate and Bitcoin mining difficulty that both dropped after the Bitcoin halving as well. The event took place on May 11 and cut the block reward in half to 6.25 BTC.

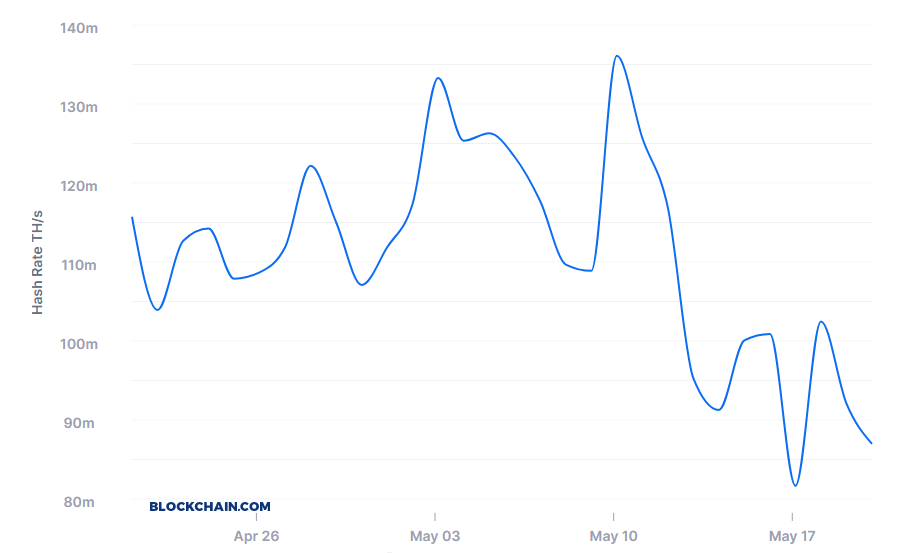

A decrease in Bitcoin mining hash rate

The Bitcoin mining hash rate fell around 40% within one week after halving. The latest data from Blockchain.com show that fluctuations on a raw value chart were severely volatile, as the mining hash rate dropped from the heights of 136 TH/s on May 10 to the lows of 81.6 TH/s on May 17.

The hash rate, which shows the total computing power used for minting the new Bitcoin blocks, has been scoring the all-time-highs, reaching even 140 TH/s per day, before the third Bitcoin halving.

However, the hash rate drop is not the uncommon thing after the cut in block reward. The decrease in the Bitcoin block reward impacts the revenue of miners, and might even make their activity unprofitable if the electricity prices are too high, for example.

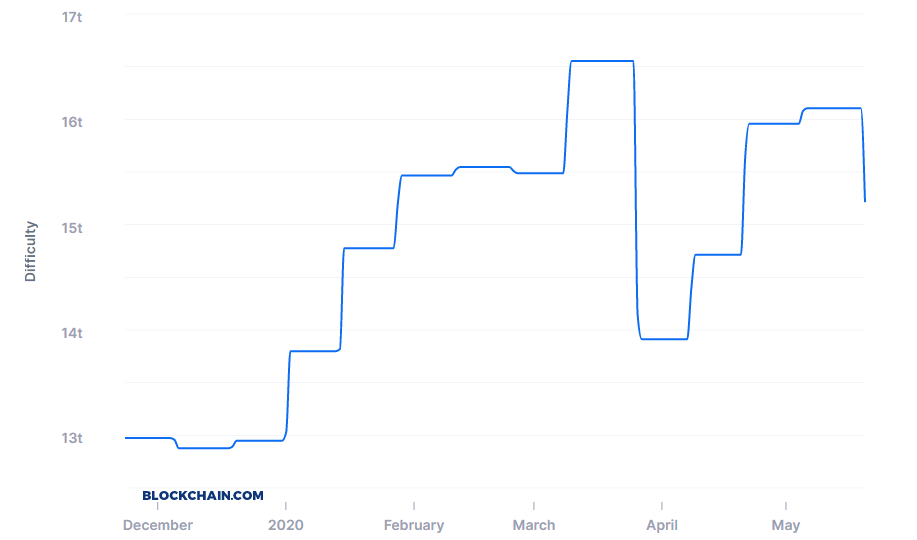

Mining difficulty drops down

Bitcoin mining difficulty – the parameter that indicates the level of competition between bitcoin miners – has also decreased within 10 days after halving.

Sponsored

Although the network difficulty sat at 16.105 trillion on May 19, it dropped around 6% within a day and floated at 15.21 on Wednesday, May 20. The fact indicates, that quite a large number of miners left the Bitcoin network.

The difficulty, however, remains in an all-time-hights compared to the historical data of Bitcoin mining difficulty. A high difficulty means that it will take more computing power to mine the same number of blocks. The difficulty adjustment happens periodically after every 2016 block is processed. The process is needed to ensure the average 10 minutes interval between blocks. If the significant amount of miners quit mining Bitcoins, the move causes a longer time interval between blocks. Meanwhile, the difficulty decreases to encourage participation.

Transaction fees highest from 2018

Despite the decrease in key metrics like hash rate or mining difficulty, there other Bitcoin news that represents statistical growth. And these are – the increasing cost of Bitcoin transactions.

The average fee for Bitcoin transactions has increased enormously even the days before halving. Within a little more than a month – from April 12 to May 20 – the transaction fees increase by around 1.700%, from $0.39 to $6.64.

Meanwhile, in 10 days after the halving, the transaction costs jumped from $2.52 to $6.42, representing the growth of more than 150%. The hights last has been seen only back in July 2018.

Despite the fact of transaction costs growing dramatically, the current transaction price is far more from the all-time-high cost, seen in the last days of 2017, when the average Bitcoin transaction fee spiked up to nearly $55.