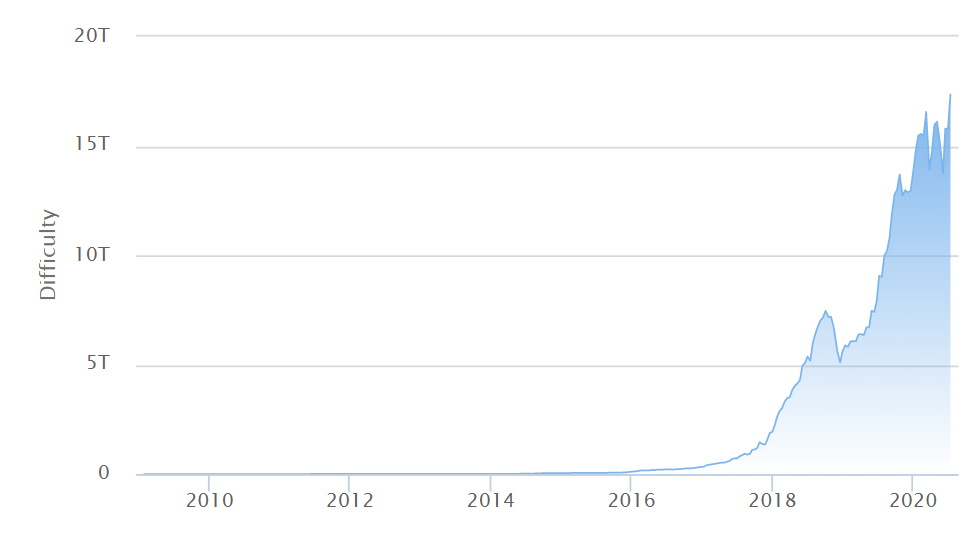

Two months after the third Bitcoin halving process, its mining difficulty jumped to the new all-time highs.

Bitcoin mining difficulty, the measure that indicates how much work the node has to put in to get a reward, has peaked at the new all-time high on July 13, when it exceeded 17.3 Trillion. The record figure signals the 9.89% growth since the previous high of 15.7 Trillion last seen on the first day of July, reveals the statistics of btc.com.

The latest historic high comes just two months after the third Bitcoin halving, which happened in May and cut its block reward in half from 12.5 to 6.25 Bitcoin per block, mined every 10 minutes. The current level of 17.3 Trillion is the highest ever and even exceeds the 16.5 Trillion peak of mid-March, and even a bit lower 16.1 Trillion high last seen just a few days before halving.

Sponsored

The latest increase comes after the lows of 13.7 Trillion on June 4, when the Bitcoin mining difficulty decreased significantly. However, the price of Bitcoin seems to remain stagnant and floating within $9.000 and $9.400 since July.

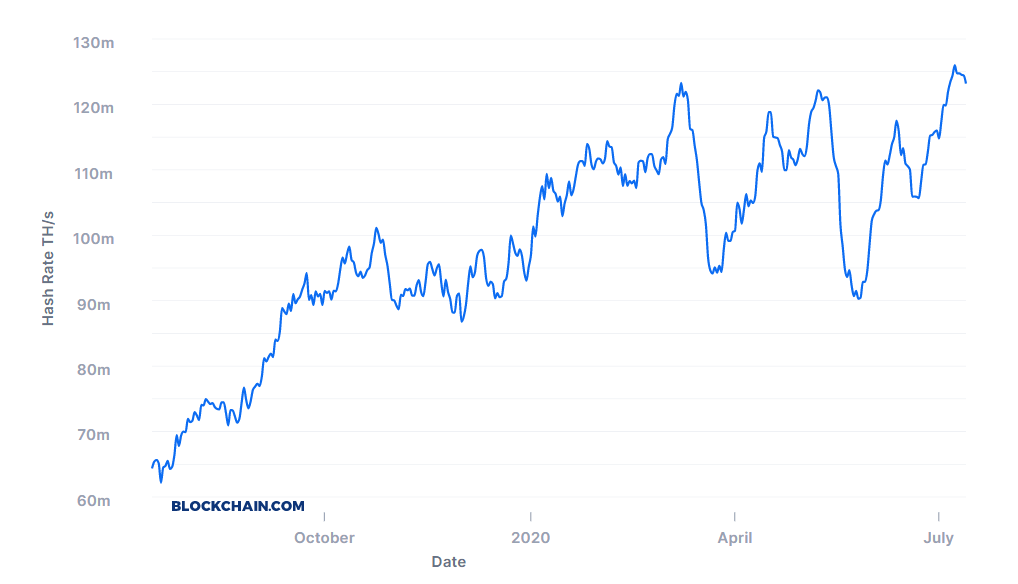

The mining difficulty is not the only Bitcoin’s parameter, which is at the historic highs currently. The hash rate or the total computing power applied to mine a Bitcoin, is also testing the top levels of 125 Th/s, according to the data of blockchain.com.

The Bitcoin network adjusts the difficulty every 2016 block in order to ensure that the process happens every 10 minutes. The level of Bitcoin mining difficulty varies depending on the ease of mining within the network. Since the network has to keep stable and add a new block to the circulating supply, it as well has to ensure the stability of time intervals. However, when it becomes easy to mine new blocks, the network increases the mining difficulty to make the process tougher.

Sponsored

The process is based on the hash power competing for a reward. When more miners compete to mine Bitcoin blocks, the total computing power of the network increases and so rises the hash rate. Accordingly, the higher hash rate means, that the network has a higher opportunity to confirm the next block.

The growth of the mining difficulty might be a seasonal though and related to the current climate conditions in China. The country which is one of the biggest cryptocurrency miners and generates around 65% of Bitcoin’s global computing power, currently experiences the rainy season in its southwestern Sichuan province. The region deploys vast numbers of cryptocurrency mining plants and is a water-rich region. The hydro-power generated by rain during the spring and summer allows to reduce electricity costs by nearly 20% and make the Bitcoin mining process more profitable.

Furthermore, the wider usage of newer and more powerful mining hardware like Antminer S19 Pro with the computing power of around 110 Th/s, might also be an important factor, contributing to the growth in Bitcoin mining difficulty.