- Bitcoin’s strong piece performance has charted interesting trends reminiscent of the 2021 bull run.

- The percentage of profitable Bitcoin holders has hit an all-time high, hinting that the market is in the early stages of a Bull run.

- However, there is one metric that implies that we have yet to enter a bull market.

Bitcoin’s performance has been nothing short of historic. In just a quarter, it catapulted from $23,000 to a 60% surge, marking a phenomenal comeback. While experts attribute this surge to institutional interest, the story goes beyond.

As Bitcoin maintains its remarkable performance, on-chain and investor data unveil intriguing trends reminiscent of the 2021 bull run, prompting a critical question: Are we witnessing the dawn of a new bull run?

Bitcoin Investors’ Euphoria Continues to Grow

In its latest report, data aggregator Glassnode unveiled a distinctive shift in Bitcoin accumulation across all wallet sizes since October. The driving forces? Bitcoin’s market performance and the increasing hopes surrounding a potential spot BTC ETF.

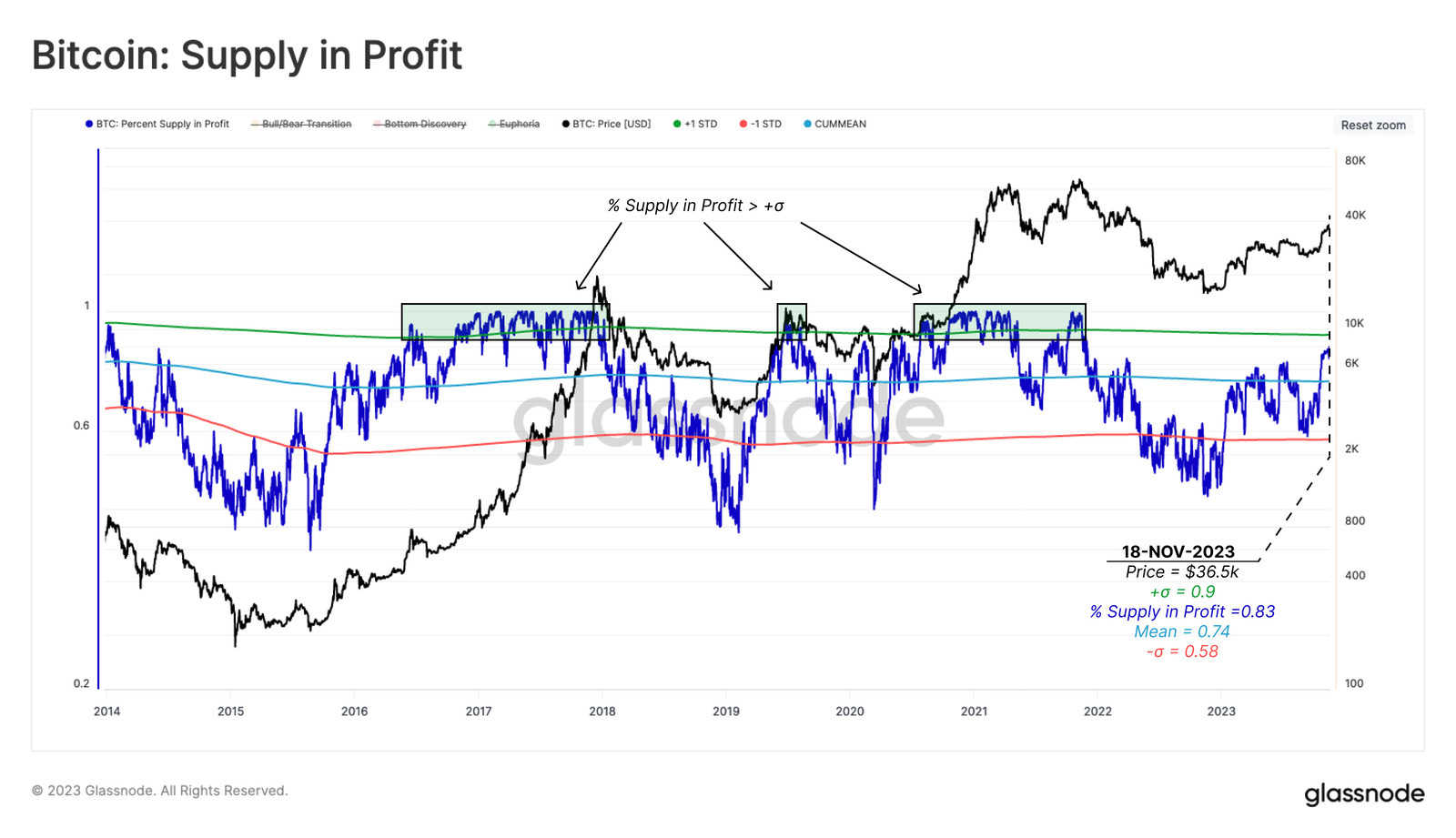

As a result, the growing confidence has propelled the percentage of supply in profit to 83% of the total circulating supply. Glassnode deems this historically significant, surpassing the all-time mean value of 74%, which suggests the market is teetering on the edge of a bull market’s ‘Euphoric phase.’

Sponsored

However, before holders can celebrate, a crucial nuance surfaces– Unrealized profit percentages have yet to reach a statistically significant level coincident with the heated stages of a bull market. Traditionally, in the Euphoric phase, average holders revel in unrealized profits exceeding 60%, but presently, they stand at 49%.

Nevertheless, Glassnode asserts that investors are fully committed to Bitcoin. Long-term holders are hitting unprecedented highs, while short-term holders are dwindling to all-time lows, implying that the market is poised for exciting times.

On the Flipside

- Bitcoin miners recently generated an all-time high figure of $44 million in daily rewards.

- Experts anticipate a 90% chance of the SEC approving a Spot ETF by early January.

Why This Matters

Bitcoin holders worldwide are anticipating a massive breakout, with sights set on the asset reaching $100,000. There are many factors, including the potential ETF approval, the Bitcoin halving, and more, that suggest that the stage is set for Bitcoin’s ascent.

Sponsored

Read how the ECB President’s son lost money to crypto investments:

ECB Chief Lagarde’s Son Loses Big in Crypto Investments

Read the latest DailyCoin Regular:

DailyCoin Cardano Regular: ADA Prepares For Bull Run; Influencers Broker Peace Between Communities Following Insider Drama, And More