- Crypto funds have extended their streak of outflows in the past week.

- Bitcoin funds were again the primary focus of outflows.

- Despite outflows, some altcoins managed to buck the trend.

Following an impressive showing earlier in the year spurred by speculations of quantitative easing from the Federal Reserve and renewed institutional interest in a spot Bitcoin ETF, crypto asset prices have become significantly range-bound with plummeting volatility.

Amid continued market uncertainty, investor sentiment remains broadly negative. Crypto funds have primarily witnessed outflows in recent weeks, with last week extending the streak to the ninth week.

Bitcoin Funds Suffer the Most

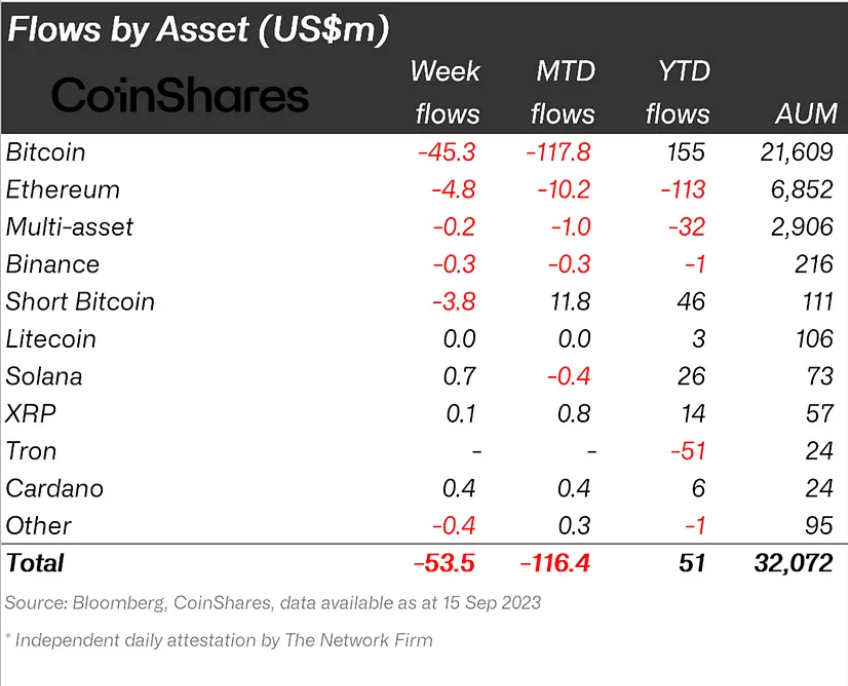

According to CoinShares’ latest digital asset funds flow report, crypto funds saw outflows totaling $54 million in the past week. Last week’s flows brought outflows for eight out of the past nine weeks to $455 million. Additionally, it brings net inflows year-to-date (YTD) to $51 million.

As is usually the case, Bitcoin funds were again the primary focus, comprising 85% of the outflows for the week. Specifically, Bitcoin investment funds saw $45 million in outflows.

Sponsored

Bitcoin investment funds were, however, not the only crypto funds to see outflows. Ethereum and Polygon investment products also saw outflows totaling $4.8 million and $300k, respectively.

Despite the broader market outflows, some crypto assets managed to buck the trend.

Solana, Cardano, XRP Resist Outflows

Solana, Cardano, and XRP resisted the market trend, recording inflows totaling $700k, $430k, and $130k, respectively.

Sponsored

Solana has emerged as the favorite altcoin for investors this year, attracting YTD inflows totaling $26 million, according to CoinShares’ September 4 report. The development comes as the network has offered users an improved experience in 2023, with only one outage reported.

On the Flipside

- Net flows to crypto funds remain positive YTD.

Why This Matters

Crypto fund flows indicate the prevailing market sentiment. Last week’s flows suggest that this sentiment remains negative.

Read this to learn more about last week’s outflows:

Short Bitcoin Funds Favored as Grayscale ETF Hype Fades

Find out about Polygon’s latest milestone:

Polygon Smashes Total Transaction Milestone as 2.0 Nears