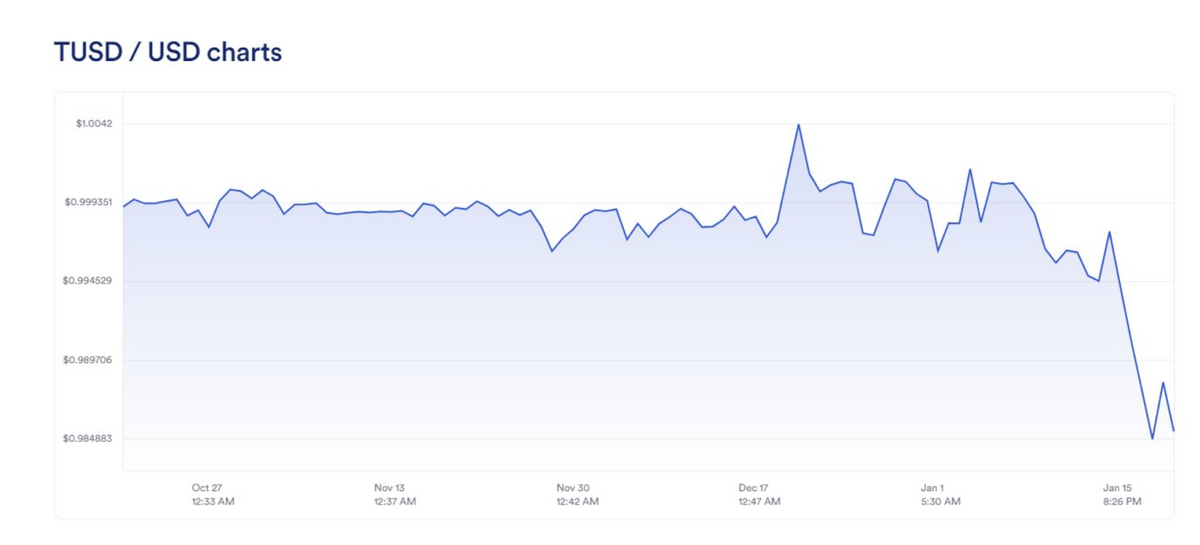

- Stablecoin TrueUSD has depegged from the dollar.

- The stablecoin is experiencing a heightened sell-off on Binance.

- The decline is reportedly connected to the November Poloniex exchange hack.

Cryptocurrency stablecoins are a vital component of the digital ecosystem, promoting stability and ease of use among investors. Their value tied to stable traditional currencies, particularly the US Dollar, makes them a practical alternative to fiat, allowing users to navigate market volatility seamlessly.

However, the value of stablecoins can be significantly influenced by intense market activity and reserve composition, and TrueUSD is the latest to feel the burn.

TrueUSD Drops to $0.985

On Tuesday, January 16, TrustToken-issued stablecoin TrueUSD lost parity with the United States dollar, plummeting from its 1 dollar price point to $0.985.

Sponsored

The depegging was linked to increased sell-off pressure on the Binance exchange. In the last 24 hours, the TUSD-USDT trading pair witnessed almost $435 million in sales but faced a shortfall of $369.3 million in buy orders, leading to a net outflow of nearly $67 million.

In December, TrueUSD enlisted the services of Hong Kong-based accounting firm MooreHK for the daily attestation services of its stablecoin fiat reserve following reports of difficulties for the stablecoin.

The drop in TrueUSD’s price is also reported to be connected to the November $100 million hack of crypto exchange Poloniex, contributing to the perceived instability of the stablecoin.

Sponsored

Read to find out more on Circle’s leading stablecoin USDC:

USDC on Cardano: Weighing Up Growth vs. Decentralization

Read more on the ongoing legal battle involving the SEC and Do Kwon:

SEC Approves Do Kwon and Terraform Labs Trial Delay Request