- Circle CEO Jeremy Allaire has said Stablecoins should not be regulated by the SEC and are globally accepted as a payment system.

- The SEC has already cracked down on Paxos and its issuance of Binance’s stablecoin.

- The Securities Act of 1933 gives the SEC large scope for its jurisdiction, which goes beyond the commonly used Howey test.

The U.S. Securities and Exchange Commission (SEC) has stepped up efforts to regulate cryptocurrencies following TeraUSD’s demise and the collapse of FTX.

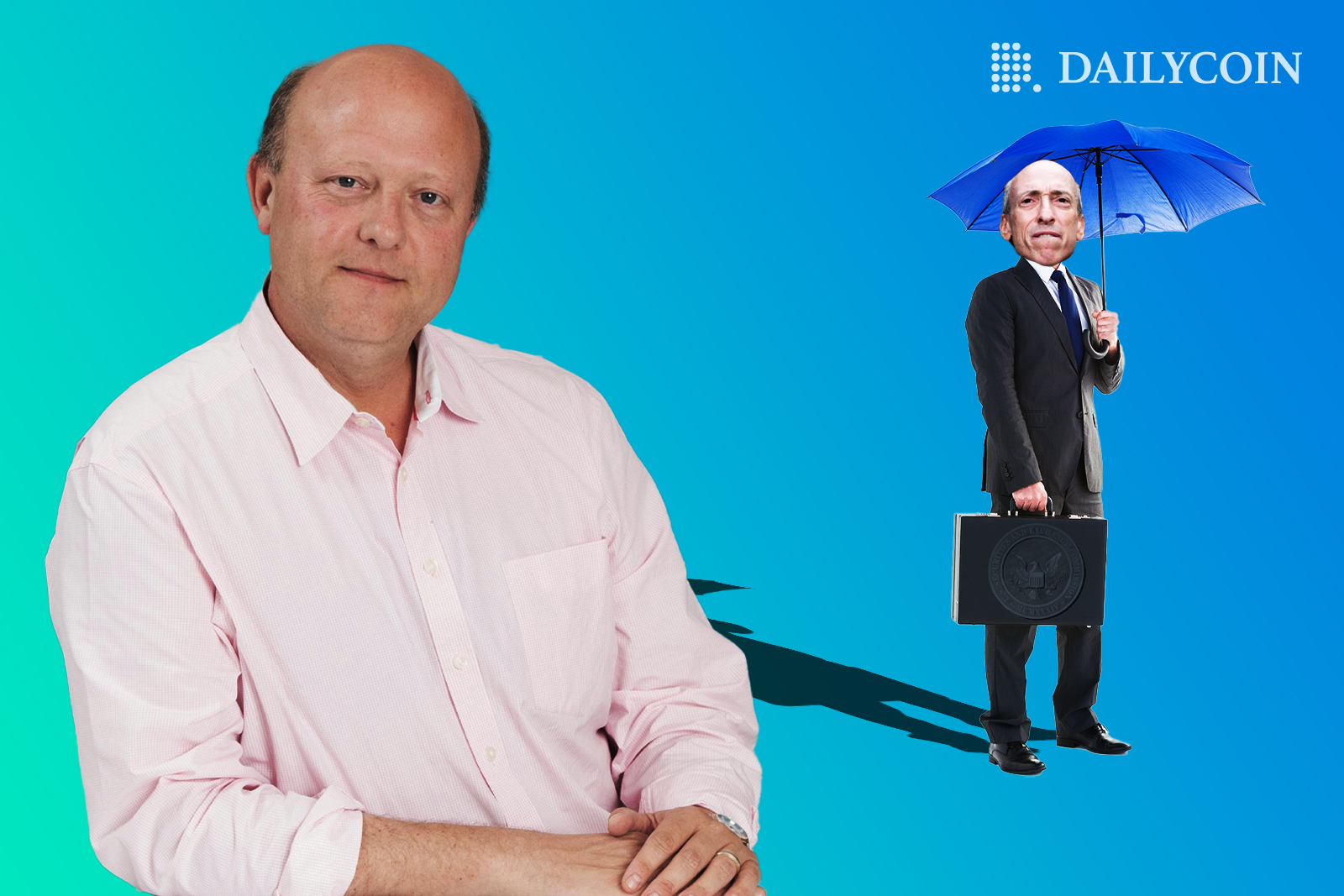

Jeremy Allaire, the CEO of payment app Circle—the same company that issues USDC—has spoken out about the SEC’s involvement, specifically referencing the regulator’s focus on Stablecoins.

Allaire asserts that the SEC is not the right regulatory body to police Stablecoins, stating his belief these fiat currency-pegged tokens are a payment system and not a security.

Sponsored

“I don’t think the SEC is the regulator for Stablecoins,” Allaire told Bloomberg. “There is a reason why everywhere in the world, including the U.S., [and its] government is specifically saying payment stablecoins are a payment system and banking regulator activity.”

Allaire added: “Clearly, from a policy perspective, the uniform view worldwide is that [Stablecoin] is a payment system, prudential regulator space.”

SEC Mobilizes on Crypto

In October last year, SEC Chairman Gary Gensler called for greater regulation in the US on Stablecoins following TeraUSD’s failure in May. However, he alluded that the Commodity Futures Trading Commission (CFTC) should have more authority over “underlying non-security tokens,” which the chairperson believes to be the class stablecoins fall under.

The SEC flexed its muscle over the Stablecoin sector on February 13, sending a Wells notice to Paxos, the issuer of Binance USD (BUSD). The SEC alleges that the BUSD Stablecoin is an unregistered security.

Sponsored

A Wells notice is a letter issued by the regulator to inform companies of planned enforcement action.

Following the Wells notice, the New York Department of Financial Services (NYDFS) reportedly ordered Paxos Trust to stop the issuance of the BUSD Stablecoin.

Vague Securities Act Gives SEC Far-Reaching Jurisdiction

Despite Allaire’s assertions that Stablecoins act as a payment system, the SEC has backed its actions thus far with a broad and ambiguous piece of legislation that expands its jurisdiction beyond what falls under the Howey test—the Securities Act of 1933.

The Howey test has long been the standard for determining whether an asset should be classed as a security. However, the Securities Act defines a security with a wide-ranging scope.

On Twitter, Business Development and Marketing Executive Adam Cochran highlighted the key difference for the SEC: “If someone is holding or otherwise securing value for you, and you are trusting them to do it, and not otherwise exempted, its a security.”

On the Flipside

- Despite the ongoing tech and crypto sector lay-offs, Circle wants to increase its workforce by as much as 25% this year. The company has also seen returns from its USDC Stablecoin reserves, boosted by rising interest rates.

Why You Should Care

Globally, crypto regulation is starting to be formalized and codified. However, in the U.S., there is still a lack of clarity on which organizations should regulate different areas in the sector. The SEC’s crackdown on the sector in recent years suggests that, under its jurisdiction, crypto would be subject to strict controls and heavy policing in the U.S.