- Polymarket Traders forecast an 89% chance of Spot BTC ETF.

- SEC is expected to approve it by Jan. 15.

- Crypto markets have been surging in anticipation.

With the anticipation of a Spot Bitcoin ETF finally getting financial approval in the US, crypto markets are in overdrive. The latest data shows a high confidence among investors that an ETF will be approved in the first half of January.

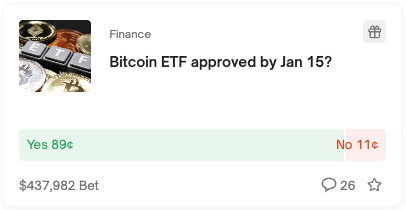

Traders on Polymarket, a crypto betting platform, are placing an overwhelming 89% odds of a Spot ETF approval by January 15.

Polymarket Traders Forecast Imminent Spot Bitcoin ETF Approval

Traders on Polymarket are leaning heavily towards a positive outcome for the U.S. Securities and Exchange Commission (SEC) approval of a Spot Bitcoin ETF. On Tuesday, January 2, the odds of a Spot Bitcoin ETF by January 15 were 89% in favor of approval.

The 89% figure reflects market sentiment and trader confidence, pointing to a bullish direction. This level of consensus suggests that traders on Polymarket are leaning heavily towards a positive outcome from the SEC.

Sponsored

At its core, Polymarket operates as a prediction market, allowing participants to buy and sell shares on the outcomes of various events. This includes Spot ETF approval, election outcomes, and more. As traders risk their money, Polymarket predictions are considered more reliable than polling data.

Grayscale Issues Amendment, SEC Wants Cash Redemption

The SEC has taken a firm stance regarding approving Bitcoin ETFs, prompting potential issuers to amend filings multiple times. Most recently, Grayscale has issued a new amendment that does not include details about authorized participants permitted to create and redeem shares.

Sponsored

Earlier, the SEC demanded that all EFTs follow the cash redemption model. This requirement obliges institutions to deposit cash equal to the ETF’s creation units’ net asset value (NAV). The ETF then uses this cash to purchase the underlying asset, such as Bitcoin. The SEC views this model as a means to mitigate market manipulation and arbitrage risks.

While originally favoring a hybrid model, EFT issuers like BlackRock have since accepted the SEC’s demands.

On the Flipside

- While optimism is high, the SEC has a track record of caution and concern over the crypto market’s volatility.

- Due to widespread anticipation, it is unclear whether the ETF approval will have a major price effect on crypto. The approval might already be priced into Bitcoin and other major cryptos.

Why This Matters

The SEC’s decision on the Spot Bitcoin ETF holds significant importance for the cryptocurrency market. Regulatory approval means more mainstream and institutional adoption.

Read more on SEC’s requirements for Spot Bitcoin ETFs:

BlackRock’s ETF Approval Uncertain: What Does the SEC Want?

Read more about the Solana surge:

How Solana Briefly Overtook BNB, Became 4th Largest Crypto