- Ripple’s XRP has encountered a double-digit percentage plunge in an abrupt market downturn.

- A billion dollars worth of leveraged positions have been liquidated.

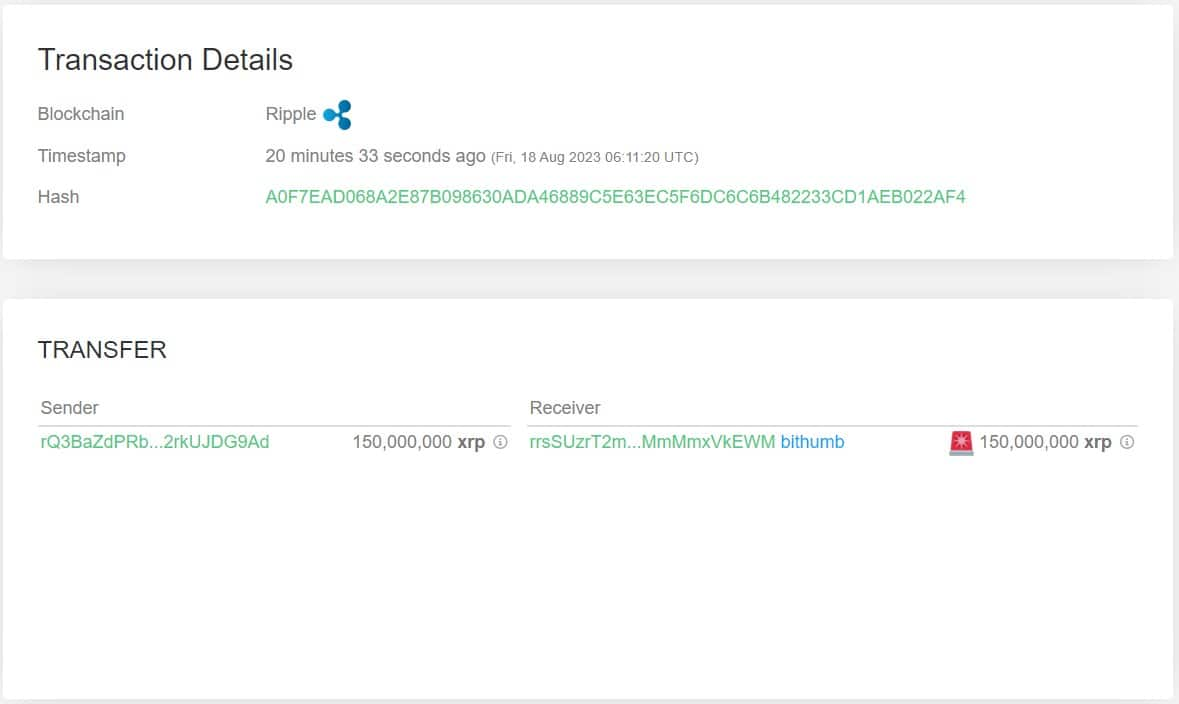

- An XRP whale has made a transaction involving 150 million XRP to Bitstamp.

In the waning hours of yesterday, August 17th, the market underwent a sudden nosedive, culminating in the liquidation of leveraged positions amounting to a staggering $1 billion. This decline has transpired following Bitcoin’s value plummeting toward the $25,000 threshold, a descent mirrored by many other cryptocurrencies.

Bithumb Receives Massive XRP Transaction Amid Market Plunge

The impact on Ripple’s XRP has been particularly severe, exacerbated by the SEC’s appeal approval. In the face of this regulatory development, the price of XRP experienced a substantial 15% drop within the same timeframe, resulting in the liquidation of leveraged positions exceeding $24 million.

Sponsored

This downturn might merely be the initial indication of the larger challenges for XRP. A notable development has been brought to light by Whale Alert, a renowned entity specialized in monitoring substantial cryptocurrency transactions. In a striking move, a transaction involving a massive 150 million XRP has been set into motion.

This substantial quantity translates to an approximate value of nearly $77 million, significantly accentuating the potential repercussions. The recipient of this substantial transaction is none other than the prominent Korean exchange, Bithumb.

Investors Eyeing Exits Could Signal XRP Performance Shift

This occurrence doesn’t necessarily guarantee an impending crash. Yet, it’s worth noting that a predominant trend among investors is to send their cryptocurrency holdings to an exchange with the primary intention of selling rather than holding onto them.

The current situation underscores the dynamic nature of the cryptocurrency market, where sudden shifts can lead to significant consequences for various assets, including Ripple’s XRP. The unfolding events warrant careful observation and analysis to gauge the potential trajectory of XRP’s future performance.

On the Flipside

- While the market experienced a sudden crash, such volatile fluctuations are not uncommon in cryptocurrency, and they often serve as opportunities for investors.

- While $80 million worth of XRP being transferred is substantial, it’s essential to consider that cryptocurrency markets often witness large transactions driven by various motives, which may not always indicate an imminent crash.

Why This Matters

This occurrence not only underscores the market’s inherent volatility but also serves as a stark reminder of the challenges and uncertainties faced by individual traders and the broader crypto ecosystem.

Sponsored

To learn more about Ripple executives’ response to the SEC’s interlocutory appeal, delve into the details here:

Ripple Executives Comment on SEC’s Bid for Interlocutory Appeal

Curious about the anonymous banker’s role in the ongoing Ripple-SEC legal battle? Get the scoop on the intriguing identity speculation in this article:

Anonymous Banker Rejoins SEC vs. Ripple Labs Legal Battle: Who Could It Be?