- The NYDFS has reduced the number of approved cryptocurrencies.

- The ratio of approved cryptocurrencies to stablecoins has shifted dramatically.

- The greenlist changes have spurred pushback from industry participants.

Cryptocurrency continues to face an icy regulatory climate at the hands of agencies overseeing the industry. The New York Department of Financial Services (NYDFS) has doled out its fair share of punishments in recent times, fining Coinbase $100 million over allegations of insufficient customer background checks and investigating Paxos as part of a wider cross-agency probe into Binance.

Following a recent review of its guidance on the listing of virtual currencies, the NYDFS has turned the screws tighter by dramatically cutting its greenlist of approved cryptocurrencies in the state, including the removal of Ripple XRP.

NYDFS Dramatically Cuts Greenlist

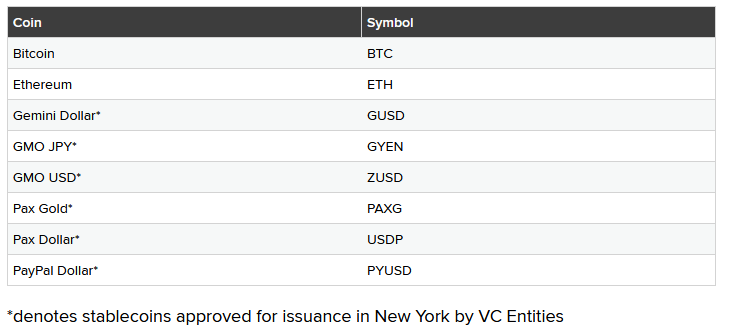

The NYDFS announced changes to the process for listing and delisting coins, which included an updated greenlist that removed all cryptocurrencies except Bitcoin, Ethereum, and Pax Gold.

Sponsored

The change meant popular altcoins, including Dogecoin, Litecoin, and XRP, which recently won a significant legal case against the Securities Exchange Commission (SEC), are no longer approved. On the other hand, the number of approved stablecoins increased with new entries from GMO USD and PayPal Dollar added to the list of existing offerings.

NYDFS Superintendent Adrienne Harris commented that the proposed changes build on the previous 2020 frameworks to keep pace with industry developments and protect investors. Furthermore, Harris added that the agency has expanded its personnel to meet the growing demands of the cryptocurrency industry while continuing to fulfill its regulatory duties.

Sponsored

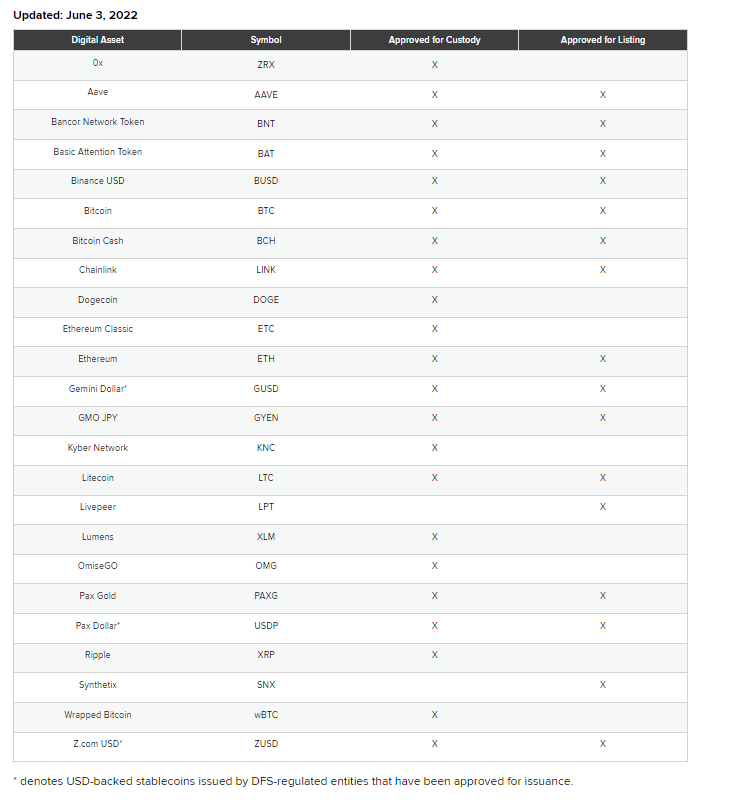

The previous NYDFS greenlist was significantly greater in scope, comprising 24 tokens comprising 19 cryptocurrencies and five stablecoins. This included obscure digital asset offerings such as 0x, Livepeer, and OmiseGO.

Despite the NYDFS’ claims of improving its regulatory standards, some industry participants argued that the changes are an overreach.

Crypto Community Has Its Say

Chiming in on the discussion, Cane Island investment manager Timothy Peterson fired a scathing response to the greenlist changes, likening the move to something a brutalist dictator would do.

Likewise, referring to Ripple’s recent legal victory against the SEC, lawyer John E. Deaton called into question the NYDFS’s impartiality for cutting XRP from the approved list of tokens.

“After it was determined NOT to be a security. It’s not even a security if Ripple sells it on exchanges. Yea, this move isn’t political or punitive in nature,” remarked Deaton.

On the Flipside

- Adopting an approved regulatory list of cryptocurrencies contravenes free market ideals.

- Ripple’s greenlist removal highlights a degree of incongruence between regulators and the US court system.

- The Monetary Authority of Singapore took a different route, focusing on overseeing service providers rather than taking a granular approach at the token level.

Why This Matters

The NYDFS slashing the number of approved tokens reaffirms the chilly regulatory climate in the US. This latest clampdown highlights authorities’ enduring wariness of crypto risk, suggesting no respite for an industry hoping for a more balanced approach to crypto regulation.

New York financial regulators unveil revised crypto guidelines. Read more here:

New York Proposes Stricter Regulations for Crypto Listings

Read Charles Hoskinson’s take on speculation Ethereum bribed the SEC here:

Hoskinson Pulls Apart SEC-Ethereum Conspiracy Against Ripple