- The Ripple vs SEC lawsuit has been found to have surprising ties to a new bill impacting cryptocurrency regulation.

- A recent court decision has thrown a wrench in the SEC’s case.

- The XRP community may have unknowingly played a role in shaping the new bill alongside the judge’s decision.

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has far-reaching implications beyond the courtroom. Recent developments suggest the case could significantly influence a new bill aimed at regulating digital assets in the US, the aptly named “Financial Innovation and Technology for the 21st Century Act” (FIT 21 Bill).

Ripple vs. SEC and the FIT 21 Bill

The FIT 21 bill, seen as a potential game-changer for the crypto industry, aims to establish clear regulations for digital assets. However, a closer look at the lawsuit reveals a surprising connection. The Ripple vs SEC case hinges on a key question: is XRP, Ripple’s native cryptocurrency, a security?

Sponsored

The answer carries significant weight for the entire crypto market. If the SEC wins, it could set a precedent for how other digital assets are classified, potentially hindering innovation and growth. But a recent court ruling by Judge Sarah Netburn Torres has complicated the SEC’s case.

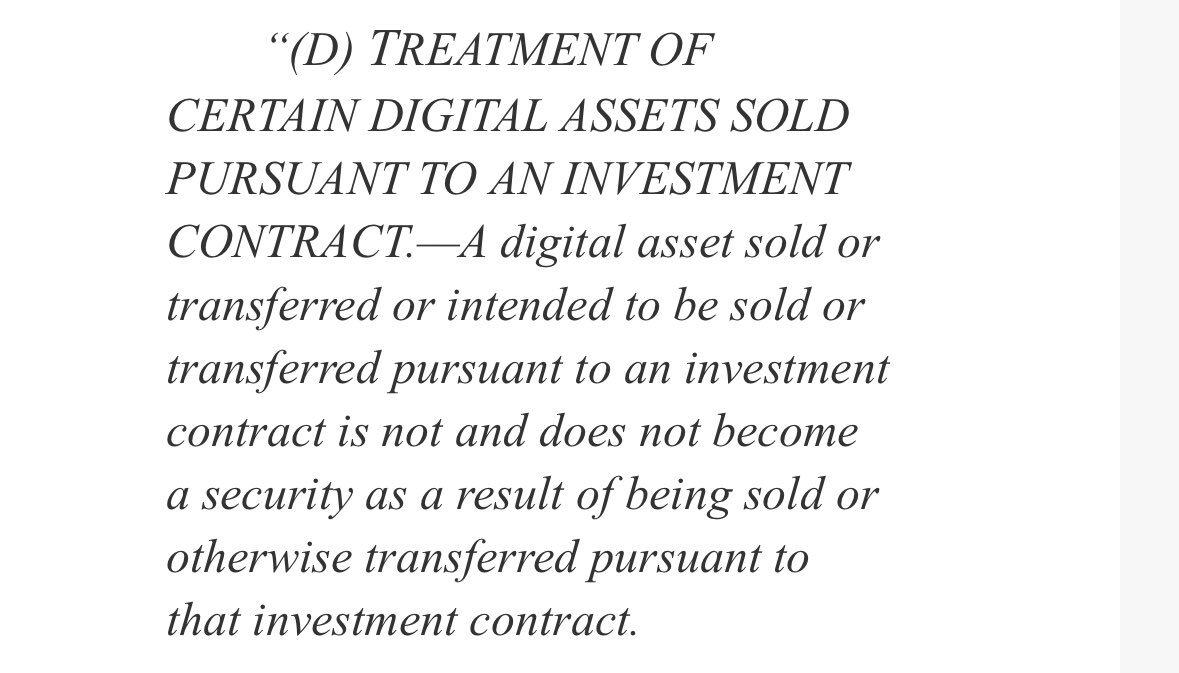

Her decision included language that appears to have influenced the FIT 21 bill. This section suggests that even if a digital asset is sold as an investment contract, it wouldn’t automatically be considered a security. This shift in perspective could have major implications for the future of cryptocurrency regulation in the US.

Did the XRP Community Help Write the Future of Crypto?

Beyond the courtroom, the XRP community, along with legal experts, has been a vocal force advocating for clear crypto regulations. Their tireless efforts to push for regulatory clarity might have played a role in shaping the FIT 21 bill.

This raises a question: has the XRP community, along with Judge Torres’ landmark decision, inadvertently helped write the future of cryptocurrency regulation in the US? The interplay between the Ripple lawsuit, the SEC’s fight to maintain its authority, and the FIT 21 bill creates a complex scenario.

Sponsored

Will the SEC challenge the court’s ruling on XRP? How will the FIT 21 bill ultimately impact the crypto industry? These are just some of the questions that remain unanswered as the legal and regulatory landscape surrounding cryptocurrency continues to evolve.

On the Flipside

- Even if XRP is ruled a non-security, it doesn’t guarantee all digital assets will receive the same classification.

- The SEC may challenge the court’s stance on the Howey Test definition of an investment contract, leading to a lengthy appeals process.

Why This Matters

The Ripple vs SEC lawsuit has become a test case for how cryptocurrencies are classified by the SEC, potentially impacting the entire industry. Judge Torres’ decision favoring Ripple and the language in the FIT 21 bill suggest a shift towards clearer regulations that don’t stifle innovation

If you found the SEC’s scrutiny of financial documents intriguing, delve into another regulatory challenge with our piece on digital asset legislation:

SEC Fights to Keep Access to Ripple’s Files

If you’re interested in legislative milestones in the crypto world, check out our coverage of a historic crypto bill passing the US House:

FIT21 Crypto Bill Sweeps Through US House in Historic Vote