- VeChain has jumped 11% over the past day.

- There is a lack of fundamental developments supporting the move higher.

- On-chain metrics show an uptick in adoption.

Enterprise-grade blockchain VeChain experienced an 11% surge over the past day. While double-digit price pumps are nothing new in crypto, VeChain’s price pump occurred with no new significant fundamental developments. However, a look on-chain showed an increase in new addresses and surging trading volume, suggesting an uptick in adoption and utilization for the veteran project.

Unique VeChain Addresses Soar

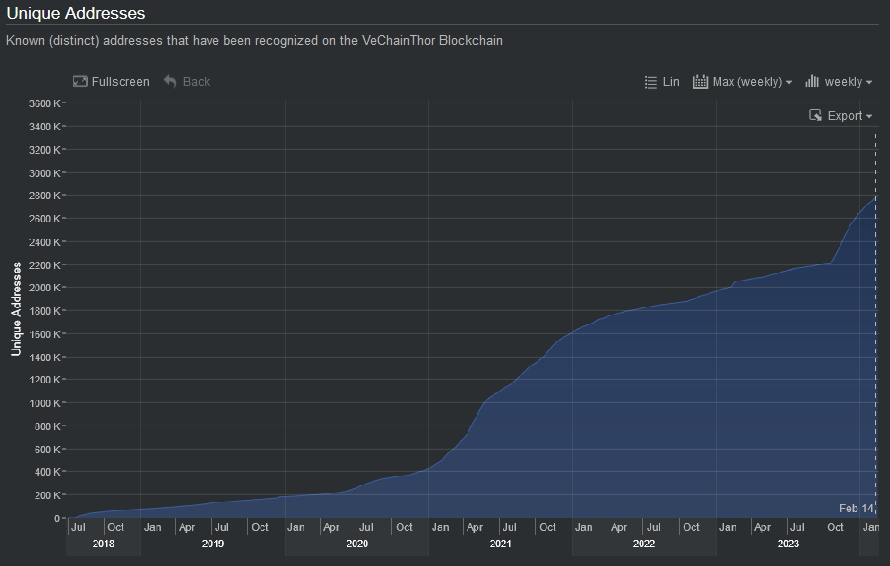

In line with rising adoption and utilization, the growth in new VeChain addresses revealed a major influx of new users and participants over the past five months. According to data from VeChainStats, unique addresses surged 27% from around 2.2 million at the start of October 2023 to a new all-time high of 2.8 million as of the week beginning February 5.

This rapid accumulation of fresh addresses follows previous strong growth seen four years prior. In April 2020, unique addresses climbed from 217,000 to nearly 994,000 by April 2021, representing a 360% increase over a year. While this trumps the recent 27% surge, a further seven more months of future address data is required to make a fairer comparison, not forgetting to factor in diminishing returns due to ecosystem maturity.

Sponsored

Since the April 2020 to 2021 surge, VeChain experienced a gradual uptick in unique addresses consistent with an expanding ecosystem. This gradual uptick turned into a flood of new users by October 2023, as denoted by the steeper gradient of unique addresses.

As well as a flood of new users joining the VeChain ecosystem, recent volume data shows that trading activity has increased over the last 24 hours.

VeChain Trading Volume Up

VeChain’s trading volume data supports its recent price pump. Data from Yahoo Finance showed that VET trading volume surged 88% to $96.4 million on February 14 from $51 million the prior day. February volume to date has hovered around the $30 million mark.

While the impressive jump in volume highlights a boost in trading activity, VeChain volume has still seen larger historical spikes recently, with January 8 turning over $134.7 million to mark the highest yearly daily trading activity to date.

Sponsored

Alongside the higher-than-normal trading volume on February 14, VeChain’s latest price action suggests support for further price gains.

VET Price Jumps 11%

Recent VeChain price action highlighted a buying frenzy sending the VET token to a $0.036 intraday high on February 14, hitting levels not seen since early January. Moreover, bullish momentum is on track for VET to close its fourth consecutive daily green candle.

Technical analysis performed by X influencer Captain Faibik noted that the recent uptick led to VET breaking out of a long-established descending channel. Descending channels are bearish trends characterized by lower highs and lower lows. A break out of this pattern suggests that a reversal is in play if the asset can maintain its price above the upper channel line.

Zooming out reveals that VET has closely mirrored Bitcoin’s price movements, trending lower on January 11 during the marketwide sell-off post-ETF approval, then forming a local bottom on January 23 at $0.0248.

Bitcoin recaptured $50,000 on February 12, and while the next day experienced US CPI-related jitters, February 14 saw the leading cryptocurrency make a decisive break to record an intraday high of $52,100. This positions the rest of the crypto market in good stead for the short term.

On the Flipside

- Hardware wallet firm Tangem added VeChain and VeThor support on Feb 1.

- VeChain pledged to expand its availability on hardware wallets soon.

- Despite recent price rises, VET is still 88% below its $0.281 all-time high, achieved in April 2021.

Why This Matters

This latest VeChain pump demonstrates its potential to see sudden bursts of speculation and volatility amidst the broader crypto bull run. Savvy traders may look to capitalize on these aggressive rallies, while long-term believers see rising prices as validation of VeChain’s staying power.

Read more about VeChain’s Q4 2023 stirring here:

Sleeping Giant VeChain Suddenly Wakes from Slumber

Find out about Kraken’s attack on privacy and self-sovereignty here:

Kraken Demands Crypto Self-Custody Wallet Info from UK Users