The crypto market has witnessed several defining moments since its arrival, and despite all the lows that have engulfed the crypto world, it has always come back even stronger. And it’s not a secret that every crypto-enthusiast has experienced “the dip” at one point, when things go south in the crypto market, and they still weather the storm of the volatile market.

Incidentally, digital currencies have not fared well over the past few months, thanks to the persisting bearish market. Notably, Terra Luna has completely collapsed, while the majority of altcoins and popular crypto-assets like Bitcoin (BTC) and Ethereum (ETH) are trading at their lowest prices in recent periods.

At best, this worrisome moment in the cryptosphere has dampened the hopes of old-timers as well as that of potential investors, irrespective of the smooth run that most coins experienced last year.

Sponsored

That said, it is not a new discovery that a lot of artificially-engineered activities are capable of disrupting the crypto market. For instance, the Elon Musks of the world are known for influencing the rise and fall of various digital currencies due to their affluence and reputation for building wealth.

Likewise, crypto whales or individuals with wallet addresses holding a significant amount of cryptocurrency are not left out. Typically, by buying and selling huge amounts of cryptocurrencies at once, these individuals often cause significant disruptions in the crypto market.

Sponsored

While these manipulative approaches to influencing the crypto market are not sustainable, to say the least, it is important to establish proactive measures to curb what may turn out to be the downfall of the emerging crypto market. One way to put a semblance of order to a market known for its volatility and instability is the implementation of an Iceberg Order.

What does that mean? In this article, we’ll break down what an iceberg order means in simple terms, how it can function as a financial instrument that is capable of solving the aforementioned problems, and how best they can positively affect the crypto market. Let’s dive in!

Introduction to Iceberg Order

To begin with, imagine a scenario where a crypto whale intends to purchase 10,000,000 units of a cryptocurrency at a hefty price of $30 per unit and an average daily trade volume of 800,000 units. You would agree that such an order is capable of disrupting the market trend, not to mention invoking panic among traders.

We are also quite familiar with the concept of “pump and dump” in the crypto world, where a big player tries to influence the price of cryptocurrency for his gain by dealing with a large-volume order. Such manipulations of the demand and supply curve have led to so many small-scale traders getting stung in the process.

However, the advent of an “iceberg order” prevents this type of scenario by introducing cushioning checks on such bulk orders, thereby creating a safer trading environment for large-scale and small-scale investors.

So does this trading model imply that both big and small-scale investors are finally on equal footing? Is this another ploy to make things easier for the big sharks, or perhaps it is a way of stifling the incessant power plays among big-scale investors from manipulating the market? Whichever way you look at it, everyone wins. So what does an iceberg order mean exactly?

What Is an Iceberg Order and Why Is It Important?

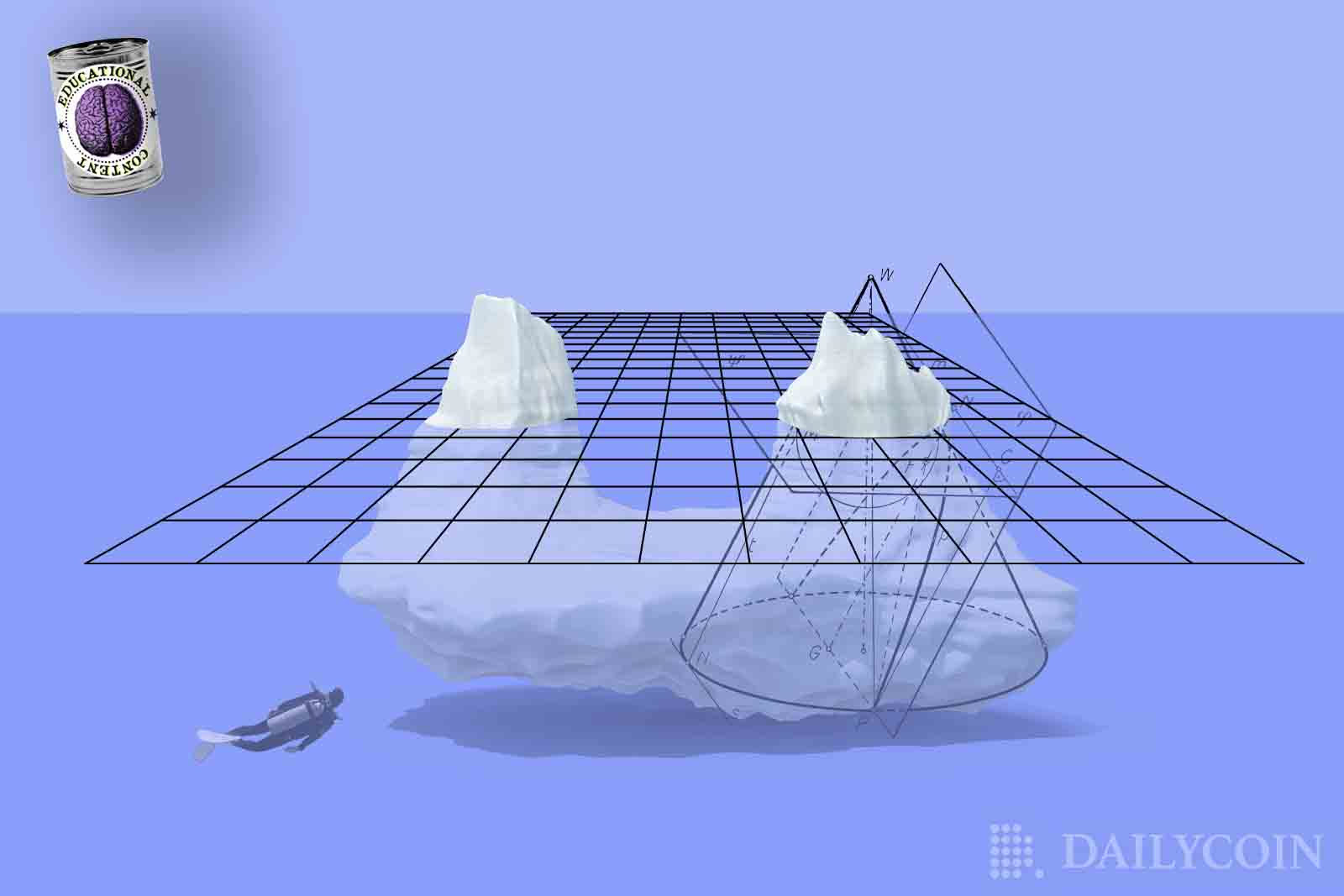

An iceberg order, according to various reliable sources, refers to a large single order that has been divided into smaller units or limited orders, usually through the use of an automated program that is designed to hide the actual order quantity from the public.

Essentially, the term is used to describe a scenario whereby a large/bulk order is placed on an exchange; however, instead of processing the order directly as placed by an investor, it is subsequently divided into bits before being processed.

This particular trading tool was adopted in the traditional financial market, which is where it was previously implemented before finding its way into the crypto world. The adoption of an iceberg order trading model for the crypto market was born out of the need to foster a healthier and more advanced market to rival the stable and trusted traditional financial market.

That said, what is the importance of an iceberg order and how is it applicable in cryptocurrency trading?

The importance of the iceberg order in steadying the quite volatile ship of the crypto market cannot be over-emphasized. Crypto whales, comprising of large firms or affluent individuals, mostly use the iceberg order when they carry out big crypto transactions to prevent potential disruption.

Although optional, the trading instrument enables large-scale buyers, mostly institutional investors to carry out large crypto transactions without upsetting the market. In other words, by using iceberg trading, they do not influence the demand and supply of the market, and such transactions usually stay away from the prying eyes of the market.

How Do Iceberg Orders Work?

In crypto terms, an iceberg order implies that a big trading order will be divided into smaller limit orders to conceal the transaction size and avoid disruptions in the price level of a crypto asset.

For instance, if a large-scale investor intends to sell 2,000 BTC; rather than sell it off at once they can decide to make use of an iceberg option on an exchange, such that the order will be programmatically divided into smaller bits. That way, the order may be filled to sell 200 BTC in multiples of 10 or depending on the amount set by the trader.

Also, iceberg orders comprise visible and hidden orders, implying that only a small portion of the micro orders will be displayed on the order book. More specifically, when the visible orders are already executed, the hidden orders are subsequently passed on to the exchange’s order book.

This situation is quite synonymous with the popular saying “Tip of the iceberg,” which suggests that a small part of something is seen or heard about, whereas there is a much larger part that is not seen or heard about.

Ultimately, creating a more structured plan for carrying out crypto transactions of any kind is already becoming a norm in the crypto world; hence, the need to include certain tools that were originally used in the traditional financial market, which are already tested and trusted.

In that light, the iceberg order and many other tools now used in the crypto world are all an attempt to build the crypto world into a more stable market.