This weekend saw a double-digit drop in many cryptocurrencies, which several analysts and economists are attributing to the increased incidence of the Omicron COVID-19 variant globally and the uncertainty whether the existing arsenal of COVID-19 vaccines and treatments will be enough to counter it.

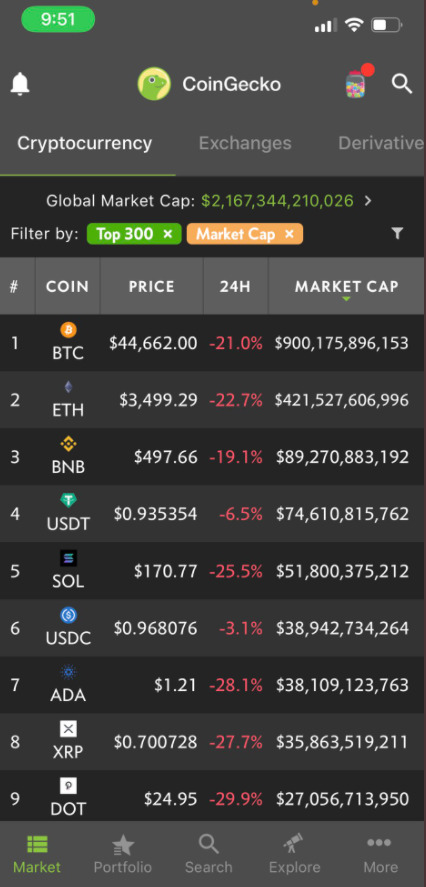

A Thursday article in Forbes noted that Omicron uncertainty was the likely catalyst for a Commitments of Traders report from the Commodities Mercantile Exchange that saw a 200% spike in short positions for Bitcoin futures contracts from 887 to more than 2,660. Leveraging that uncertainty, and the huge increase in short positions, could have played a role in this weekend’s flash crash that saw a more than 20% decline for several top-10 crypto projects including Bitcoin, as seen in this screenshot from CoinGecko on Saturday morning.

Many crypto investors saw this decline as an opportunity to buy the dip, such as El Salvaror’s president Nayib Bukele who tweeted that his country bought another 150 Bitcoin during this latest drop.

Sponsored

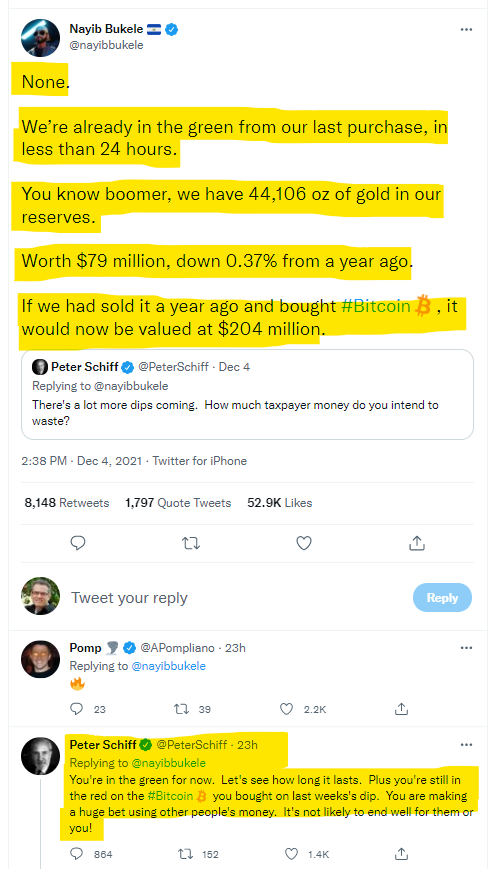

While that post had nearly 10 thousand retweets and 71 thousand likes, one response from the founder of Euro Pacific Asset Management firm, ardent gold investor, and vocal Bitcoin critic – Peter Shiff – blasted Bukele’s move asking, “There’s a lot more dips coming. How much taxpayer money do you intend to waste?”

Schiff’s comment provoked a provocative exchange between the two as depicted in this following screenshot.

Despite Schiff’s assertion, Bitcoin has averaged annualized returns of more than 200% since its creation. As of this writing, Bitcoin was trading at $48,818 and was down 1.32% over the last 24 hours. With this latest purchase, El Salvador currently holds 1,270 Bitcoin.

On The Flipside

- Buying the Bitcoin dip repeatedly has been a successful strategy that has added tens of millions in profit to El Salvador’s public coffers.

- Those funds have been used to build schools and animal hospitals.

Why You Should Care?

This latest decline seems to have been triggered by the Omicron strain but may have been amplified by the unprecedented spike in short leverage positions of 200%. This is a warning that as more investors adopt cryptocurrencies, we need to be aware of traders who seek to exploit negative news to their advantage.