Tron-based stablecoin Decentralized USD (USDD) lost its peg to the U.S. dollar on Sunday, marking the second time in the last 7 days that the algorithmic stablecoin has suffered a drop in value.

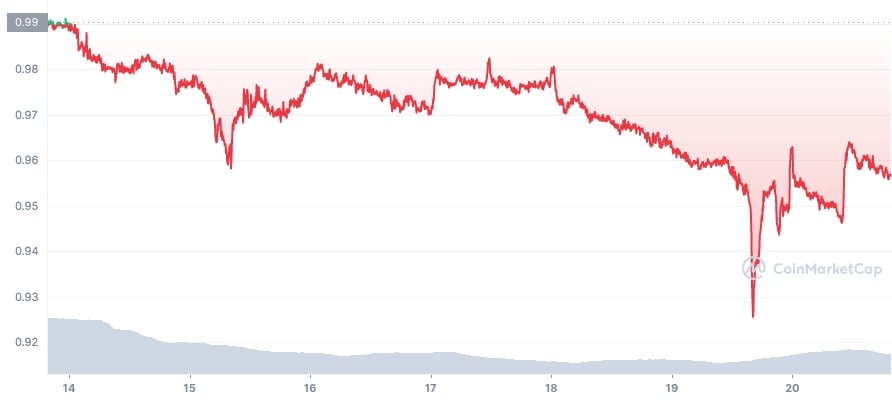

The USDD stablecoin slipped to a low of $0.9256 on June 19th, declining by nearly 3.3% in just a few hours, as seen on CoinMarketCap. Tron’s stablecoin had experienced a similar 3.2% decline early last week, sliding from $0.9907 to $0.9582 on Wednesday, June 15th. The coin has failed to regain its original peg since then, and trades at $0.9585 at the time of writing.

Accordingly, the value of Tron’s native coin TRX dwindled 26% down to $0.4773, before rebounding to its current value of $0.0609 at press time.

After launching in the early days of May, Tron’s algorithmic stablecoin held a 1:1 peg to the United States dollar. The coin was widely labeled an exact copy of Terra’s now notorious UST, operating with identical mint and burn mechanisms that rely solely on the algorithm to maintain a $1 value. Simply speaking, the mechanism burns Tron’s native governance coin TRX to mint USDD, and vice versa, thereby keeping stablecoin stable. As we now know, this model failed for Terra.

Sponsored

Relfecting on this, Tron upgraded its USDD earlier in June to safeguard it from the same ending, partially backing it with various digital assets in the Tron DAO Reserve as a means of supporting the dollar peg.

Tron then officially named USDD as the world’s first “over-collateralized stablecoin”. The issuer claims that the updated USDD has a 130% collateralization rate, and will be collateralized to the extent of $10 billion.

Sponsored

As stated on the official website, the Tron DAO Reserve currently holds a total collateral of $2.3 billion, while the total supply of USDD accounts for more than 723 million USDD stablecoins.

Billions of TRX Withdrawn

Despite the measures put in place, USDD slipped from its 1:1 peg twice in the span of a single week. To explain this, Tron’s founder Justin Sun blamed a large number of short-sellers who had allegedly targeted TRX on the Binance crypto exchange.

Sun hinted at the injection of $2 billion to fight the short-sellers, and predicted a short squeeze in the TRX market. Instead, the Tron DAO withdrew 1.5 billion TRX from Binance “to safeguard the overall blockchain industry and crypto market”, as it then stated.

To safeguard the overall blockchain industry and crypto market, TRON DAO Reserve withdrew 948 million #TRX out from binance. https://t.co/k0KibtuWdd

— TRON DAO Reserve (@trondaoreserve) June 15, 2022

In other words, Justin Sun and Tron DAO withdrew TRX from the market to boost the price of its USDD stablecoin. The reasoning for the move is that, if the price of Tron’s governance coin continued to drop, failing to stabilize, it would not be valuable enough to redeem in USDD.

In terms of the mechanics behind algorithmic stablecoins, the tactic should have worked, assuming the proper amount of TRX tokens were burned or removed from circulation.

Unfortunately, the exact opposite has happened, and the stablecoin with a market cap of $693 billion saw its value dip to $0.92. Furthermore, on-chain data shows, that only $544 million worth of TRX coins have been transferred to the network’s dead wallet at the time of writing.

Why You Should Care

At the time of writing, the Tron DAO Reserve holds 10.8 billion TRX, more than 14K bitcoin, over 140 million USDT, and more than 1 billion USDC.

If TRX’s price fails to stabilize, the Tron DAO Reserve will need to deploy reserve assets to help maintain its 1:1 peg to the U.S. dollar.

In such uncertain times, amid a gloomy macroeconomic landscape due to the looming threat of recession, when even prominent crypto hedge funds face liquidation, the crash of yet another stablecoin could send destructive ripples through the cryptocurrency market, and perhaps even send Bitcoin tumbling to lows long unseen.