Thanksgiving is a time for family and friends to get together and count their blessings. It’s also when our relatives ask us how our crypto portfolios have been doing since last year.

Unfortunately, most crypto holders won’t have much to brag about this year. The markets have been hit hard by rate hikes and a series of centralized entities going bust, culminating with the spectacular meltdown of FTX.

Sponsored

Despite allegations of stealing user funds, Sam Bankman-Fried is still likely getting better treatment from the media than many people will get from their relatives this Thanksgiving – especially if they told them to invest in crypto last year.

Under pressure from disgruntled relatives, many traders may be tempted to sell their tokens while still at the turkey table. That’s why we are bringing some tips to help holders get through Thanksgiving dinner.

Put Things in Perspective

Bitcoiners are notorious for their devotion to “digital gold,” and many will share it on Thanksgiving.

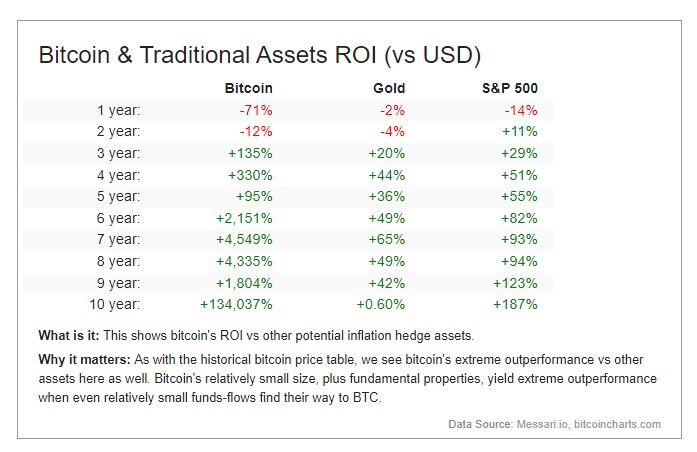

Its performance could have been better in 2022, to say the least. The digital asset lost 71% since last year.

Sponsored

However, it’s important to put things in perspective. Despite the highs and the lows, Bitcoin’s returns have so far been spectacular.

For instance, in the last six years, its return on investment (ROI) has been 2,158%, compared to 49% for gold and 82% for the S&P 500.

Putting things in perspective should help to avoid any Thanksgiving awkwardness. Crypto holders may not win this year. But in the long run, they usually come out on top.

Give Better Advice

However, Bitcoin’s performance tells only a part of the story. Just because BTC did well does not mean that most bitcoin holders did.

The problem is that most people only invest when the hype is at its highest, which is usually when the market reaches a peak. When prices crash, they sell, only to get back in at the top of the next hype wave. Instead of buying the hype, it’s better to do independent research and buy and hold tokens from promising projects.

However, it’s also important to be realistic. Average traders don’t know what’s going on in every crypto company and can’t really assess the risks. That’s where diversification comes in.

Diversification is crucial to get the best returns as a retail trader. Investing in multiple blue chip tokens will allow investors to benefit from the rise of decentralized tech. At the same time, they will reduce the risk if any of them go under.

Talk About Tech, Not Tokens

Talking about specific tokens will inevitably lead to awkward conversations with relatives. Instead of talking about prices and trades, it’s better to focus on the potential of the technology.

Educate friends and families about the importance of self-custody and how to avoid scams.

Thanksgiving is a good time to explain the phrase “not your keys, not your coins.” It’s also a good time to educate people about the dangers of custodial “yield-farming” platforms that offer unrealistic returns.

A lack of education is what burned investors in Terra-Luna and FTX. The only way to avoid this in the future is to educate crypto users.

Don’t Talk About Crypto

Sometimes, it’s better to avoid the topic of crypto altogether. There’s a reason that people avoid talking about finances at the dinner table.

Most people don’t just talk openly about their stock portfolios or how much their house is worth. Why should crypto be any different?

Thanksgiving is a time for family and friends, so use it wisely. At the end of the day, enjoying a stress-free Thanksgiving dinner with your loved ones is all that really matters.