- Media have reported that the slow-moving price action is a frosty forecast that the crypto winter is coming.

- Some analyses went on to show an even stronger bullish pattern has been quietly consolidating and growing.

- Trading volume on Bitcoin has been extremely low for the past few weeks.

- The only certainty in the crypto market is that it will change.

The crypto crash of May 19th of this year, sent frosty chills down the spines of many cryptocurrency hodlers who saw their portfolios drop by more than 50 percent. During the nearly four weeks since then, there has been modest movement in the crypto markets as most of the prices of cryptocurrencies have been range bound following Bitcoin’s lead.

Generally speaking, as Bitcoin goes – so goes the rest of the crypto market.

Which is why, if you look at this chart that goes back to May 22nd – prepared by expert technical analyst and crypto influencer MMCrypto over on YouTube – it clearly appears that Bitcoin has been frozen in a pricing channel that ranges between $31,000 to $40,000 U.S. Is that the sign of an early crypto winter or a consolidation cooldown?

Some in the mainstream business and crypto media have reported that this sluggish pattern with slow-moving price action is a frosty forecast that the crypto winter is coming.

However, on Sunday June 13th Bitcoin saw a double-digit price spike and a weekly close above $39,600 – a key price resistance level for the coin, which could melt the crypto-winter worries. Additionally, the MMCrypto 4-hour chart below for Monday June 14th shows a positive price trend circled in yellow.

Furthermore, his technical analysis went on to show an even stronger bullish pattern has been quietly consolidating and growing over the past several days. The MMCrypto chart below reveals that there has been a W-pattern (also called a double-bottom pattern) building, which is easier to use when the blue resistance line on top and blue support line beneath the pattern are added.

According to Investopedia, a W-pattern or double-bottom pattern is considered a bullish technical signal:

"Rounding bottom patterns will typically occur at the end of an extended bearish trend. The double bottom formation constructed from two consecutive rounding bottoms can also infer that investors are following the security to capitalize on its last push lower toward a support level. A double bottom will typically indicate a bullish reversal which provides an opportunity for investors to obtain profits from a bullish rally. After a double bottom, common trading strategies include long positions that will profit from a rising security price."

MMCrypto noted in his analysis that this appears to be an especially strong bullish signal because each of the yellow circles on his chart clearly shows higher highs and higher lows along the ascending lines of support and resistance, which are all indicators of a positive pricing trend.

While the past few weeks may have left many digital asset investors believing the winds of crypto winter were beginning to blow, it might be too early to break out the hodler hoodies, ETH earmuffs, and BTC boots. In fact, if the bullish pattern is confirmed within the next 48-72 hours, things may just be heating up for a strong pricing pump.

However, even the dawning sun casts shadows, and there is a looming shadow that’s growing on the daily chart for Bitcoin. On Thursday, June 17th MMCrypto posted a video discussing the strong likelihood of a technical “Death Cross” for Bitcoin in the next few days.

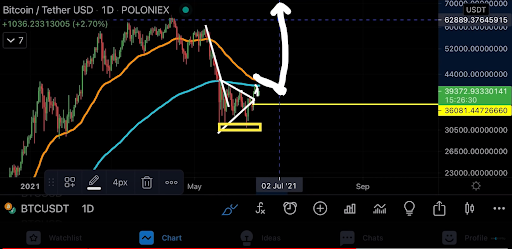

On the chart below, the orange line represents the 50-day moving average for Bitcoin’s price and the blue line represents the 200-day moving average. The downward sloping orange line clearly shows a declining pricing trend for Bitcoin during the past several weeks.

If (and likely when) it crosses the 200-day moving average, that intersection is called a “Death Cross” – which happens to be a bearish signal. While that cross has not happened yet, its point of contact is circled in white to demonstrate just how close we are to this particular event. MMCrypto calculated that to flatten the orange line and avoid the crossing pattern would require a $1,500 increase in Bitcoin’s price, every day for the next 12-14 days. Basically, the daily green price candles need to start popping above the orange line and stay above it for about two weeks.

The excellent website, Investopedia, is an incredible resource for anyone interested in learning more about technical analysis and the markets in general. Here it provides a sobering definition of a Death Cross:

The death cross is a technical chart pattern indicating the potential for a major sell-off. The death cross appears on a chart when a stock’s short-term moving average crosses below its long-term moving average. Typically, the most common moving averages used in this pattern are the 50-day and 200-day moving averages."

"The death cross indicator has proven to be a reliable predictor of some of the most severe bear markets of the past century: in 1929, 1938, 1974, and 2008. Investors who got out of the stock market at the start of these bear markets avoided large losses that were as high as 90% in the 1930s. Because a death cross is a long-term indicator, as opposed to many short-term chart patterns, it carries more weight for investors concerned about locking in gains before a new bear market gets underway. An increase in volume typically accompanies the appearance of the death cross."

It’s important to note that trading volume on Bitcoin has been extremely low for the past few weeks, so it’s difficult to say that a massive, bearish sell-off can occur without the required volume to support it. While no one can predict the future, MMCrypto believes that even if the Death Cross does occur – it won’t last long. In his final chart below, he extends the orange 50-day moving average below the 200-day BUT he believes the Bitcoin pricing discount will be too great for institutional investors to ignore. He says the buying pressure could be swift, resulting in a Bitcoin price rebound that could spike to new highs by mid-July – as drawn in the white arrow upward.

Once again, the only certainty in the crypto market is that it will change. To know for sure whether it will change to a winter bear or summer bull – we’ll have to wait and see.

On the Flipside

- While a strong price breakout above a prolonged pricing channel is positive – as occurred with Bitcoin on Sunday June 13th – to confirm whether it’s a “bullish breakout” or “bearish fake out,” analysts say the price must reverse down to the previous resistance level it broke through.

- If the price bounces off the former resistance line, transforming it into a new support line, then the bullish trend is confirmed.

- However, if the price crashes below the resistance line, the resistance remains intact and the asset is likely to experience lower lows until it finds a new level of support.