- The cryptocurrency market has experienced a bullish trend in the past weeks.

- The market is undergoing a price decline as the value of Bitcoin teeters.

- Other high-capitalization assets have also seen a decline in prices.

For many, Christmas has come early this December, as a crypto market rally sparked life into bullish momentum for the industry. Leading the charge is Bitcoin (BTC), which is experiencing a significant price increase amid the market surge and expectations of Bitcoin spot ETF approvals from the U.S. regulatory body.

However, the inherently volatile nature of the industry has reared its head once more as Bitcoin and other top-performing crypto assets experienced a sudden decline in their trading prices.

Bitcoin Drops to $40K Price Mark

In the early hours of Monday, December 11, trading activity revealed a plummet in Bitcoin’s price, which sank to $40,521 from $43,357.

Sponsored

Shockingly, the 7.5% drop occurred within a 20-minute period, erasing several days of gains for investors.

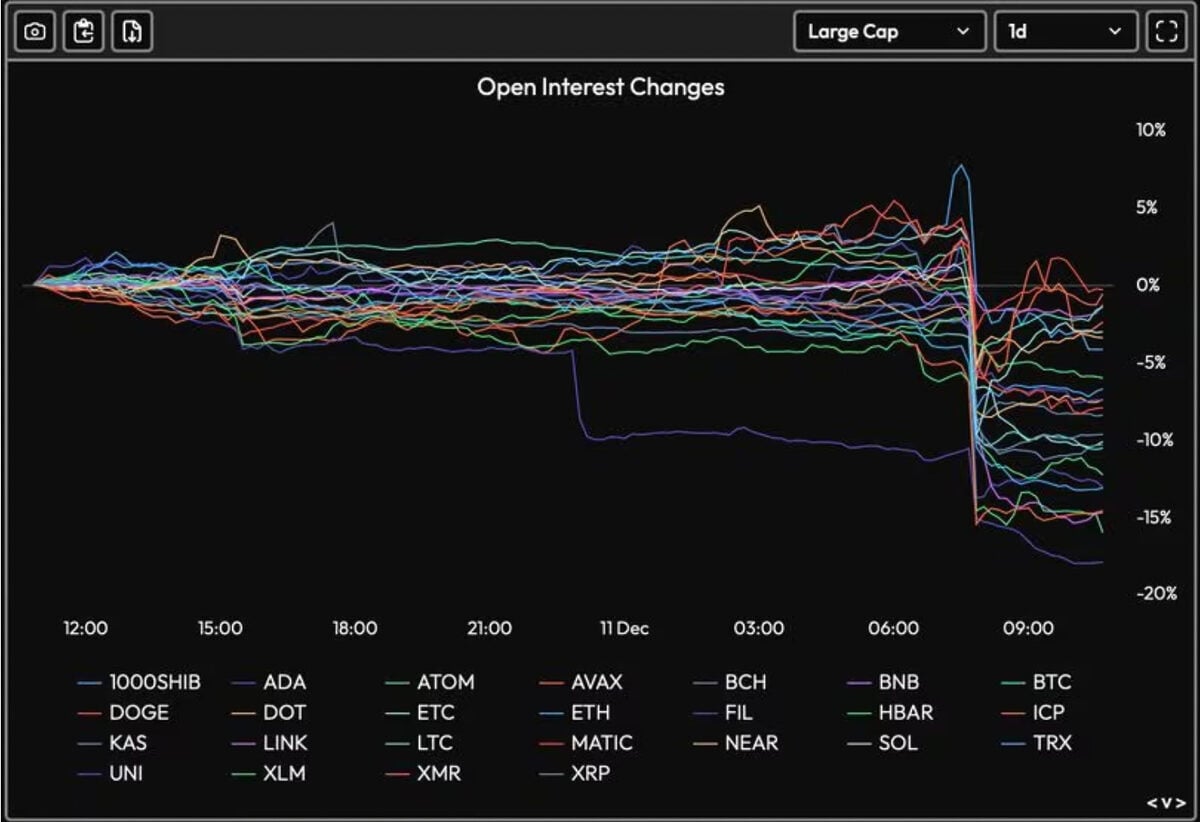

Bitcoin was not the sole asset affected by the market drop, as 25 other industry-dominating assets lost value within the same timeframe. Around 2:30 am GMT, Ethereum (ETH) fell nearly 9%, plummeting to a low of $2,170 from a price point of $2,370, along with Solana (SOL), which dropped to $66 from $74.59.

The assets did go on to make a partial recovery, with Bitcoin rebounding to trade at $42,245, 3.6%, still lower than its starting point. Ethereum has also experienced an upward shift, trading at $2,248, while Solana climbed to its current trading price of $68.26.

According to Coinglass data, the crypto market witnessed over $335 million in liquidations in the past 12 hours, with Bitcoin and Ether leading the charge at more than $89 million and $74 million, respectively.

Sponsored

Bitcoin, at the time of writing, is trading at $41,923, indicating a correction from its month-long market rally and price increase.

The December Bitcoin Price Rally

December 2023 started on a high note for Bitcoin, with a significant price surge occurring just a few days into the month.

On December 2, Bitcoin began its ascent, breaking through its struggle with a month-long price range of $34,000 to $37,000. The asset surpassed $42,000 in the early hours of Wednesday, December 4th, before reaching $44,000 in less than 24 hours. The upward momentum marked the strongest movement since Bitcoin’s previous cycle run in November 2021.

The market surge was further fueled by the expectations of spot exchange-traded funds (ETFs), intensifying trading as investors eagerly anticipate an imminent flurry of approvals that could unlock billions in institutional funds into the asset.

On the Flipside

- The SEC is yet to make a decision on spot Bitcoin ETFs, despite the market buzz that an approval is imminent, expected on January 10.

- Bitcoin remains 37% below its all-time high, but industry experts predict it will continue to rise in value, potentially hitting above $1 million.

- Intensifying regulatory scrutiny on the industry from financial regulators may challenge the rallying market.

Why This Matters

The drop in asset prices counters the expectations of a bullish cycle for the industry, particularly in the light of optimistic expectations of Bitcoin reaching $50K by the new year, which is expected to influence the SEC’s consideration of ETF proposals.

The United States is still cold toward the cryptocurrency industry. Find out more:

Senator Warren Labels Crypto A Threat To The United States

Read more on predictions of a bullish run as we approach 2024:

Are We Entering a Bull Market? Binance Report Suggests So