- Tether has expressed optimism about its Q1 profits.

- USDT has seen a large influx of volumes due to migration from USDC.

- USDT’s growing circulation has raised concerns about Tether’s ability to provide proper guarantees of reserves.

Tether, one of the biggest stablecoins, has reported a positive outlook for Q1 profits as March ends. The demand for USDT increased during the quarter, contributing to the revenue surge. However, the future may hold some challenges for the stablecoin.

According to Tether’s latest report, the company expects more than $1 billion in total revenue from USDT in Q1, with a projected profit of $700 million for the quarter.

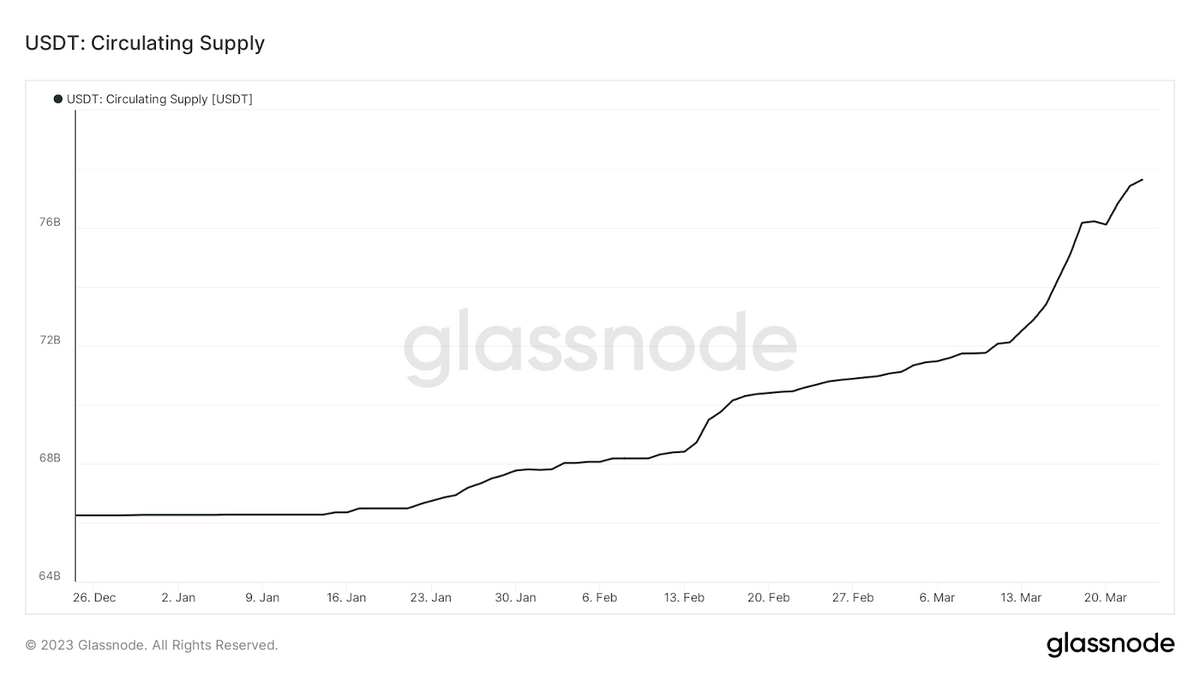

The stablecoin segment, which refers to a specific part or division of the cryptocurrency market, has experienced a lot of activity in the first quarter, particularly following USDC‘s depegging. Many people migrated from USDC to USDT, contributing to the volume surge. Tether also increased USDT supply in Q1 and continues to do so, according to recent data from Glassnode.

However, there are concerns about whether the increase in circulating supply will match the prevailing stablecoin demand. Looking at active addresses and transfer volumes can provide interesting insights.

Active addresses peaked in mid-February, during which there was a surge in daily transfer volume. This is likely due to the outflows as the market saw ample demand. Interestingly, USDT transfer volume peaked on March 11, mainly due to the inflows resulting from USDC migration. However, transfer volume has dropped since then due to outflows as the demand for cryptocurrencies surged.

Concerns Over Tether’s Ability to Provide Reserves

Despite the positive outlook for Tether, its stability has been a point of concern for some in the crypto community. Critics worry that Tether may not have adequate reserves to back up the USDT stablecoin. The SEC recently added to those concerns by criticizing Tether and USDT, calling proof of reserves meaningless in a recent statement to investors.

While some see regulators’ increased scrutiny of cryptocurrencies and stablecoins as a negative development, others view it as a positive sign that regulators are taking the industry seriously. Despite the differing views, there are still worries that a bank run could cause stablecoin pegs to be lost in the future.

On the Flipside

- A collapse or loss of confidence in stablecoins would have far-reaching consequences for the broader financial system.

- Reports and rumors regarding Tether’s financial health have been circulating for some time.

- Questions regarding the financial structure that underpins USDT have consistently been directed at Tether.

Why You Should Care

Tether’s status as the largest stablecoin in the crypto market makes it an integral part of the ecosystem. If Tether were to lose liquidity or collapse, it could have far-reaching effects on the entire crypto industry and even spill into other financial markets, potentially causing widespread panic.

Sponsored

For information on Tether’s recent profits despite market volatility, take a look at this article:

Tether (USDT) Reveals $700M Profit in Last Quarter Despite Crypto Market Turmoil

Binance has recently decided to establish a blockchain hub in Georgia to help promote crypto adoption. Read here to learn more:

Binance to Set Up “Web3 Outpost” in Crypto-Friendly Georgia