The collapse of the Terra (LUNA) network marked one of the biggest disasters the cryptocurrency space has ever experienced. The protocol crashed, forked, and rebranded simultaneously, creating a diverse ecosystem in the aftermath, the Terra Luna Classic communities.

At first glance, they share the same goal: revitalizing the Terra protocol. But if you look closely, you can see that each has its hidden interests.

DailyCoin decided to look at the trending narratives across Terra Classic communities and who is behind them.

Backstory: The Terra (LUNA) Collapse

In early May 2022, Do Kwon, co-founder and CEO of Terraform Labs, the company behind Terra (LUNA), allegedly unstaked and withdrew $3.9 billion worth of TerraUSD (UST) algorithmic stablecoins from Anchor, the lending protocol built on Terra’s blockchain.

Sponsored

The massive liquidation triggered a TerraUSD price decline, whose $1 peg was directly supported by the supply of Terra’s native governance coin, LUNA. The LUNA supply varied to keep the TerraUSD’s stable $1 value.

Sponsored

When Terra’s stablecoin de-pegged, more LUNAs were minted, pushing the supply to unprecedented highs and consequently crashing the price. TerraUSD and LUNA lost over 99% of their value in less than a week. This sent shockwaves across the whole cryptocurrency market and crashed the price of almost all digital assets, including Bitcoin (BTC).

Source: CoinMarketCap.com

The same month Do Kwon proposed to fork from the compromised network, its validators voted “yes,” and thus, the new Terra Luna 2.0 (LUNA) project was born. The old one kept functioning, rebranded as Terra Classic, maintained the same stablecoin, and renamed itself TerraClassicUSD (USTC).

Do Kwon abandoned the crypto project and eventually disappeared due to charges of fraud, illegal fundraising, and tax evasion in South Korea. Thousands of investors were consequently left bereft of their life savings.

LUNC Burning Initiative: Why Is It So Important?

As the Terra protocol victims searched for ways to survive, they eventually clustered into specific communities that shared the similar goal of reviving the network. The initiative to contribute to LUNC token burning emerged.

The key idea behind cryptocurrency burning is to remove tokens from circulation. The digital assets are sent to the wallets so that they can not be recovered, thus reducing the supply. Lower supply automatically means a higher price of the crypto.

At the time of writing, the total circulating supply of Terra Classic governance tokens is over 6.87 trillion, and only 36 billion are burnt. This represents a mere 0.52% of the token’s total supply.

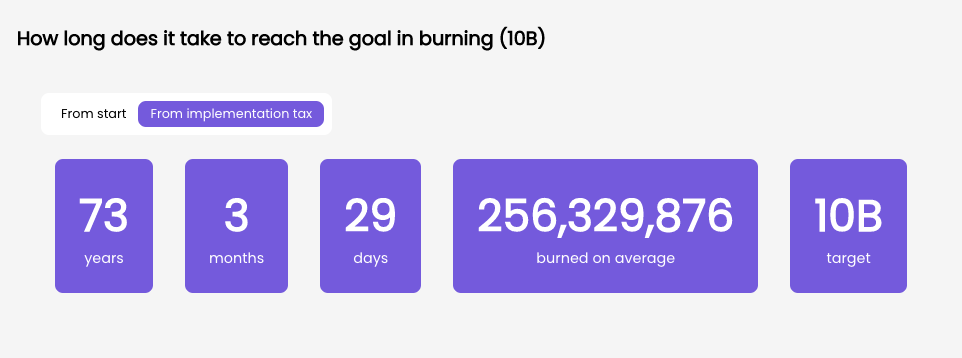

If the burning keeps proceeding at a similar rate as of the time of publishing, it may take more than 73 years for the Terra Classic community to burn trillions of tokens and reduce supply to at least 10 billion.

Source: Lunc.tech

Hence the blockchain-based community came up with the initiative of applying the burn taxes on every on-chain transaction of the network’s governance token to speed up the process. If implemented, the upgrade should have taken a big step forward, especially if Binance or other major cryptocurrency exchanges that generate substantial volumes agreed to support the idea.

For the deal to be implemented, the network first needed someone to develop its protocol.

Terra Rebels (TR) Took the Wheel… and Crashed

Volunteer developers Terra Rebels (TR) took over running Terra Classic after Do Kwon and TerraForm Labs abandoned the network.

They came up as a decentralized non-profit organization to revitalize the Terra Classic ecosystem, gain independence from TerraForm Labs, and “provide and deliver software clients to community and validators” through the efforts of volunteers.

Terra Rebels supported the narrative of adding a 1.2% burn tax on LUNC transactions to speed up token burning, although it later retreated to 0.2%.

Simultaneously TR declared plans to develop the protocol’s infrastructure, like the community-owned wallet called Rebel Station, which appeared to be necessary after TLF announced plans to suspend transferring LUNCs on its Terra Station wallet.

The Rebels collected nearly $150K in donations from the Terra Classic community to implement their plans and ideas. Soon after, it was disclosed that they were extorting crypto donations and sharing them between team members instead of investing in blockchain-based infrastructure.

The group of volunteers that took over Terra after TFL abandoned it have, yet again, defrauded the community via a fake governance spend that went to Discord mods instead of "core infrastructure" as advertised. LUNC finally has a use case: home appliances for grifters. pic.twitter.com/ELR8unIynH

— FatMan (@FatManTerra) January 9, 2023

Terra Rebels lost the community’s trust and nearly undermined its goal to maintain burn tax support from the major cryptocurrency exchanges that earlier agreed to implement 1.2% burn taxes on sport and margin Terra Classic’s token transactions.

One of them, Binance, accounts for more than 50% of LUNC trading volume. The exchange is also the most significant contributor to its token burning, with more than 20 billion altcoins burnt. However, Binance decreased its LUNC burn contributions by half by the end of the year following the Rebels scandal.

The team of the latter consequently split by the very end of 2022. The core developers, Edward Kim and Tobias Andersen (Zaradar), and numerous others, left Terra Rebels due to disagreements over management decisions on funding, alleged censorship, and concentration of power.

Soon after, they both announced the new Terra Classic Layer-1 team, named the “Joint L1 Task Force.” It currently focuses on a long-term vision and roadmap for Terra Classic, which includes NFT development and possibly revitalizing the USTC coin.

Terra Rebels reduced its team to 12 active members.

$LUNC @TerraRebels now cutting to 12 active members. pic.twitter.com/AvewxyPpkK

— Classy 🔮 (@ClassyCrypto_) December 19, 2022

Cult Leader Praises Do Kwon and Twin Moons

But as the whole drama of Terra Rebels unfolded, the burning narrative was actively supported by the LuncDao, another influential voice of the Terra Luna Classic community.

The anonymous owner of the Twitter account with 123.2K followers is the fifth biggest LUNC validator who introduces himself as the “Twin Moons” maximalist.

The concept of twin moons refers to the potential Merge of Terra Luna 2.0 and Terra Classic and has gained the support of Do Kwon.

LuncDao is a controversial community leader, communicating in twisted satirical messages and not even hiding that he represents a LUNC cult.

Question "Is $LUNC DAO a cult?"

— 🔥⚛️ 𝕃𝕌ℕℂ 𝔻𝔸𝕆 ⚛️🔥 (@LUNCDAO) July 2, 2022

Answer: Yes. We've addressed this many times before. LUNC DAO is a cult with 30,000 members and we have always been 100% transparent about being a cult. Here's how it works: once you join LUNC DAO, you can never leave, it's a lifetime commitment pic.twitter.com/zZ8wvICXzu

Balancing on the verge of sanity, he plays with his followers’ minds, sharing messages that constantly contradict each other.

One day he supports the twin moon narrative; another day, he distances from it and neglects everything.

Over the next year, you will all benefit from the results of my brainwashing you all for the past 8 months

— 🔥⚛️ 𝕃𝕌ℕℂ 𝔻𝔸𝕆 ⚛️🔥 (@LUNCDAO) January 21, 2023

The $LUNC burn narrative, Twin Moons, the Merge, etc. They were all stories I made up. And now you live inside my imagination

You never stood a chance

1-0 to Coach Bruce

What is repetitive, though, is his praise of Do Kwon, one of Interpol’s most wanted individuals. LuncDao disagrees with the charges against him and alleges that FTX‘s Sam Bankman-Fried was the mastermind behind Terra (LUNA) protocol crash.

From time to time, LuncDao enters public battles with Fatman, another anonymous community member aiming for justice for TFL victims.

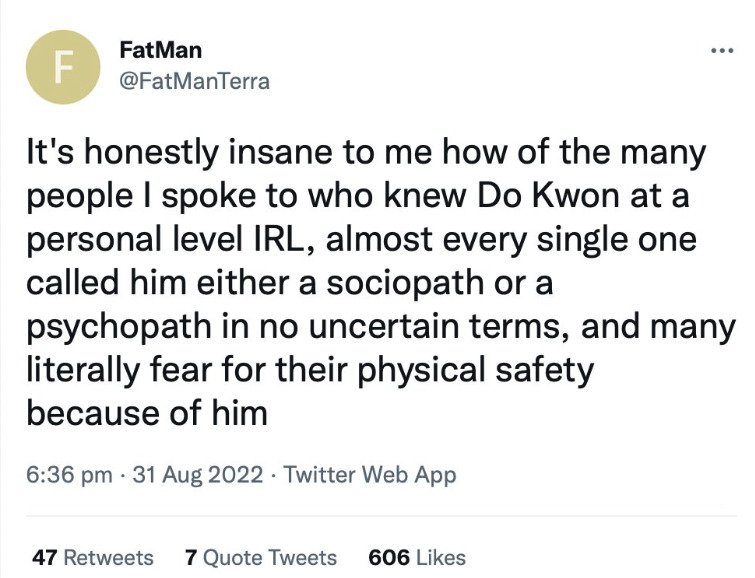

Fatman, the former heavy investor in LUNA who lost up to 40% of his life savings, runs the influential Terra-focused Twitter account dedicated to disclosing frauds.

His critical posts, including the one about Do Kwon being a sociopath, provoked a harsh reaction from LuncDao, who blamed Fatman for being hired by Alameda, the sister company of Bankman-Fried’s FTX crypto exchange.

Source: Twitter.com

The controversial account strongly supports Edward Kim and Zaradar, who plan to take over Terra Classic’s development and potentially revive USTC.

Burning Cryptocurrency Not Enough to Revive Terra Classic

At the time of writing, the value of Terra Classic sits at $1.07 billion, while the total supply is close to 5.96 trillion. If the cryptocurrency burning speed continues to go on the same levels as now, the goal may only be accomplished after more than 72 years.

Despite the trending burn narrative, Terra Classic community members agree that burning its token is not enough to revive the network. Burning does not add long-term value, they say; the only way to create it is through building utility on the crypto network. They accordingly claim that validators are currently the major issue for the future of the network.

As community members asserted, many of its validators are currently building on Terra Luna 2.0. At the same time, they use Terra Classic for governance voting and gaining rewards to continue building over the forked blockchain.

The community worries that, eventually, LUNA-focused Terra Classic protocol validators will dominate the network and leave no space for its builders to make any influence.

As an alternative narrative for revitalizing the post-collapse crypto protocol, they mention potential re-pegging with TerraClassicUSD (USTC), the algorithmic stablecoin of the network.

USTC currently trades at $0.02291 and has more than 9.8 billion circulating supply, meaning that even re-pegging to $0.1 requires billions of investments.

In addition, more than 85% of USTC’s supply is in the hands of the Top 100 holders. This leaves slightly above 14% of the total supply to be backed by fresh capital.

Finally, there pops up another narrative of merging Terra Classic with its fork Terra Luna 2.0. The latter is the most controversial, as it means getting back with the team that once abandoned the protocol.

The Bottom Line

Eight months after the collapse of Terra (LUNA), Terra Classic coin holders are still dealing with the aftermath of the disastrous event. Once abandoned by TerraForm Labs and its founders, the loyal cryptocurrency investors have not yet returned to a safe place.

On the contrary, the Terra Luna Classic community continues to live in a landscape full of influential players whose true interests remain undisclosed.

Find out more about Do Kwon, the CEO of TerraForm Labs:

The Rise and Fall of Do Kwon

Read about the effects of the Terra (LUNA) Crash:

Down to Zero: Terra Luna Crash and Its Impact on Crypto Adoption