South Korean authorities have had enough of Do Kwon’s evasive behavior, as the TerraForm Labs CEO reportedly left Singapore, where he had been living for the entirety of 2022, on September 17th, 2022. Terra (LUNA), relocated its headquarters from South Korea to Singapore due to being under investigation for tax evasion charges in CEO Do Kwon’s motherland.

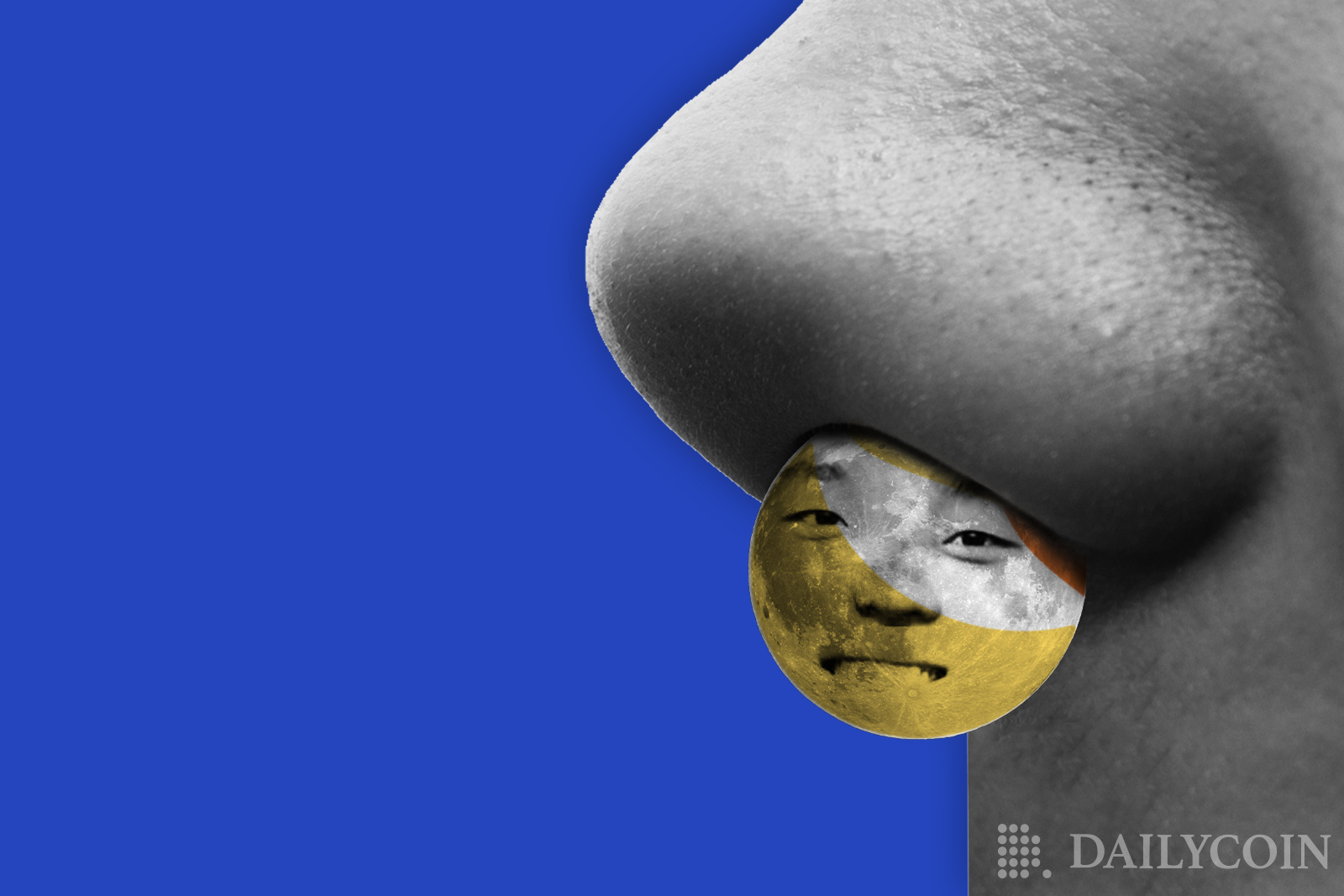

Today, the South Korean government confirmed that Interpol has issued a ‘Red Notice’ for Do Kwon. This means that police in 196 countries around the world will be on the lookout for Do Kwon, who now features on Interpol’s Most Wanted list alongside some rather inhospitable faces.

Interpol officially issues red notice for Do Kwon 🚨@stablekwon has been labeled a 'fugitive' on the run.

— Joe Consorti ⚡ (@JoeConsorti) September 26, 2022

Unreal 😂 pic.twitter.com/1d0RiTMYv0

Do Kwon Tramples on Capital Markets Law

As if that wasn’t enough, Do Kwon stands accused of violating the ‘Capital Markets Law‘, with multiple breaches cited. Along with 5 other TerraFirms Lab insiders, Kwon is wanted for the total collapse of Terra (LUNA) & Terra (UST), which saw investors lose more than $60 billion worth of crypto.

Sponsored

South Korean authorities remain unconvinced by Do Kwon’s self-proclaimed “extremely high bar of integrity”, stating that Mr. Kwon has not cooperated with law enforcement, with police certain that Do Kwon fled Singapore to avoid the long arm of the law. However, Do Kwon had previously asserted on Twitter that he is not, & has never been “on the run”, candidly claiming that he just wants to “cut some calories.

Tbh havent gone running in a while, need to cut some calories https://t.co/SP9VtS5ob2

— Do Kwon 🌕 (@stablekwon) September 17, 2022

A Plot Twist for Terra Luna Classic (LUNC)

Despite its rapid decline over the past two weeks, the infamous Terra Luna Classic (LUNC) is surging once again, recording gains of 35% in the last 24 hours along. However, the uptick still leaves LUNC 52.5% in the red for the fortnight, and an eye-watering $60 billion down when measuring since the Terra (UST) stablecoin’s de-peg back in May.

Sponsored

It’s a similar story with the newly launched Terra (LUNA) blockchain, which shows that Do Kwon’s “crypto frankenstein” Terra (LUNA) is trading at $2.69 at the time of writing, having recorded a 10.6% gain in the last 24 hours. Performing identically to LUNC over the last fortnight, both coins are at a 52.5% deficit, though Terra Luna Classic (LUNC) and the Terra 2.0 blockchain both had a positive monthly performance overall, with both spiking by approximately 60% in the last 30 days. Despite ranking #41 among cryptos by market cap, the original Terra is trading at just $0.00030614 at press time, according to CoinGecko.

$LUNC makes me hate this Industry.

— McKenna (@Crypto_McKenna) September 26, 2022

Theory here is Do Kwon buying with his last remaining shekels to short squeeze GCR before his imprisonment. pic.twitter.com/f2oCOrO2T1

On the Flipside

- Both Terra (LUNA) & Terra Luna Classic (LUNC) have recorded double-digit gains in the last 24 hours.

Why You Should Care

The fiasco of Terra (LUNA) and the Terra (UST) algorithmic stablecoin started an uncontrollable domino effect throughout the crypto industry, shredding apart crypto hedge funds like Three Arrows Capital (3AC), Voyager Digital, and Celsius, which had been considered highly successful prior to the crash.

Read more about Do Kwon’s trials & tribulations after the biggest crash in crypto history:

Do Kwon’s First Interview Since Terra (LUNA) Downfall Called Out As Biased

Do Kwon Flees Singapore, Denies Being on the Run as Terra (LUNA) Sinks