- Crypto investors have been flocking to stablecoins in a potential sign of a shift in risk tolerance.

- USDC and USDT have been battling it out for stablecoin dominance, with USDC showing surprising growth.

- The total market value of stablecoins has ballooned to a staggering $161.4 billion, fueled by institutional investors.

The cryptocurrency market’s recent rebound has investors wondering if a crash is lurking around the corner. While volatility is part of the crypto game, a new trend suggests some are seeking calmer waters: the surge of stablecoins.

Unlike their roller coaster-like counterparts, Bitcoin and Ethereum, stablecoins are cryptocurrencies pegged to stable assets like the US dollar. Imagine them as crypto with a safety net, a way to stay invested without the stomach-churning dips.

Stablecoin Surge Signals Investor Shift

Here’s where things get interesting. According to market analysis firm Santiment, the number of wallets holding stablecoins is skyrocketing. This surge, particularly in 2024, indicates a growing investor preference for stability in a potentially volatile market.

Sponsored

The data reveals a fascinating race among stablecoins. Circle’s USDC, boasting 13.9% growth in non-empty wallets this year alone, according to Santiment, is emerging as a strong contender. This suggests a rising demand for USDC as a safe haven within the crypto ecosystem.

However, the heavyweight title still belongs to Tether (USDT), with a whopping 5.7 million non-empty wallets. USDT remains the most widely used stablecoin, boasting a growth of 15.7% in 2024. Although USDC is slightly behind in this regard, the increase in USDC’s non-empty wallets could hint at an early potential shift in investor preferences.

DeFi Darling DAI Makes its Mark

The decentralized finance (DeFi) space is also joining the party. MakerDAO’s DAI stablecoin, with over 500,000 non-empty wallets, highlights the increasing interest in DeFi and DAI’s role as a stable asset within those protocols.

Sponsored

This surge in adoption translates to a booming market. The overall stablecoin market capitalization has reached a staggering $161.4 billion in 2024, signifying a significant inflow of capital. This growth is partly fueled by the launch of US spot Bitcoin ETFs, attracting institutional investors who are boosting their stablecoin holdings for ETF participation.

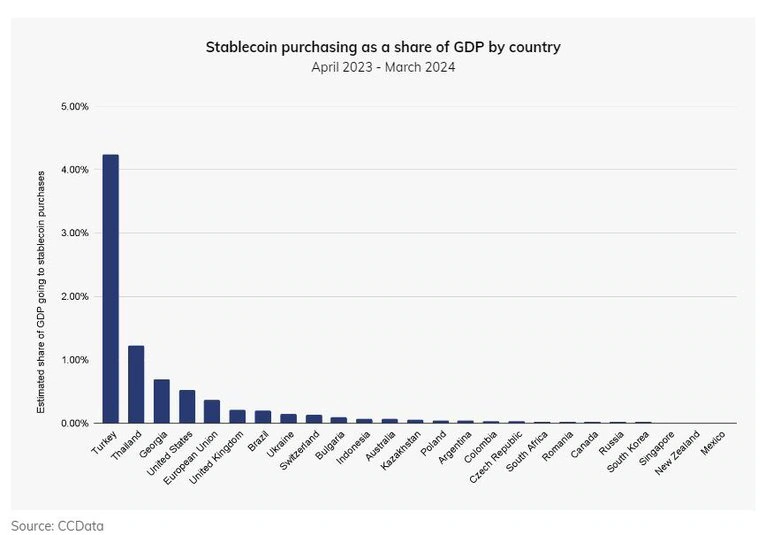

The trend isn’t limited to established markets. Chainalysis reports that the US alone purchased over $30 billion in stablecoins in January 2024. But here’s a surprise, emerging economies like Thailand, Brazil, and especially Turkey are witnessing a surge in stablecoin purchases relative to their national GDP.

On the Flipside

- Increased stablecoin use doesn’t guarantee overall crypto market stability. Volatility in Bitcoin and Ethereum can still cause the selling of stablecoins.

- Investors may simply be parking their funds in stablecoins to wait for a buying opportunity, and a market downturn could still trigger a mass sell-off.

Why This Matters

The rise of stablecoins could be a sign of crypto maturing. Investors are seeking stability alongside innovation, and stablecoins offer a bridge between the two worlds. While the future remains uncertain, the data points towards a growing role for stablecoins in the cryptocurrency landscape.

If you like this article, you might also be interested in this article about Tether minting $1 Billion USDT and what it means for the market:

Is Tether Minting $1 Billion USDT a Sign of Upcoming Surge?

If you like this article, you will probably also like this article about the U.S. government’s investigation into Tether, a leading issuer of stablecoins:

U.S. Scrutiny of Tether Raises Concerns for Stablecoin Industry