- The total market capitalization of stablecoins has dropped, reaching the lowest level since September 2021.

- Trading volume with stablecoins has experienced a significant decline.

- The contraction of the stablecoin market has signaled deteriorating liquidity.

In a disconcerting trend for the recovery of cryptocurrency prices, the stablecoin market is poised to contract for the 14th consecutive month, signaling a draining of capital from the digital asset space.

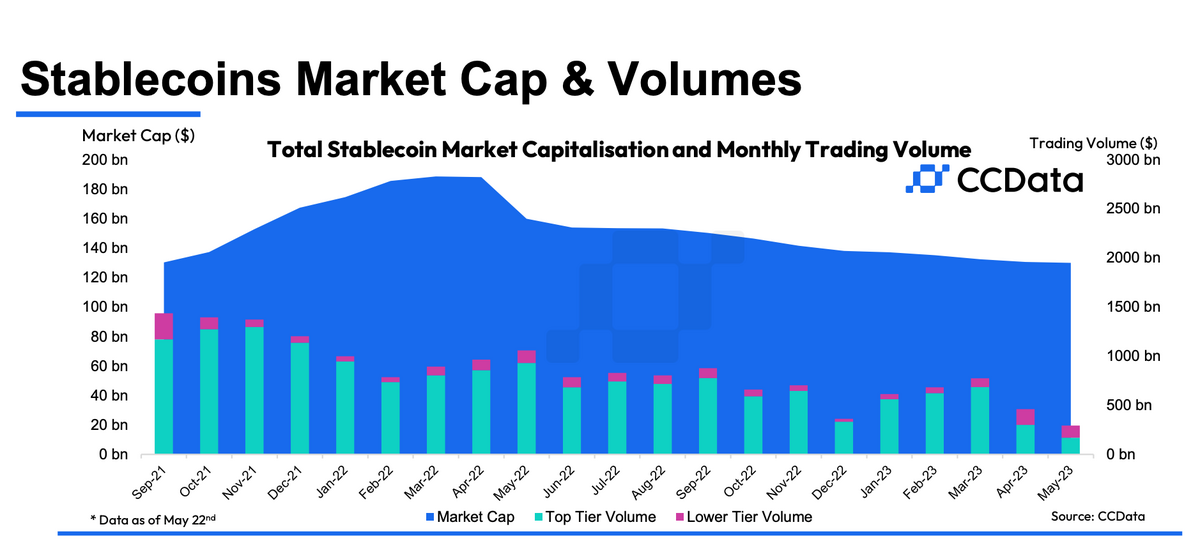

Digital asset data firm CCData revealed in its recent market report that the total market capitalization of stablecoins plummeted to $130 billion in May, reaching its lowest level since September 2021.

This ongoing decline, which began in March 2022, according to CCData, raises concerns about the liquidity of stablecoins and its implications for the broader crypto ecosystem.

Trading Volume Plunges 40.6%, Lowest Since December 2022

The CCData report reveals a drastic 40.6% plunge in trading volume with stablecoins this month, resulting in a mere $460 billion volume on centralized exchanges. This marks the lowest monthly volume since December 2022.

The report suggests that this decline in trading activity is aligned with major crypto assets remaining range-bound and failing to break through crucial support and resistance levels.

Interestingly, amidst the overall market slump, TrueUSD (TUSD) stablecoin has managed to defy the trend, experiencing an increase in trading volume to $29 billion so far this month, according to CCData.

TUSD has surpassed its struggling competitors, USDC and BUSD, making it the second most traded stablecoin on centralized exchanges for the first time.

Sponsored

This resurgence can be attributed to Binance, the world’s dominant crypto exchange, which has actively promoted the use of TUSD on its platform by waiving trading fees for buying and selling Bitcoin (BTC) using the stablecoin.

Stablecoin Market Must Stabilize for Crypto Prices to Recover

A recent report by banking behemoth JPMorgan highlighted that cryptocurrency prices are unlikely to experience a sustained recovery until the stablecoin market stabilizes.

Furthermore, a global investment bank Goldman Sachs report earlier this year likened the decline in stablecoins to quantitative tightening for the crypto market, indicating diminishing liquidity and leverage.

On the Flipside

- While the stablecoin market has been contracting for 14 consecutive months, it’s worth noting that the overall cryptocurrency market has experienced significant growth and adoption during the same period.

- The decrease in trading volume with stablecoins could be partially explained by market participants exploring alternative trading methods and decentralized exchanges, which offer different liquidity dynamics and trading mechanisms.

- TrueUSD’s recent success might be attributed not only to promotional efforts by Binance but also to the token’s unique features and advantages that have resonated with traders seeking alternatives to more established stablecoins.

Why This Matters

As a vital source of liquidity, stablecoins play a crucial role in facilitating cryptocurrency trading and investment. The contraction of this market poses challenges for the recovery of cryptocurrency prices, hindering sustained growth and highlighting the lingering effects of the bear market.

To learn more about the plummeting usage of USDT and its impact on the market, read here:

USDT Usage Plummets to 4-Year Low Despite Record Market Cap

To stay updated on the latest crypto and digital asset trends of 2023, as revealed in the Ripple report, read here:

Ripple’s Value Report Spotlights Key Trends in Crypto, Tokenization, and DeFi