- The cryptocurrency market has been subdued in May. Bitcoin has failed to capitalize on halving hype so far.

- Analysts have been divided on whether there will be a summer slump or a bullish resurgence.

- Stablecoin activity has revealed reduced investor confidence, but a recent influx has sparked hope.

The cryptocurrency market has experienced a subdued May so far, with Bitcoin (BTC) failing to capitalize on the momentum of the earlier halving event. While some analysts predict a summer of consolidation, others remain cautiously optimistic, looking for indicators of a potential bullish resurgence.

Sponsored

This month, Bitcoin faced downward pressure, with altcoins mirroring the trend. Memecoins, known for their volatility and community-driven hype, were a rare exception, managing some gains. However, the broader market sentiment leaned bearish.

Stablecoins Offer Clues to Investor Behavior

Analysts turned to stablecoin activity to gauge investor sentiment. Stablecoins, cryptocurrencies pegged to a fiat currency like the US dollar, are often used as a safe haven during market downturns. Examining on-chain data from CryptoQuant, the focus was placed on two key metrics: active addresses and exchange reserves.

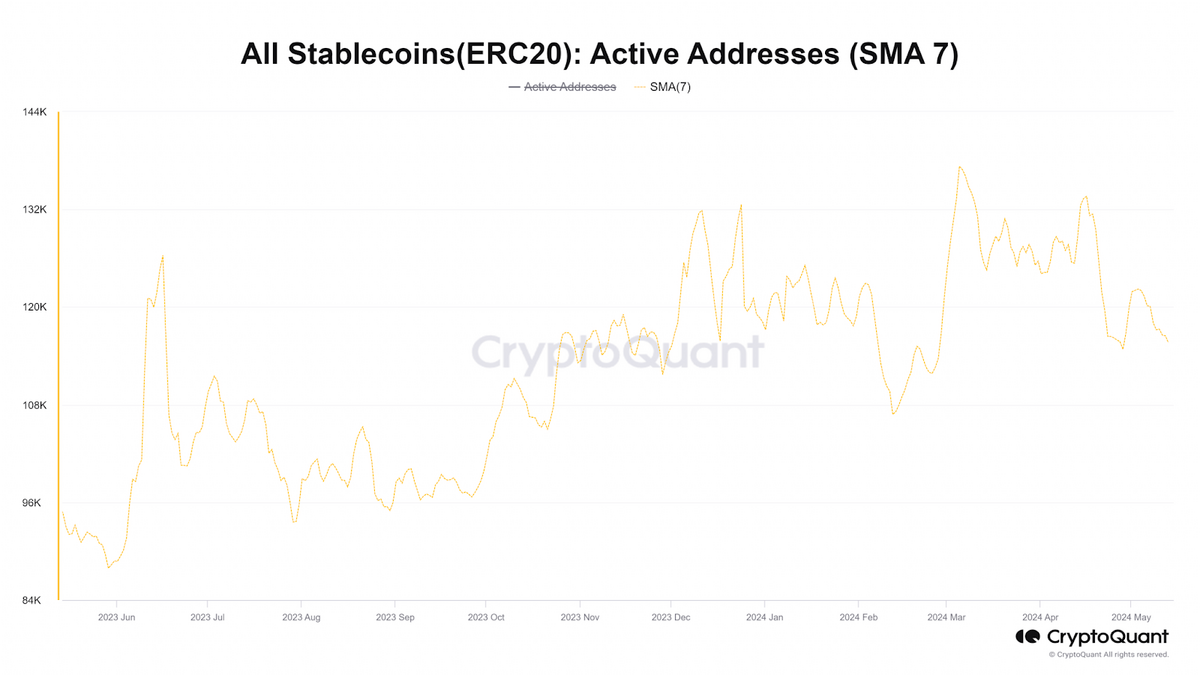

The number of unique active stablecoin addresses, which tracks both sending and receiving activity, has been trending downward since mid-April. This mirrors a similar pattern observed in February and March when a surge in active addresses coincided with a strong market rally that saw Bitcoin break the $70,000 barrier.

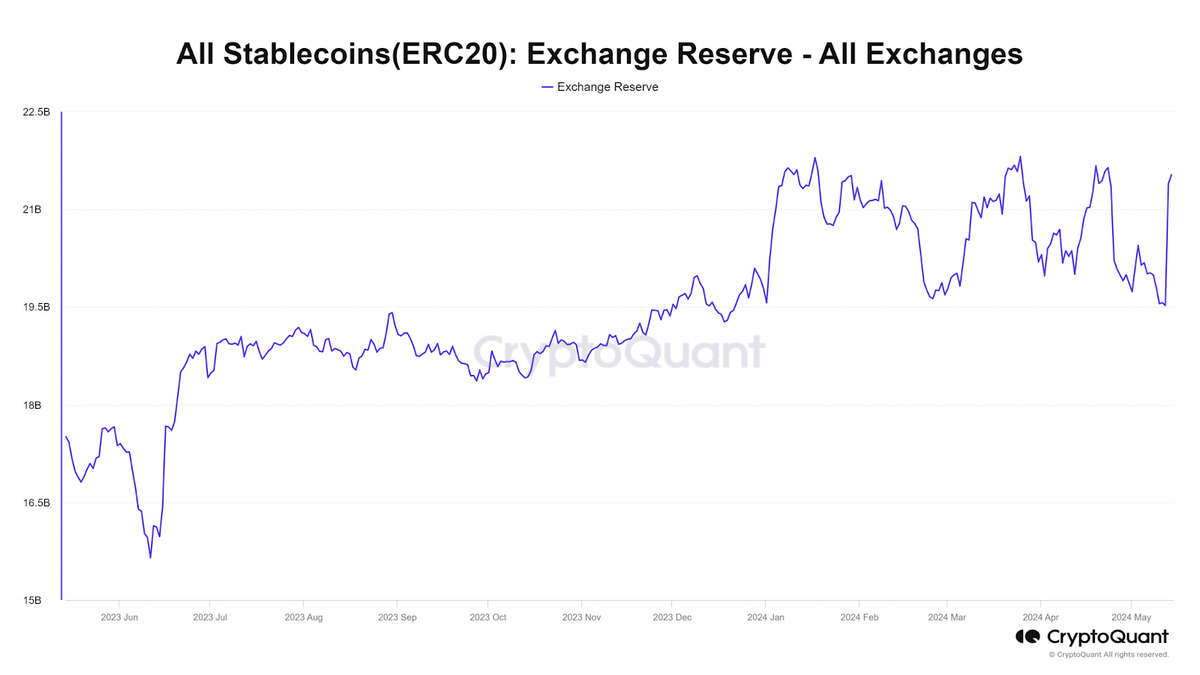

The recent decline suggests reduced trading activity, potentially indicating a lack of bullish conviction among investors. Exchange reserves, representing stablecoins held on exchanges, offer another glimpse into investor behavior.

Sponsored

While these reserves have mostly consolidated throughout 2024, a sharp drop from late April to mid-May highlighted a decline in buying power. This implies that stablecoin holders were less inclined to convert their holdings into other crypto assets during this period.

However, a recent influx of stablecoins onto exchanges on May 13 offered a potential sign of renewed buying interest. If this trend continues, it could be seen as a positive development for bulls.

Tether Dominance: A Signal for Bulls or Bears?

The dominance of Tether (USDT), the leading stablecoin, offers another data point. The Tether Dominance chart tracks USDT’s market capitalization as a percentage of the total crypto market cap. An upward trend in this metric indicates a preference for holding stablecoins, which can be interpreted as investors staying on the sidelines.

Conversely, a downtrend often accompanies market rallies. Currently, Tether Dominance is positioned above a key support level. While a move toward the resistance level is anticipated, a drop below this support could be a bullish signal.

However, thorough technical and fundamental analysis of individual crypto assets remains crucial for informed investment decisions beyond relying solely on Tether Dominance. The coming weeks will be crucial in determining the direction of the cryptocurrency market.

On the Flipside

- Stablecoin data only reflects a portion of investor sentiment. It doesn’t account for investors holding other assets.

- The gains seen in memecoins might be temporary and unrelated to the broader market trend. They can be highly susceptible to social media hype and unpredictable swings.

Why This Matters

This article offers valuable insight into investor sentiment by analyzing stablecoin activity and Tether dominance. A resurgence in stablecoin trading and a drop in Tether dominance could signal a return of bullish momentum in the broader cryptocurrency market, potentially leading to a breakout from the current subdued phase.

If you’re interested in this article, you’ll probably also like this article about how AI will likely use stablecoins for payments:

How Will AI Make Payments for Us? The Answer Is Stablecoins

If you’re interested in the stablecoin industry, you’ll probably also like this article about the U.S. government investigation into Tether, a stablecoin issuer:

U.S. Scrutiny of Tether Raises Concerns for Stablecoin Industry