- Meme coin Slerf appoints LBank Exchange to handle donations.

- LBank Exchange faced suspicions of misappropriating user funds.

- Third-party audit raises serious concerns for LBank Exchange

Amid the memecoin mania on Solana, multiple projects have posted significant returns. The surge, however, was not without controversies, especially when it came to Slerf. This memecoin first made headlines when the lead developer accidentally destroyed the project’s $10 million liquidity pool.

Recently, the meme coin Slerf once again found itself in controversy by choosing LBank Exchange as the custodian for its donation address. This decision has reignited discussions around LBank’s past suspicions of misappropriating user funds and its efforts towards enhancing security and transparency.

Slerf’s Choice and LBank Exchange’s Past Controversies

On Tuesday, March 19, following an “accident” that cost the project $10 million, Solana-based memecoin Slerf found itself in another controversy. Following the setup of a donation wallet for users affected by the losses, several crypto exchanges pledged donations. However, questions arose around the choice of the custodian for the funds.

Sponsored

Following a donation by the exchange, Slerf picked LBank Exchange as the custodian of its donation address. Given the exchange’s controversial past, this move raised eyebrows in the crypto community. LBank had been accused of misappropriating user funds, casting a shadow over its reputation.

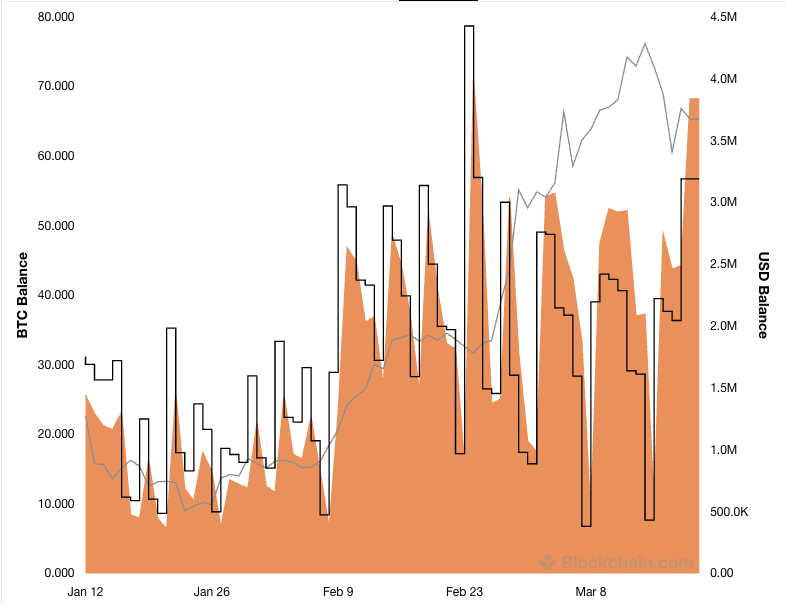

Despite promising to publish a Proof of Reserves (POR) in 2022 to bolster trust, it wasn’t until 2024 that LBank disclosed only a fraction of its hot wallets, revealing holdings of merely 25.79 Bitcoins. Since then, the Bitcoin balance in the wallet has risen to 56 Bitcoins, or $3 million.

This disclosure, intended to showcase the exchange’s commitment to transparency, fell short of community expectations and only raised more questions about the exchange.

LBank Has ‘Falsified Liquidity’ and ‘Exploitable Issues’: Hacken

LBank, a Hong Kong-based cryptocurrency exchange, has been a topic of discussion in the crypto community, even before Slerf chose it to manage donations. A comprehensive review by blockchain security firm Hacken, last updated on September 14, 2023, highlights several critical areas of concern.

Sponsored

These include transparency issues, security vulnerabilities, and potential market manipulation. While LBank has taken steps toward addressing some of these issues, the findings suggest that users and projects considering the exchange should proceed with caution.

“We can conclude that LBank is unreliable exchange for crypto trading, due to apparently falsified liquidity and exploitable cybersecurity issues,” Hacken wrote.

On the Flipside

- LBank announced the adoption of Merkle-tree proof-of-reserves, aiming to provide a higher level of asset security and management transparency.

- It is not clear whether Slerf’s developer had any knowledge of LBank’s controversial past.

Why This Matters

The situation involving Slerf and LBank underscores the critical importance of trust and transparency in the cryptocurrency sector. Exchanges play a pivotal role in the ecosystem, and their actions significantly impact user confidence and market stability.

Read more about why Slerf posted gains despite the major error:

Here’s Why Solana Slerf Hit $1 Despite Token Burning Error

Read more about Slerf’s token burn mistake: