As the sanctions imposed on Russia catalyze in part the collapse of the Russian ruble, data suggests that Russians are turning to Bitcoin as a means of protecting themselves from the fallout.

Bitcoin Has Become a Lot More Expensive in Russia

The media outlet known as DeFiprime.com has noted that Bitcoin is trading by as much as $20,000 above the market rate on Russian exchanges.

Sponsored

The platform called this the “matreshka premium” as a joke, putting a spin on the kimchi premium which was a prevalent phenomenon in 2016.

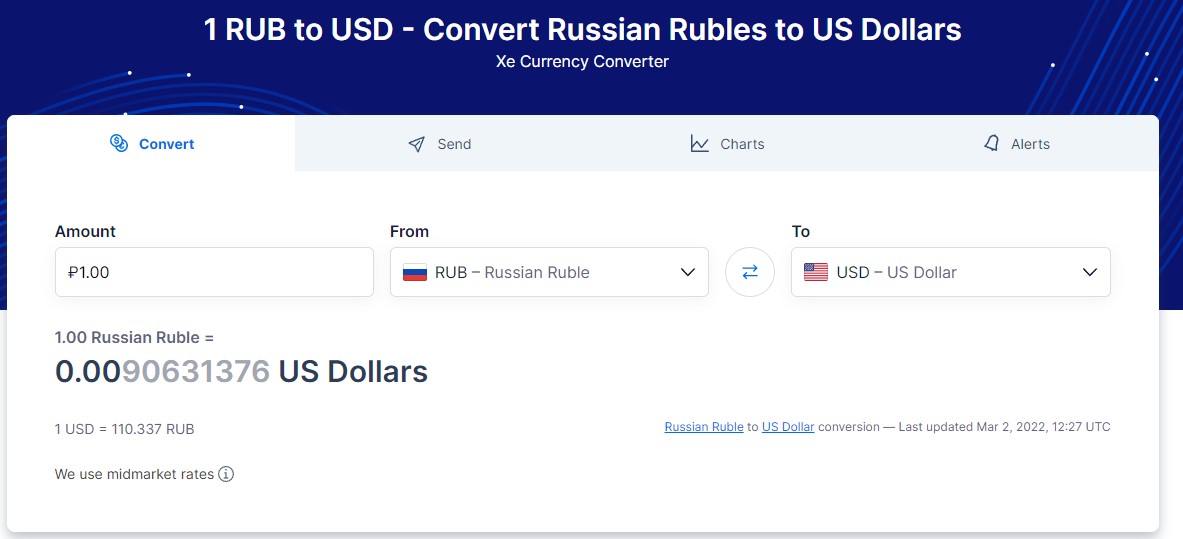

In the wake of Russian banks being excluded from the SWIFT global payment network, the ruble has sunk to record lows against the dollar, where 1 ruble is currently worth $0.009.

Source: Xe Currency Converter

In response to this, the Russian central bank has raised its rates to 20% as a means of countering hyperinflationary pressure.

Furthermore, BTC/ruble as a trading pair has seen the highest trading volume in recent days since last May, and due to the fact that the “matreshka premium” exists, it is clear that many Russians see Bitcoin as a safer option than the Ruble in its current state.

Bitcoin has proven to be a viable alternative means of mobilizing money in the midst of a crisis such as war.

On the Flipside

- Bitcoin’s value has once again spiked in value. As of March 2nd, 2022, the token is trading at $44,126.07, a price point far above its lowest point of 2022, recorded at $34,391.

Why You Should Care

As the sanctions imposed on Russia impact its finances, many people will likely switch to cryptocurrencies as a means of protecting themselves, and this could in turn lead to the increase in utility, mass adoption, and the value of cryptocurrencies as a whole.