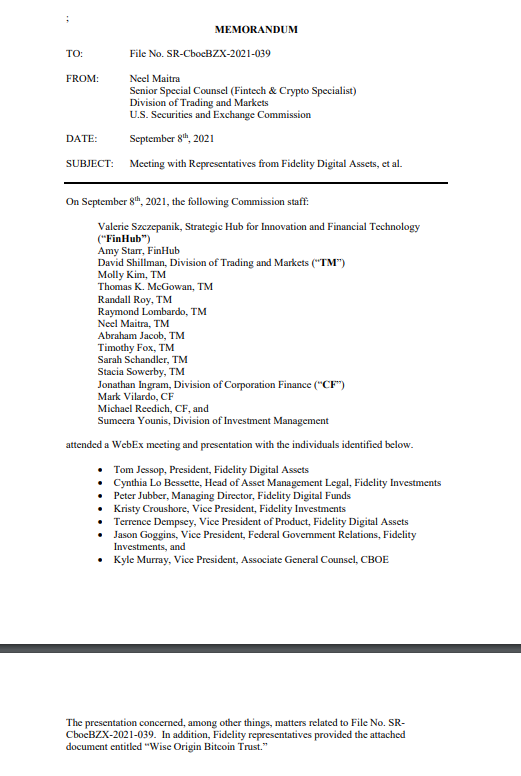

In a surprising disclosure, the U.S. Securities and Exchange Commission (SEC) has published on its website a memo listing attendees of a private WebEx meeting held last Wednesday, September 8th between Fidelity Digital Assets and SEC personnel.

The link also features the proprietary presentation made by Fidelity to the SEC, requesting approval of Fidelity’s application for a Bitcoin exchange-traded fund (ETF). A screenshot of the memo listing those in attendance can be seen here.

An ETF is a security that follows a certain asset, commodity, industry, or index. The flexibility of an ETF is further enhanced in that it can be traded on a stock exchange the same as any other stock, but it typically provides greater diversity and reduced risk.

Sponsored

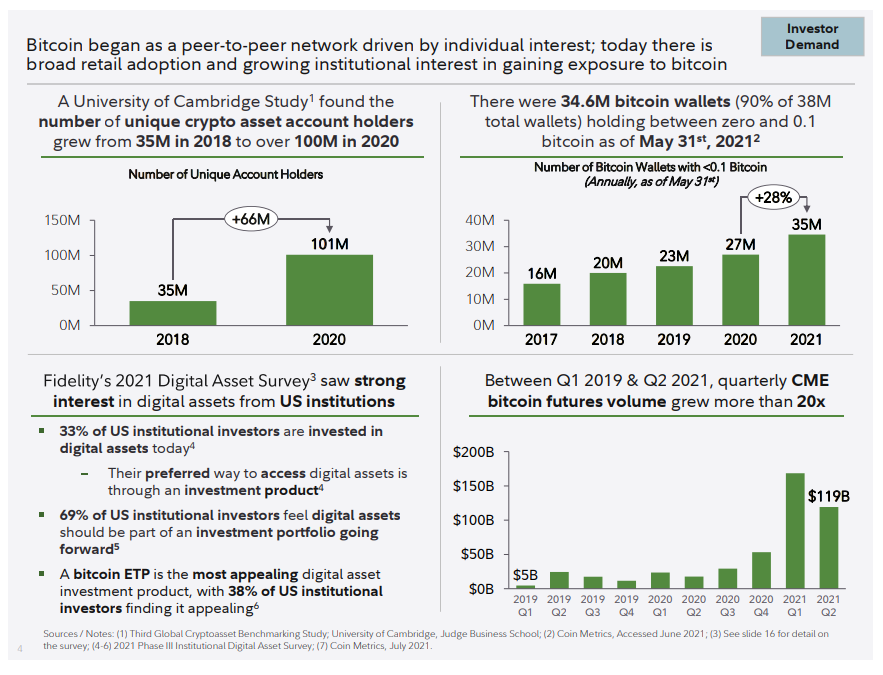

The published documents revealed some interesting facts about Fidelity’s thinking and rationale for submitting its ETF application, including the name of the fund “Wise Origin Bitcoin Trust.” According to the following slide, a key driver of the Bitcoin fund was high institutional demand for access to Bitcoin.

From this packed slide, it’s worth noting the reference to in the lower left hand corner, Fidelity’s 2021 Digital Asset Survey, which found:

- 33% of US institutional investors are invested in digital assets today

- Their preferred way to access digital assets is through an investment product

- 69% of US institutional investors feel digital assets should be part of an investment portfolio going forward

- A bitcoin exchange-traded product (ETP) is the most appealing digital asset investment product, with 38% of US institutional investors finding it appealing

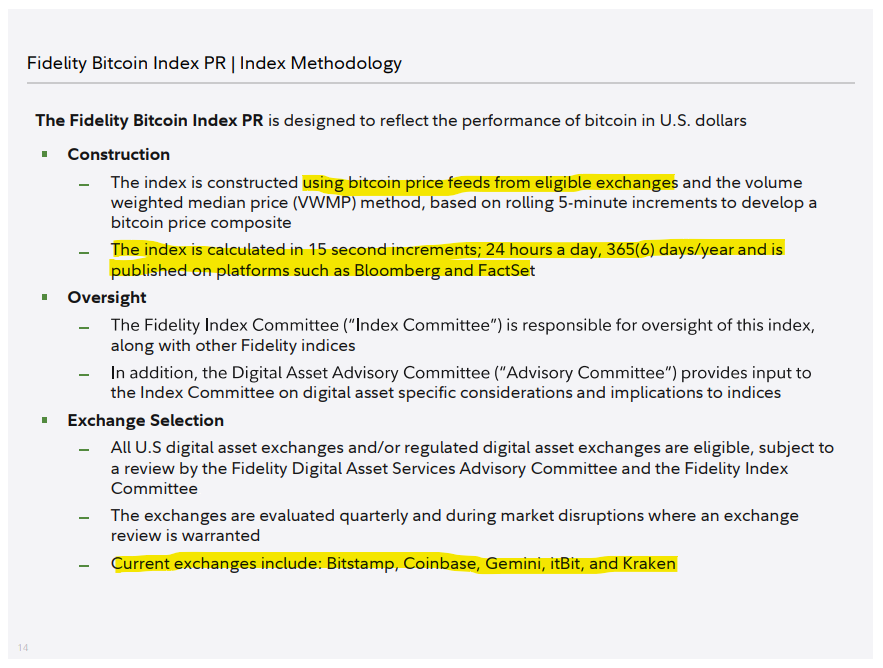

Equally interesting was Fidelity’s admission in the slides that providing investors with a real-time price for Bitcoin could be a challenge, which they would address by applying an index methodology. The index would be a Bitcoin price composite based on “…price feeds from eligible exchanges…” that would be calculated every 15 seconds, 24/7/365 and then posted to Bloomberg and FactSet in real-time.

You’ll note at the bottom of the above slide, the list of crypto exchanges Fidelity intends to use for the Bitcoin price index are Bitstamp, Coinbase, Gemini, itBit, and Kraken. Additionally, the Fidelity team used four packed slides to discuss how it would monitor the current Bitcoin Futures instrument, available on the Chicago Mercantile Exchange (CME), as an early detection system against price manipulators of its own proposed ETF.

Sponsored

Our study’s finding that the CME bitcoin futures market leads to bitcoin price discovery across bitcoin futures and spot markets, means that an actor trying to manipulate the ETP would be reasonably likely to have to trade in the CME bitcoin futures market.

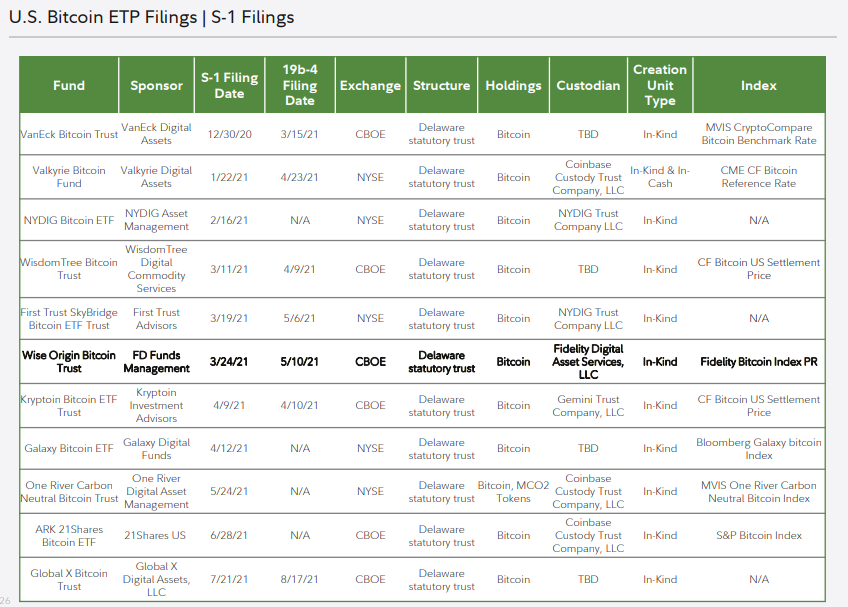

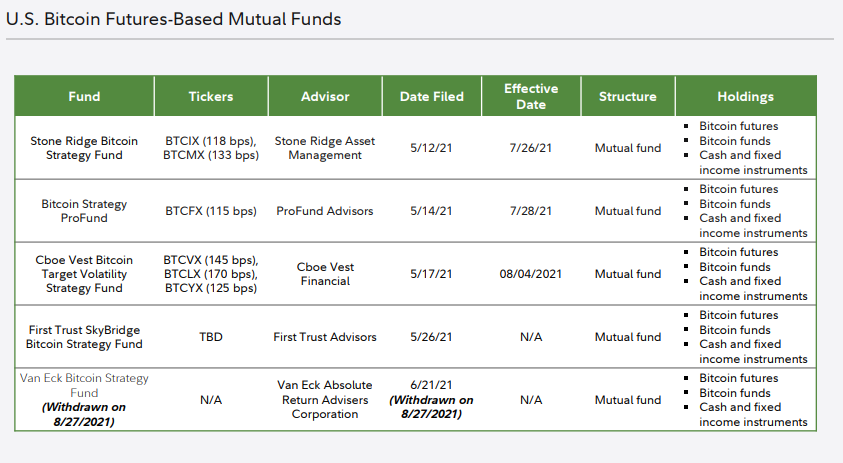

Fidelity stressed that since Bitcoin Futures are already traded on the regulated CME, they could leverage that as a first barrier of protection for investors in their own ETF against price fixers. Lastly, Fidelity added two slides in the presentation appendix that listed 11 pending exchange-trade product applications AND five Bitcoin-based mutual funds.

And here are the mutual funds.

This is all useful information for “hodlers” and should reinforce the fact that big institutional investors have big plans for cryptocurrencies.

On The Flipside

- If you look at all 29 slides on the SEC website, a case could be made that there are proprietary details in that deck that Fidelity would NOT want publicly disclosed for competitive reasons.

- Why in the “Blue Hell” did the SEC publish the deck and all of the attendees? Was it intentional or incompetence?

- Anyone interested in the contents of the entire slide presentation should immediately go to the SEC link and copy the document before it gets taken down.

Why You Should Care?

Whichever financial institution gets its ETF approved first will have a huge advantage and influence within the crypto-space. It will also unlock the floodgates for mass adoption of cryptocurrency as an easy on-ramp for those not interested in crypto tech, KYC, digital wallets, cold storage, and tracking all their transactions for tax reporting.