- Bored Ape Yacht Club NFTs sink in price significantly.

- NFT sales for all markets tank.

- The debate surrounding the cause of waning NFT interest is undecided.

Bored Ape Yacht Club (BAYC) non-fungible tokens (NFTs) are now priced below 30 Ethereum, per data from NFTPriceFloor.com. This marks a significant reversal from peak NFT mania, as embodied by the $69.3 million sale of Beeple’s “Everydays: The First 5,000 Days” in March 2021.

During the mania phase, NFTs were thrust into the mainstream, regularly featuring on conventional media outlets and sparking discussion around the sums being asked for “just jpegs.” Fast forward to now, with BAYC seemingly losing its sparkle, the discussion points now center on whether NFTs are dead.

Bored of the Apes?

The chart below shows the BAYC NFT price floor at 28.45 ETH at the time of writing. At the start of this year, it was hovering at around 69 ETH, equating to a year-to-date (YTD) performance of -63%.

Sponsored

Zooming out shows the BAYC collection hit a peak floor price of 128 ETH in May 2022, equating to a 78% drawdown from its all-time high price.

Twitter personality DonAlt commented that BAYC’s price decline was “wild to watch.” He signed off the tweet asking his over 500,000 followers whether they think recovery is on the cards. Commenters to the tweet gave a mixed response, with some attributing the price decline to fragility within the broader economic landscape.

Yuga Labs released BAYC on the Ethereum blockchain in April 2021. The collection features 10,000 unique digital collectibles of cartoon-like apes that vary according to qualities such as clothes, eyes, and background.

Sponsored

The BAYC collection was further popularized by celebrity purchasers, including Neymar Jr., Steph Curry, and Justin Bieber, who all joined the bandwagon. However, A-list endorsement isn’t enough to halt waning NFT sales.

NFTs Sales Tank

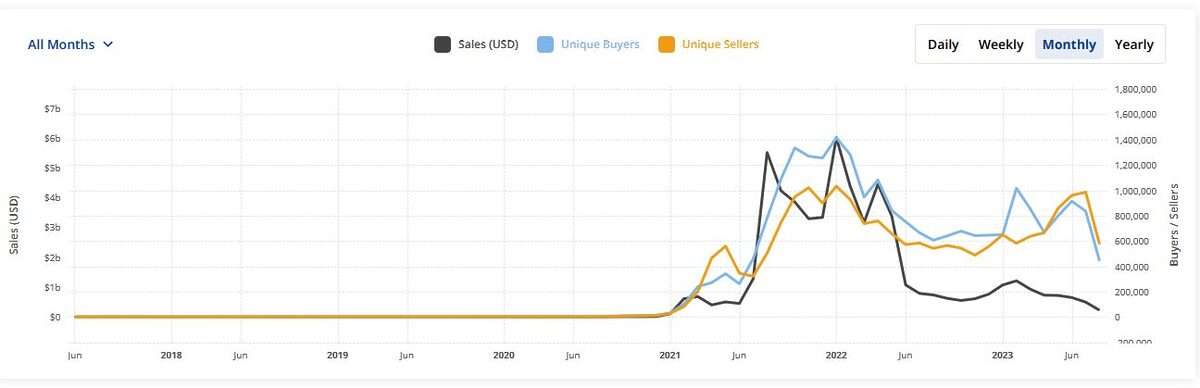

Data from CryptoSlam.io shows NFT sales have sunk to $221.2 million in August – marking a 31-month low for the sector.

The sector achieved peak monthly sales of $6 billion in January 2022. But since then, sales and interest have been trending downwards – with June and July seeing a sharp dip in buyers and sellers.

On the Flipside

- All high-risk speculative assets are subject to price pressure under the current macroeconomic conditions.

- Regardless of sliding prices and sales, the NFT value propositions of uniqueness and rarity remain intact.

Why This Matters

It’s unclear whether the NFT bubble has popped or whether broader economic factors are to blame. Either way, it is clear that “just jpegs” fall in priority during financial stress.

Find out more about the BAYC Nazi rumors:

Bored Ape Yacht Club in Hot Water Amid Nazi Allegations

Read about Coinbase’s Base chain getting in on NFTs:

Coca-Cola’s AI-Powered NFTs on Base: What You Need to Know