- Investment firm Neuberger Berman has filed with the SEC for a commodity-focused fund.

- If granted, the fund manager will join the likes of Goldman Sachs, Blackrock with exposure to crypto futures.

- Like other institutional investors, Neuberger Berman hopes to utilize cryptos as a hedge against inflation.

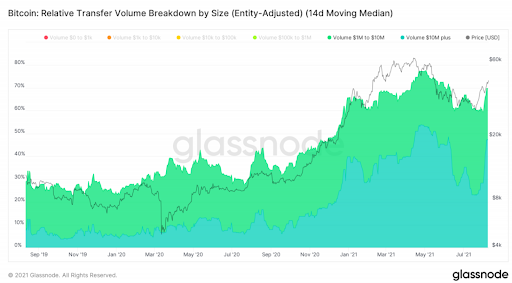

- We are currently witnessing the return of institutional investors; the on-chain transaction volume of Bitcoin, valued above $1 million, is now over 70%

Despite crypto’s market performance stealing the headlines, 2021 has been dubbed “the year of institutional investors.” The year has seen private banks, global fund managers, and pension/superannuation funds entering the crypto industry.

Neuberger Berman to Enter Crypto

Investment management firm Neuberger Berman, has filed with the securities and exchange commission (SEC) for a commodity-focused fund. If accepted, Neuberger Berman’s commodity strategy fund will be getting exposure to both Bitcoin and Ethereum futures.

Neuberger Berman currently manages more than $400 billion in assets. According to the firm, Bitcoin is worth “watching closely.” In a blog post, the firm explained that the move is designed to grow the fund’s use as an inflation hedge.

Institutional Investors Remain Bullish

The demand for crypto by institutional investors hit an all-time high in 2021. So far this year has seen the likes of Goldman Sachs, Blackrock, Morgan Stanley, the Bank of New York Mellon, JPMorgan, Tesla, State Street, and a long list of others, officially enter the digital assets space.

Following the May sell-off, institutional investment fell to its lowest point in 2021. However, we could now be seeing the big players return to the asset class. Data from Glassnode reveals that, in the first week of August, a staggering 63,289 BTC was transferred out of cryptocurrency exchanges like Coinbase, Kraken, and Binance.

Sponsored

Despite increased regulatory scrutiny of lawmakers faced by the crypto market, Joel Kruger, crypto strategist at LMAX Digital, has underlined that “investors are looking to the positives around regulation rather than the negative.”

On The Flipside

- Despite the bullish stance of institutional investors regarding crypto, the market is currently experiencing a brief correction.

- The likes of Bitcoin, Ethereum, Binance Coin, and Cardano are all down by at least 5% from the last 24 hours.

- The correction has seen the value of the industry drop from $2.1 trillion down to $1.8 trillion.

The Big Players Are Back

The involvement of institutional investors in cryptocurrencies brings reassurance about the true value and use of cryptos. The potential investment of Neuberger Berman can just be the final confirmation needed that the big players are returning to crypto.

The on-chain transaction volume of Bitcoin, valued above $1 million, has risen by more than 10% since the beginning of August. More importantly, it accounts for approximately 70% of the total value transferred.

According to Checkmate, a Glassnode analyst;

“Retail investors rarely move transactions [with values of at least $1 million] on a scale to create such dominance ….. The rising dominance also correlates with [massive] Coinbase exchange outflows since December 2020, which we also assign to likely US institutions”

Bitcoin transfer volume with values of at least $1 million over the last 14 days. Source: Glassnode.

The positive movement of institutional investors comes at a time when the crypto industry is faced with intense political and regulatory developments worldwide, such as the recent $1 trillion infrastructure bill in the U.S. This could be a good sign for the industry.

Why You Should Care?

The appearance of institutional investors in the crypto market has always heralded positive market reactions.