Earlier this month, JPMorgan announced its plans to launch a Bitcoin fund for its high-net-worth individuals.

It won’t be readily available to everyday retail investors and customers – only those at the top of the financial food chain.

In the past, JPMorgan’s CEO, Jamie Dimon, has called Bitcoin a “fraud” and the people who buy it “stupid.”

Sponsored

As recently as May 2021, he told the Wall Street Journal:

"I'm not a Bitcoin supporter, I don't care about Bitcoin. I have no interest in it. On the other hand, clients are interested, and I don't tell clients what to do,"

he said.

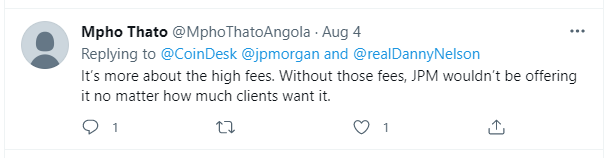

Apparently, clients were interested enough to force this reversal of fortune upon JPM and Dimon. JPMorgan’s move was embraced by some and mocked by many on Twitter.

Since Twitter is not necessarily known for its even and balanced reaction to anything, the DailyCoin reached out for exclusive perspective from investment advisor and syndicated radio host Chuck LaRocco.

Sponsored

LaRocco has 27 years of experience as a professional money manager and financial expert. He has received his C.R.C. (Certified Retirement Counselor) designation, Series 7 and 63, and is a Licensed Insurance Agent for Life, Accident & Health, and Variable Life/Variable Annuities. He’s also designated as a top ten advisor at Cadaret Grant, and he’s the Managing Partner at the Commonwealth Financial Group and is widely recognized as “The Money Doctor.”

LaRocco says the move by JPMorgan is surprising given Dimon’s infamous pledge in 2027 that he would fire anyone in his organization who traded in Bitcoin.

“I do find the move contrary to what Jamie Dimon said a couple of years, where he said [Bitcoin] was going to blow up and cause a tidal wave of people losing money. I think what’s happened is that due to cryptocurrencies’ popularity, especially among the younger generation, we have a case of the tail-wagging-the-dog and customers coming to JPMorgan demanding access to this asset class – pushing JPMorgan to create this Bitcoin fund,”

said LaRocco.

He added that this move by the largest bank in America clearly validates the investment viability narrative for Bitcoin, but he advises all investors to have a plan and not buy any asset based on emotion.

“People need to be goal-driven. The investments in their portfolio need to reflect what those goals are in the short- and long term. If an investor’s short-term goal is income, they shouldn’t invest in a bar of gold. If an investor’s goal is trying to protect against inflation, perhaps precious metals make more sense in that longer-term scenario.

It’s like when you follow a recipe. You’re only going to use the ingredients and instructions that result in your desired food – you’re not going to introduce elements that mess up the recipe. The same holds true with your investments,”

he said.

While LaRocco acknowledged that he’s not a blockchain expert, he says investors still need to use common sense, do their own research, and take the necessary precautions to protect their funds regardless of the investment instrument.

“Don’t view crypto as a short-term investment, it’s too volatile for that. Day traders in stocks get wrecked all the time and it happens in crypto as well. Use crypto as a long-term investment. Educate yourself on any asset before investing a dime and make sure you do your own research,”

he said.

On The Flipside

- JPMorgan’s move could result in more market manipulation in the future by big money moving into the space.

- It’s unlikely that we’ll be able to track transactions on the blockchain scanners since institutional investors are able to make their money moves over-the-counter.