The number of Bitcoin whales is growing again, however, the large crypto market players are less wealthy than before.

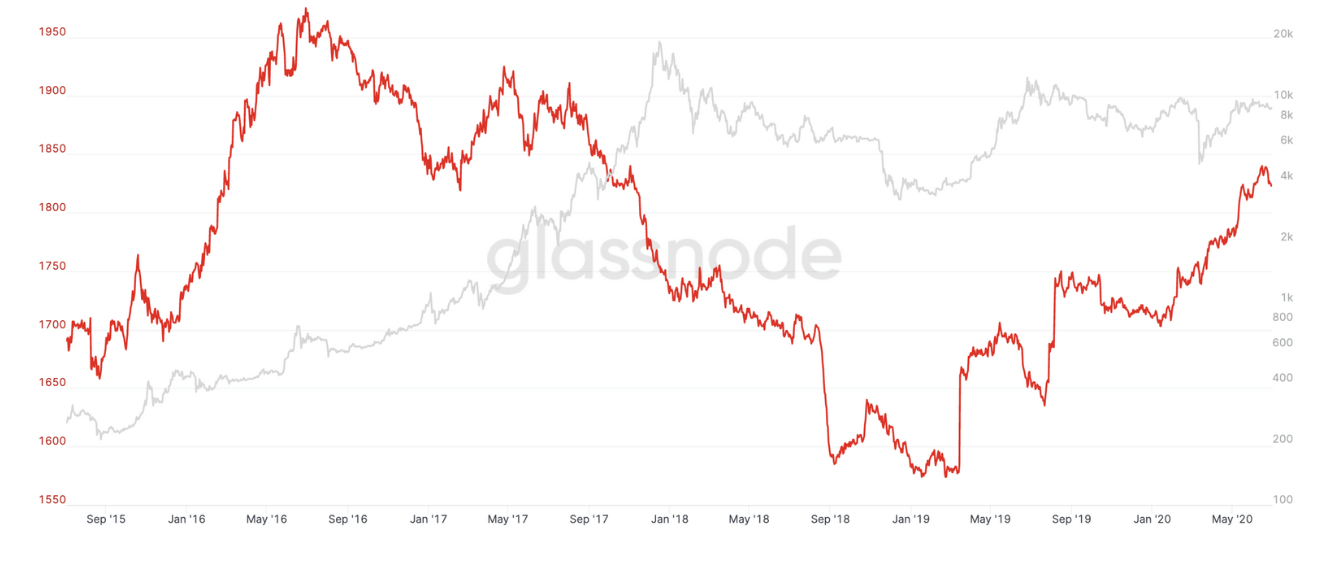

The total amount of Bitcoin whales grew for the first time since 2016 and is approaching the number of 1850, says the latest report from crypto analytics Glassnode, which also suggests that this fact may indicate the macro bullish trend.

Whales’ term is usually applied to the market players with significant funds that are able to move the cryptocurrency market. In Glassnode’s report, the same term defines entities with a balance of at least 1.000 Bitcoins. The definition does not include the cryptocurrency exchanges as well.

Sponsored

Thus the number of Bitcoin whales is increasing the first time since the decline in 2016. The mid-March global market crash marks the turning point of the trend with around 250 new whales emerging.

Whales less wealthy

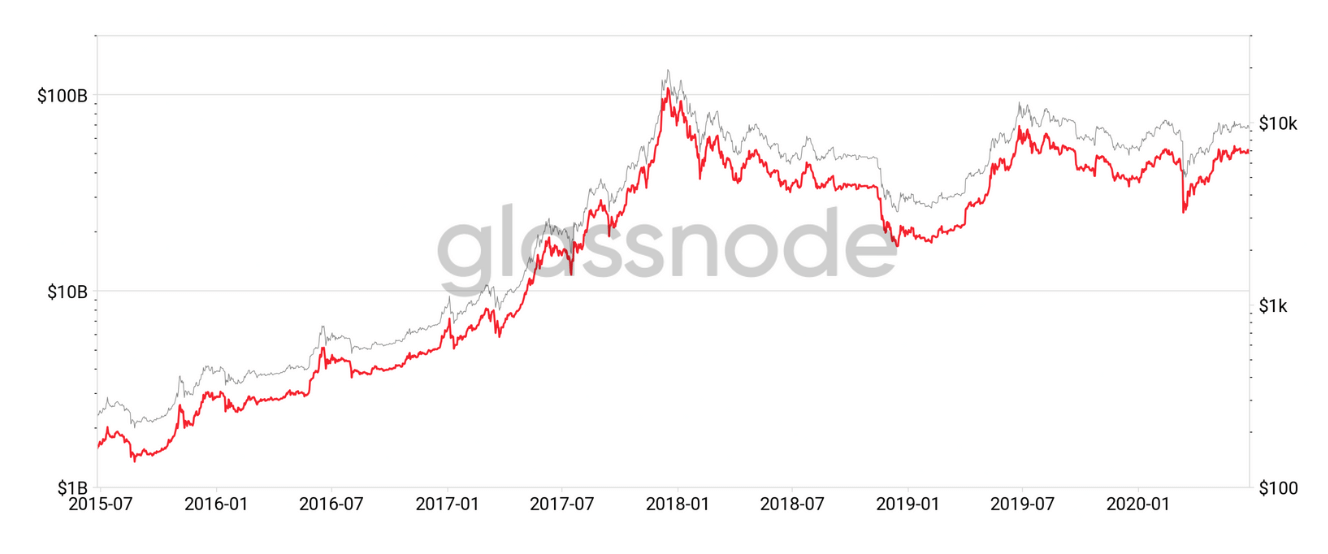

Moreover, following the increase in the whale population, the total number of Bitcoins held by these entities is also on the incline since 2016. In 2020 alone, the Bitcoin whale balance has grown from 5.2 million to almost 5.5 million. The report stated though, that the current balance is still below its peak of 2016:

Despite the increase in whale holdings this year, the balance of BTC held by whales is still well below the peak.

However, due to the increasing whale balance, the Bitcoin whale domination is currently seeing its largest sustained increase. The growth is the largest in almost a decade, the report stated.

Additionally, the research revealed that in terms of wealth Bitcoin whales are less rich today compared to 2017 when the leading crypto was at its peak and the price of it surpassed $19.000. This means that an average individual whale is not getting richer, despite the fact that currently there are more of them.

Where do the whales come from?

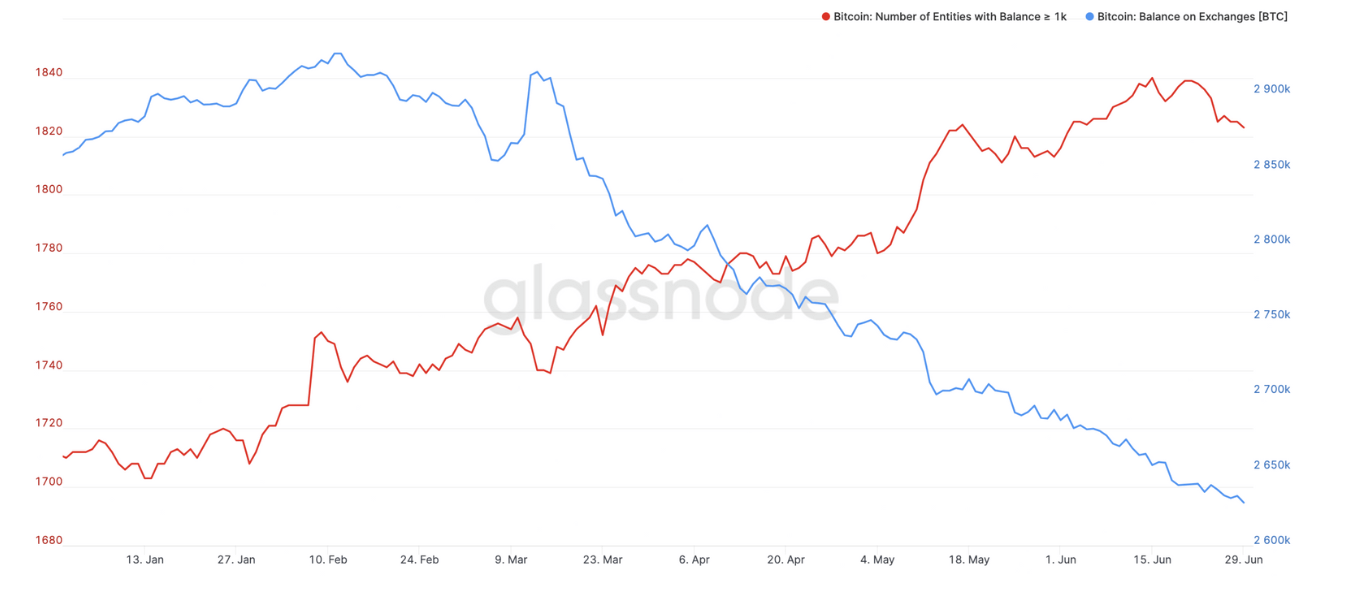

One of the main reasons explaining the growth of the Bitcoin whale population is attributed to the wealthy entities that are currently withdrawing their funds from the cryptocurrency exchanges.

Sponsored

The total balance of Bitcoin on exchanges has decreased significantly within this year, especially since Black Thursday in March, when the global markets sank in chaos and the world’s benchmark crypto fell by almost 50% within 24 hours.

The recent data confirm the growing downtrend of the exchange dominance in terms of Bitcoin balance and the simultaneously increasing number of new whales. Furthermore, the experts believe it could be the most convincing reason that explains the emergence of such a large number of new whales in a short amount of time.

The experts further believe that Bitcoin whales have used the Black Thursday market crash as “an opportunity to buy in at the bottom and then withdraw their Bitcoin to HODL for the longer term in anticipation of the next bull run”.

As DailyCoin reported before, the major part (60%) of Bitcoins – 11.4 million – are held by individuals or companies as a long-term investment, while only 3.5 million (19%) Bitcoins are moving across exchanges.