The first three months of the year were possibly the most difficult times in the history of cryptocurrencies. Especially for Ripple (XRP) as the coin was stated to be the worst-performing digital asset among other top virtual currencies except Bitcoin.

The leading cryptocurrency analytics firm Messari announced its quarterly report on cryptocurrencies last week. According to analytics, Ripple’s XRP virtual currency will continue to underperform for the second year in a row.

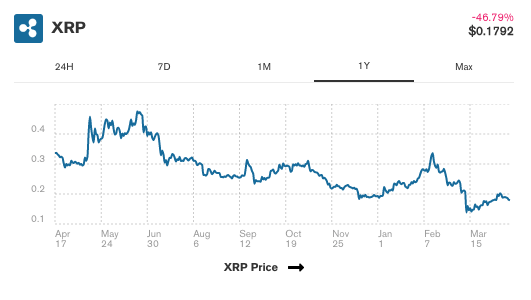

2019 was painful for one of the leading cryptocurrencies as it lost over 90% of its value. According to Messari, the XRP was dropped out of the top 3 by market capitalization as USDT ascended the ranks. However, the data of CoinMarketCap shows XRP is back in the third position with market capitalization being significantly thinned to around $8.2 billion. Meanwhile, the price is in the historical lows of $0.18 per coin.

What are the reasons?

Messari claims, that there are a verious reasons explaining such a situation. According to analytics, both internal and external factors might be blamed for the unsuccessful XRP performance this year.

Certainly, the coronavirus pandemic has played a key role. However it has affected all cryptocurrencies and Ripple alone is not an exception.

The inner reasons seem to be fundamental here. First to be the distrust that intensified earlier this year, after Ripple’s CEO Brad Garlinghouse admitted that XRP has to be sold if it wants to be profitable or cash flow positive. The fact indicated that Ripple is dependent on regular XRP sales to finance its operations. The topic is sensitive for the XRP community, as it has previously blamed Ripple for dumping XRP tokens to further affect its performance.

According to Messari, another critical factor that causes pessimism among the investors is uncertainty about the nature of XRP. This is due to a still open class-action lawsuit against Ripple, where the company is accused of unlawfully selling tokens as unregistered securities under US Federal law.

Long-term optimism

The analytics note, that although the nearest future might look opaque for the XRP, the long-term perspectives stay promising.

The company has recently taken some big steps into the cross-border payments market. The latest strategic partnership with the National Bank of Egypt opened the way into the North Africa market. A little bit earlier this year, the company announced its cooperation with a leading US-Mexico remittance service provider.

Since the new partnerships settled the company as one of the prominent players in the cross-border payment industry, institutional custodians showed their interest in it as well. DailyCoin reported previously that Anchorage, the member of Facebook’s Libra and Celo alliances, also offered XRP storage to its institutional investors.

In addition, cryptocurrency exchange Bitmex launched last month the XRP perpetual swap contracts onto its platform. The derivative product allows users to buy or sell assets at a specific price without an expiry date and is expected to help stimulate the XRP trading.