- The Crypto Market Cap has broken down below $1 Trillion after being unable to hold support.

- Over $300 million has been liquidated due to several developments in the cryptocurrency market.

- Bitcoin (BTC) has plummeted to below $20,000 on the back of negative news in the industry.

The crypto industry is in turmoil as the market cap struggles to find support. Many cryptocurrencies have fallen with it, leading to millions in liquidations. The recent downturn in the market can be attributed to a series of negative news stories affecting the sector, including the shutdown of Silvergate and a lawsuit against KuCoin regarding the alleged sale of unregistered securities. These events have had a significant negative impact on the market.

Market Cap Crashes After Local High

The market cap has undergone a downturn since exceeding the $1.04 trillion resistance level on February 21st, breaking below the $945 billion support level on March 9th.

The cryptocurrency market has taken a hit recently, with the total crypto market cap and Bitcoin (BTC) dropping significantly due to poor performances of major coins following highly negative news. Exchanges such as Coinbase and Huobi have also experienced a significant decline in value, while lawsuits have been rolled out to Kraken and KuCoin, further adding to the market’s instability.

Looking for Support After Liquidations

The leading digital asset, Bitcoin, has seen its price fall below crucial horizontal support levels, leading to the recent market crash. This decline has significantly impacted the rest of the market, as many other cryptocurrencies are heavily dependent on Bitcoin’s performance. In addition to poor market performance, faith among investors is low as multiple exchanges take hits.

Ethereum (ETH) has also experienced losses recently due to regulatory concerns. The New York Attorney General’s suggestion that ETH may be considered a security has further fueled the fire started by SEC Chair Gensler, leading to fear among investors and significant price drops. This has led to millions of dollars in liquidations.

Crypto Liquidations in the Last 24 Hours: Coinglass

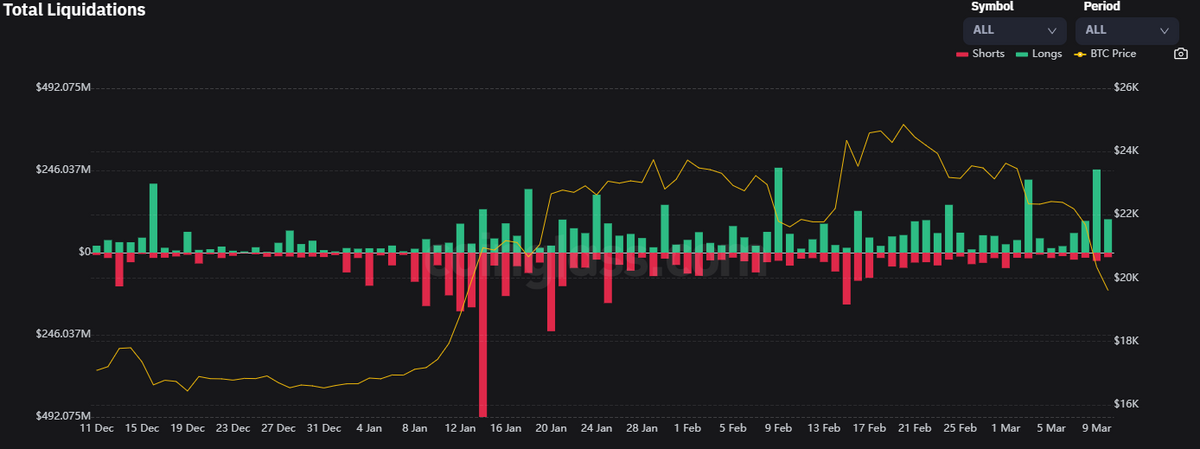

Over the past 24 hours, there have been over $370 million in liquidations, with Bitcoin being the most liquidated at $130 million, followed by Ether with $93 million. Almost all of the liquidations are from traders with long positions, who were not entirely unjustified in opening such positions, as the market had appeared to be building up momentum before the reversal.

On the Flipside

- Although longs saw most of the pain, those shorted also saw losses amounting to nearly $35 million.

- Despite the recent decline in the price of Bitcoin, the cryptocurrency has been at similar price levels in the past and is still up by approximately 20% from its lows in November 2022.

Why You Should Care

The recent downward trend in the crypto market, with Bitcoin and the total market cap both dropping, is a development that affects the entire cryptocurrency community.

Sponsored

The increasing amount of liquidations and ongoing lawsuits against major exchanges like KuCoin and banks such as Silvergate are causing uncertainty in the market, leading to short-term instability.

Read more about the ongoing KuCoin lawsuit and its potential impact on the crypto market:

KuCoin CEO on Silvergate: ‘Our Funds Are Safe’

Amidst a sea of red, XRP has held steady and outperformed many other coins. Read more here:

XRP Defies Bearish Crypto Market Amid SEC Updates