- PEPE’s unevenly-balanced combined order book is piling with selling orders.

- Derivatives traders see PEPE jump above SHIB and BONK with a volume of $58.35M.

- PEPE expands adoption with an immediate Bitstamp listing along LMWR & BLUR.

PEPE, the popular frog-inscribed memecoin piques the interest of the broader crypto markets again with a 7-day run of 22.9% gains. Tacking on Bitcoin’s (BTC) bullish wave, the memecoin outperformed the king crypto, which gained 16.8% in the same timeframe.

Previously battling liquidity issues, the latest blockchain data reveals a tremendous spike in the combined order book. PEPE’s Derivatives trading is also up 115% to claim $58.35 million in Derivatives trading volume over the past 24 hours.

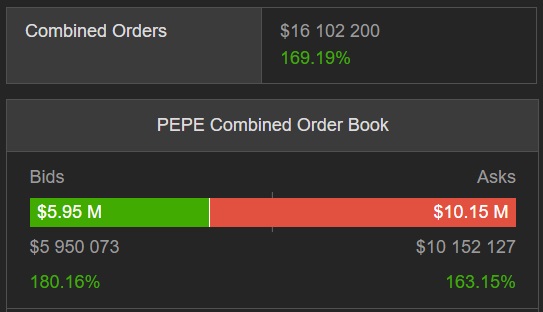

However, the scales between pending buys and pending sells are lob-sided to the bears’ advantage. Topping $10.15 million in pending sales in the last 24 hours, the uneven order book suggests that many PEPE holders are cashing out at the current price range, despite the 180% rise in crypto traders eager to buy PEPE, according to crypto research platform CoinPaprika.

While the selling pressure towers, it’s unclear whether the 11.9% price upswing will be enough to soften the blow, even though several key technical metrics remain positive. To illustrate, the Bollinger Bands on the 4-hour PEPE charts are widely expanded, hinting at a gradual consolidation of PEPE’s price with lower volatility.

PEPE Gets 115% Boost in Derivatives Trading Volume

While PEPE’s latest bullish impulse awakened spot trading investor interest, the Derivatives market is also thriving with an influx of $56.35 million in trading volume. In comparison, that’s substantially more than Shiba Inu’s (SHIB) $35.28 million or Bonk’s (BONK) $32.07 million in the same period, as per CoinGlass real-time blockchain data.

Short positions still marginally outweigh long positions, as the current ratio is 0.9505. OKX’s customers seem more bullish on PEPE, with an extraordinarily high 2.7 long versus short ratio. Meanwhile, PEPE saw a breakthrough in European adoption, as Bitstamp informed their Twitter audience of the token’s arrival.

Following the developments, the popular memecoin trades at $0.000001097, quickly approaching $500 million in market capitalization after a month-long hiatus. However, neither crypto bulls nor bears have an advantage to take control, as the Relative Strength Index (RSI) points to the status quo.

On the Flipside

- Despite the selling orders heavily outweighing the buy orders in the combined Spot order book, the 7-day PEPE whale transactions indicate a different sentiment among large holders, as 55% of whales are going long on PEPE, according to Hyblock Capital.

Why This Matters

Memecurrencies are known for high price volatility, therefore technical indicators provide a different perspective apart from social hype surrounding the coin.

Sponsored

Delve into DailyCoin’s top crypto news:

Sen. Warren’s Crypto Bill Draws Fire from Blockchain Association

How an XRP ETF Could Unleash the Full Potential of XRP