- Hong Kong Bitcoin and Ethereum ETFs launched on April 30.

- The Hong Kong BTC ETFs saw a decrease in valuation.

- In contrast, US BTC ETFs are booming.

The launch of spot Bitcoin ETFs in the US earlier this year marked a watershed moment for mainstream acceptance of digital assets. The highly anticipated US Bitcoin ETFs hit the markets in January to overwhelming demand, collectively reeling in multiple billions of dollars in net inflows to date as investors piled in.

Sponsored

In the hope of replicating this crypto investment boom, Hong Kong rolled out spot Bitcoin and Ethereum ETF offerings to much fanfare on April 30. However, just over two weeks later, the three funds comprising Hong Kong’s inaugural Bitcoin ETF market are now worth less than their closing value on debut day.

Hong Kong’s Bitcoin ETFs Falter

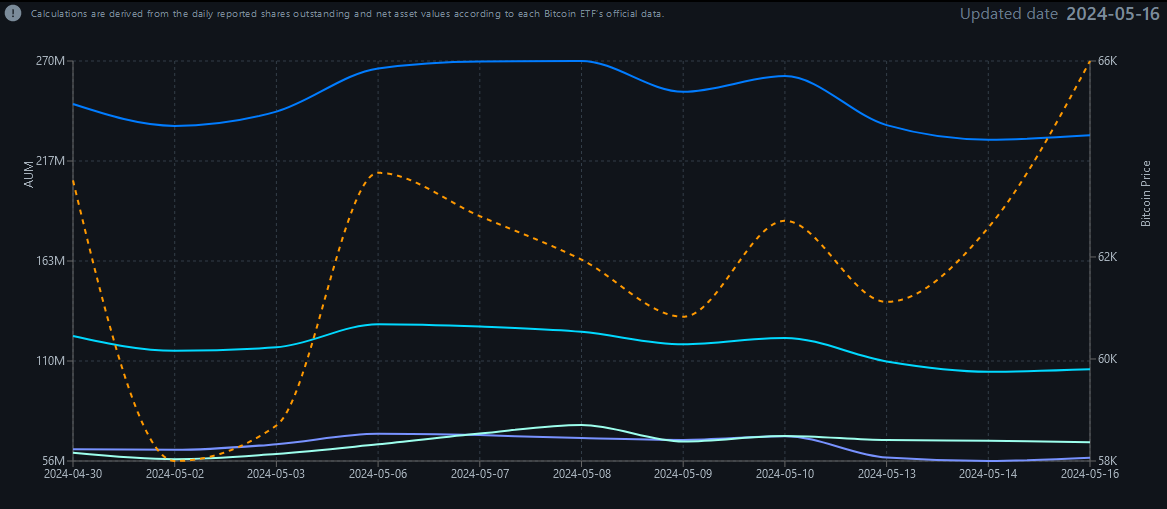

The total value of Hong Kong Bitcoin ETFs is now lower than on their debut due to BTC net outflows, which have reduced their assets under management (AUM) valuation. The total AUM of the BTC ETFs dropped from $247.7 million on the close of the launch date to $231 million as of May 16, according to data from Bitcoin ETF Fund Flow.

AUM fluctuates based on investor flows in and out of the fund and the price performance of the underlying assets it holds. For Hong Kong’s Bitcoin ETFs, the peak daily fund flow occurred on May 6, with $23.1 million entering the funds. However, fund flows have decreased since then, while outflows have picked up.

The biggest single-day outflow came on May 13, when investors collectively pulled $26.3 million from the funds. The rising redemption activity signals waning investor confidence in the short period since the products hit the market.

According to Le Shi, head of trading at market-making firm Auros, the tepid reception to Hong Kong’s crypto ETFs so far can be attributed to being “beaten to the punch by the US” in listing spot crypto products. Additionally, Shi cited “ongoing uncertainty about China’s intentions with regards to crypto” as prompting investors to caution or avoid Hong Kong’s funds.

US Leads The Way

Although the hostile US crypto regulatory landscape is a cause for investor caution, Bitcoin has been immune to the backlash, equating to a boom for spot BTC ETFs. Despite ongoing crackdowns and restrictions around other cryptocurrencies, American investors have flocked to the recently launched Bitcoin funds.

Sponsored

The combined AUM for all US Bitcoin ETFs skyrocketed from $29 billion on January 11 to $54.9 billion as of May 15, equating to an 89% increase in the total valuation of the participating funds over the period, while underscoring the investor demand and appetite for BTC exposure through regulated investment vehicles.

BlackRock’s IBIT fund has been the star performer among the US offerings. IBIT’s AUM exploded from $10.6 million on its debut to $18.1 billion by May 15.

Although Grayscale’s GBTC fund currently has a higher $19.1 billion AUM than IBIT, GBTC had a “head start” via its conversion from Grayscale’s Bitcoin Trust, which launched in 2013. GBTC has shed around $10 billion in AUM since Jan 11.

On the Flipside

- The Hong Kong crypto ETF products are closed to mainland Chinese traders. However, there is speculation that the products will be added to Stock Connect.

- Stock Connect is a China–Hong Kong cross-border access channel to trade and settle shares.

- More than 600 institutional investors have bought US BTC ETF products.

Why This Matters

The underwhelming debut of crypto ETFs in Hong Kong is a blow to its crypto hub plans. It raises questions about the region’s appetite for digital assets and potentially dampens efforts to attract more digital asset businesses and top talent.

Bloomberg’s James Seyffart gives his take on HK’s BTC ETF debut:

Analysts Evaluate Hong Kong Bitcoin ETFs’ Disappointing Debut

Bullish sentiment returns as crypto prices bounce back on better-than-expected inflation data:

Crypto Prices Rebound: Weekly Market Cap Gains Over $130B