- OPNX will shut down this month.

- The exchange experienced a significant drop in activity.

- The reputation of OPNX’s founders is an enduring legacy.

The crypto contagion that erupted in 2022 took down many centralized platforms, underscoring the industry’s instability and lack of safeguards. One of the key contagion factors was the collapse of the Three Arrows Capital (3AC) crypto hedge fund, which was declared insolvent in June 2022. The fund’s co-founders, Su Zhu and Kyle Davis, earned pariah status due to their alleged reckless high-risk trading and borrowing.

Despite that, the pair saw fit to launch a new venture with the CEO of the failed CoinFLEX exchange, Mark Lamb. The OPNX exchange went live in April 2023 and ironically specialized in tokenizing users’ bankruptcy claims against defunct platforms such as FTX, Celsius, and Voyager. But in a further twist of fate, OPNX has announced its closure in a notice to users.

Why Did OPNX Shut Up Shop?

OPNX posted a notice informing that it would cease operations this month. The notice stated that users are to withdraw their funds and export their transaction data by February 14. However, no explanation for the exchange’s closure was given.

Sponsored

“We are deeply thankful to each member of the OPNX community for their dedication and trust. As we conclude this chapter, we cherish the experiences shared and look ahead with gratitude,” stated the OPNX closure notice.

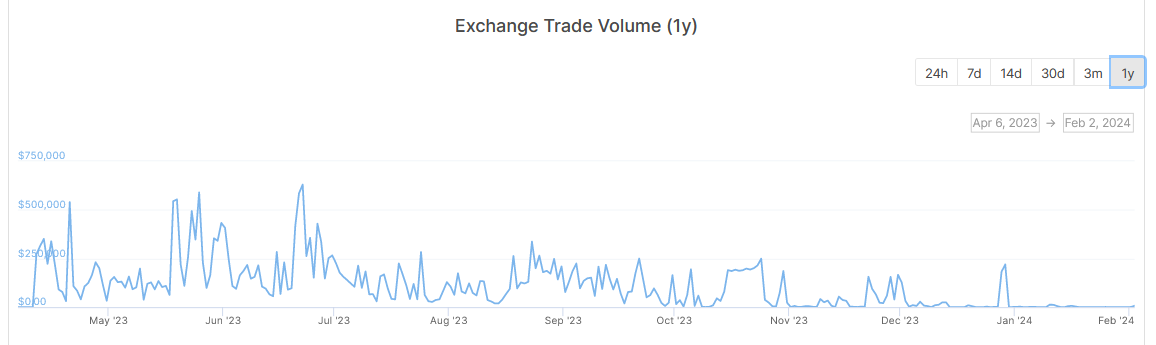

Data from CoinGecko showed OPNX’s daily spot trading volume had thinned significantly in January, ranging from a few hundred dollars to a peak of $12.7k on January 12. This lack of activity stands in contrast to the exchange’s opening months, which saw an all-time high daily spot volume of $630k on June 22, 2023.

Since the June peak, trading volume has tailed off significantly, leading to a flat line activity rate from November 23 onwards. Sporadic spikes occasionally broke this, but it is clear that users have moved on.

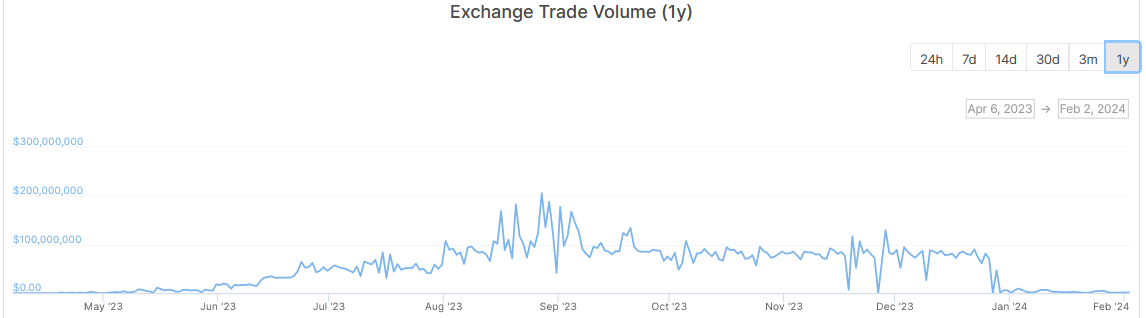

The story is similar to OPNX’s derivative trading volume, which flat-lined from January onwards, turning over just $949k on February 1. For comparison, market leader Binance turned over $33.4 billion in derivatives trading volume over the last 24 hours.

While anemic trading volume appears to have starved OPNX’s operations, the exchange has always been fighting an uphill battle for legitimacy in the eyes of a skeptical crypto community still embittered by 3AC’s actions.

3AC Tarnished

Given 3AC’s central role in catalyzing crypto’s 2022 downward spiral, OPNX launching under Zhu, Davis, and Lamb’s leadership was initially met with an immediate backlash. Commenting on the exchange’s bankruptcy tokenization process, one X user stated that while it seemed like an innovative approach to help users with stuck liquidity, he would “never support” the OPNX co-founders.

This sentiment was echoed by others, including “Doctorwhat.eth,” who considered OPNX “doomed to fail right from the start,” adding that he has no sympathy for investors who backed the project.

Researcher FatManTerra opted to target Lamb’s credibility by bringing up his decision-making skills in allowing Roger Ver “a non-liquidation margin account,” ultimately leading to the collapse of CoinFLEX.

Zhu and Davis were imprisoned in September 2023 for four months on charges of evading investigations into 3AC’s collapse. During a recent interview, Zhu described his prison experience as “magical” and conducive to restful sleep. These statements were widely criticized and led to a loss of sympathy for the pair.

All in all, the baggage carried by OPNX’s originators engendered the opposite of community confidence, making the exchange a hard sell from the off.

On the Flipside

- Court documents showed that 3AC owes its 27 creditors $3.5 billion.

- OPNX’s Open Exchange (Ox) token fell 25% over the last 24 hours at the time of writing.

Why This Matters

The demise of OPNX after less than a year of launching raises pressing questions about the judgment of its founders and the viability of exotic crypto financial constructs. The irony of its bankruptcy claim focus only amplifies this reality.

Read about OPNX’s run-in with Dubai authorities here:

Dubai Regulator Slaps OPNX with $2.7M Fine; FLEX & OX Tumble

Find out more on the pushback against Coinbase’s appointment of George Osbourne here:

Coinbase’s Hiring of Former UK Chancellor Draws Disapproval