- The court has released Sam Bankman-Fried’s trial schedule.

- SBF faces an eight-count charge, including wire fraud and money laundering.

- The trial is expected to last four to five weeks but may extend further.

Former CEO Sam Bankman-Fried has been caught in the crosshairs of legal battles since the collapse of the now-defunct exchange FTX.

Sponsored

Currently incarcerated at the Metropolitan Detention Center, the disgraced CEO awaiting trial since his indictment will appear before the judge and a jury starting October 3rd.

SBF’s 21-Day Trial

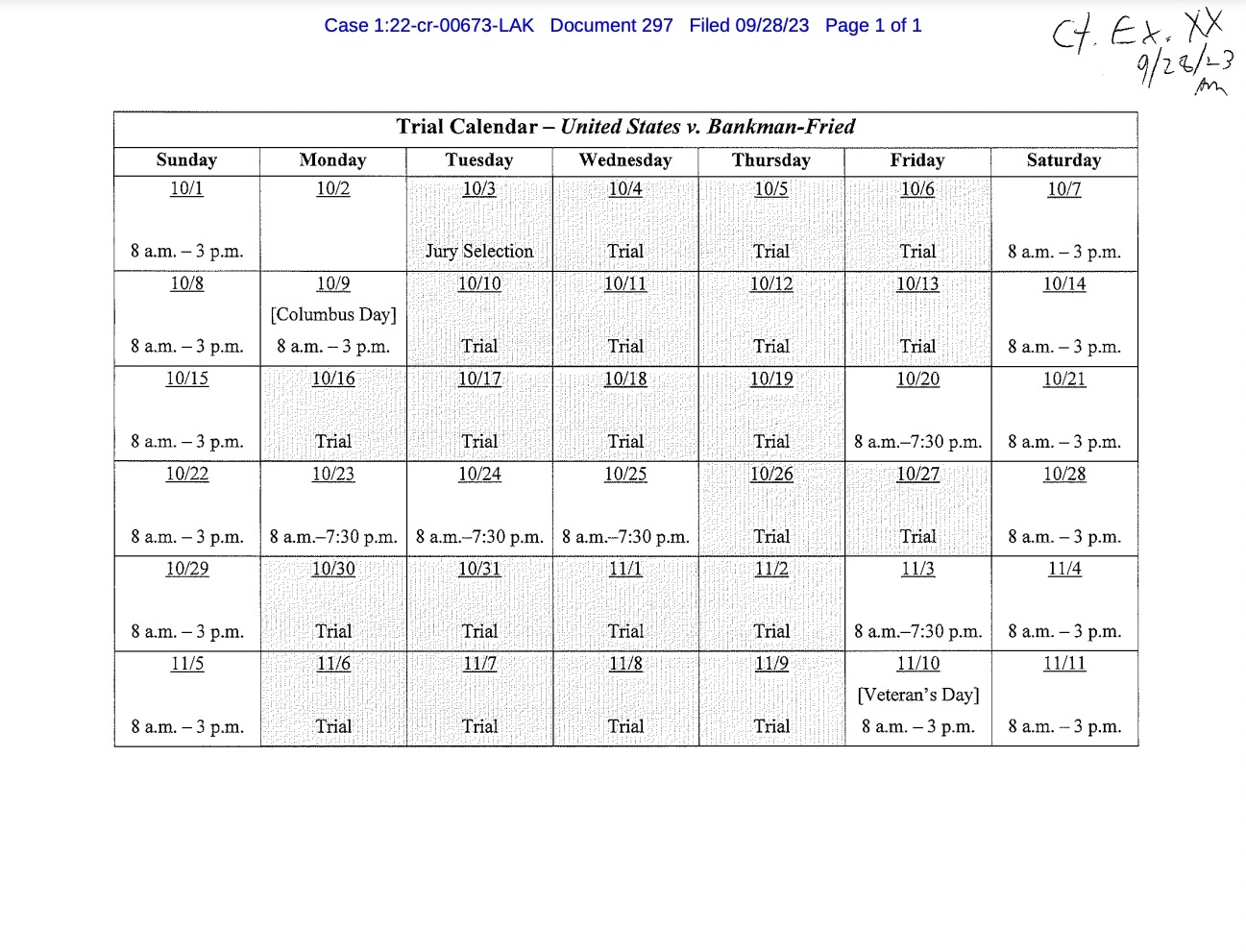

According to a recently released court trial calendar, SBF’s trial will commence on October 3rd. Officially titled United States v. Bankman-Fried, the trial is expected to span from October through the first week of November, lasting 21 days.

The trial’s first day will involve jury selection, followed by the case’s opening arguments projected for October 4th. The schedule highlights several breaks during which no court sessions will be held, such as October 20th to 25th, November 3rd, and 10th.

At a hearing held on September 28th, both the prosecution and defense presented the estimated durations of their cases. While the Department of Justice estimated the trial would span four to five weeks, Mark Cohen, who represents Bankman-Fried, emphasized that the defense’s case is more streamlined and may require an additional week and a half for the charges.

A Litany of Charges

The collapse of FTX resulted in a range of charges for the disgraced CEO, totaling 12 criminal charges filed by the U.S. Department of Justice.

Sponsored

The charges against him originally included eight counts of fraud and conspiracy, charges of misappropriation of billions from FTX customer funds, and illegal political campaign finance. However, the Department Of Justice dropped the illegal political donations charge, reducing his charges to the eight he was originally indicted for.

The upcoming trial will see the FTX founder tried for money laundering, fraud, and conspiracy charges as filed by the U.S. Department of Justice and the Securities and Exchange Commission’s charges, including securities law violations and theft.

Guilty Or Not?

In January, SBF pleaded not guilty to all fraud and money laundering charges before U.S. District Judge Lewis Kaplan in Manhattan federal court.

He emphasized not being responsible for any wrongdoings leading to the FTX collapse and argued that he didn’t intend to commit fraud. However, he admitted to committing errors while running the company.

SBF’s legal team doubled down on his not-guilty plea in May, arguing that the federal criminal charges against the FTX founder violated the terms of his extradition. The lawyers moved to dismiss ten charges against him, adding that some may result in unfair prejudice against him during the trial.

However, four of the exchange’s top executives have pleaded guilty to similar criminal charges. These developments will contribute significantly to the legal proceedings and the judgment.

What Will SBF’s Fate Be?

According to federal statute, a conviction for a single count of wire fraud is punishable by up to 20 years. Due to the combined maximum sentence of the eight counts filed against him, Sam-Bankman Fried could potentially face a staggering 115 to 155 years behind bars if declared guilty by the federal court.

The 30-year-old has a slim chance at victory and is at risk of spending the remainder of his life in prison. However, the outcome hinges on the trial proceedings and how the judgment unfolds.

On the Flipside

- SBF’s top associates, Caroline Ellison and Zixiao Wang, both pled guilty to criminal charges against them.

- In July, prosecutors accused Bankman-Fried of leaking the former Alameda chief’s diary to discredit her as a trial witness, but he denied the allegations.

- In an attempt to recover millions of dollars, FTX has gone on a litigation spree, initiating a series of lawsuits against various individuals, including SBF’s parents.

Why This Matters

Sam Bankman-Fried was once a prominent figure in the cryptocurrency industry, and the outcome of the high-stakes trial will undoubtedly resonate across the global crypto industry.

SBF said his piece about the fall of FTX and his ongoing legal case. Read more:

SBF’s Unposted Twitter Thread Leaks: I’m “Broke” and “Hated”

Cryptocurrency exchange Gemini founders are under scrutiny for suspicious withdrawals months before Genesis Global’s bankruptcy. Read more:

Gemini Founders’ $282M Withdrawal Questions Credibility