- Cryptocurrency exchange Gemini allegedly withdrew millions of dollars from lending company Genesis Global.

- The lending company filed for bankruptcy in 2023.

- Gemini has revealed plans to expand its services in India.

Over the past year, cryptocurrency exchange Gemini has been embroiled in several legal battles with the now-bankrupt crypto lending company Genesis Global and its parent institution, Digital Currency Group (DCG).

The exchange, which filed a lawsuit against Genesis in January, was scrutinized for its alleged involvement in suspicious transactions months before the lending company’s bankruptcy.

Suspicious Movement of Funds

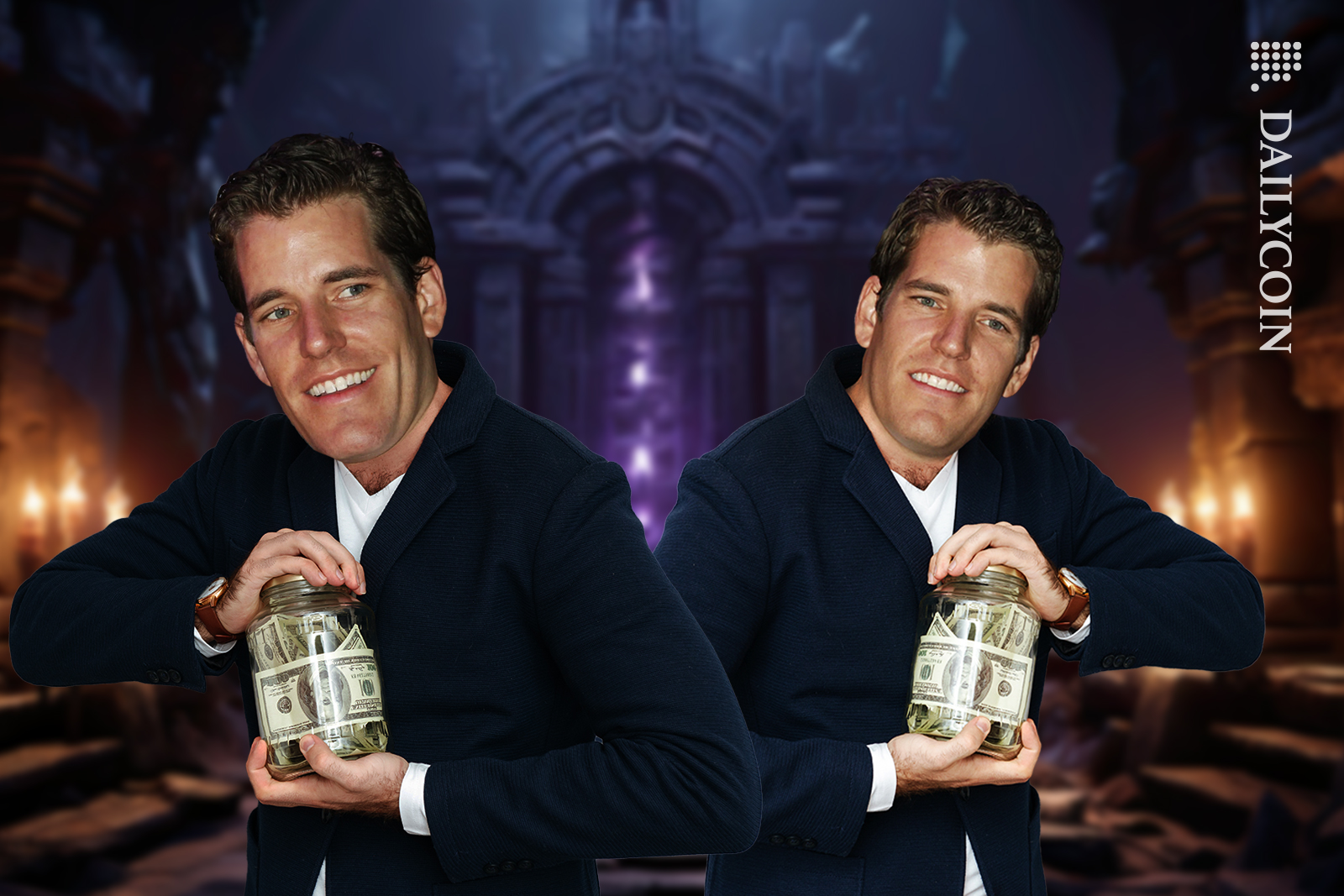

According to a Bloomberg report, Gemini founders Cameron and Tyler Winklevoss secretly withdrew $282 million from Genesis Global months before the institution froze investor assets.

Sponsored

The withdrawal was allegedly aimed at establishing a reserve to facilitate immediate redemptions for participants of Gemini’s ‘Earn’ program, a joint investment venture that allowed users to invest and loan crypto assets through Genesis.

A spreadsheet dated August 8th, 2022, revealed that the funds, including 3,120 in Bitcoin, 18,060 in Ether, 49.6 million in Dogecoin, and more than 142 million worth of Gemini’s stablecoin (GUSD), were retrieved as personal assets of the Winklevoss twins, not customer funds.

This move has raised questions about the credibility of the exchange and its founders, as users wonder to what extent they were aware of Genesis’ precarious financial situation and looming bankruptcy and, thereby, whether they were knowingly jeopardizing customer assets.

Genesis Bankruptcy Fallout

In January 2022, Genesis Global filed for bankruptcy after the infamous FTX collapse, freezing over $3.5 billion in user assets, including those of Gemini’s Earn investors. The suspension of withdrawals on Trust Earn accounts followed suit, leaving investors’ funds inaccessible.

Sponsored

What ensued was a legal battle between the former partners. Alleging an unfulfilled $900 million debt in users’ assets, the Gemini founders filed a class action lawsuit against Genesis, demanding recovery of funds amid claims of reluctance on the debtor’s part to engage in constructive dialogue. A subsequent charge accused DCG CEO Barry Silbert of accounting fraud and demanded his immediate removal from the firm.

The turmoil fueled rumors of potential bankruptcy for the exchange and several internal struggles, including a marked decline in trading volume and employee layoffs.

However, despite the difficulties, Gemini seems to be set on expanding services beyond its current base.

Gemini Planning Expansion in India

Gemini has unveiled plans to invest $24 million in the Indian market to expand its regional presence over the next two years.

According to the official release, Gemini aims to capitalize on India’s favorable startup ecosystem to foster the growth of a vibrant Web 3 ecosystem. This decision follows the acquisition of a trading license in 2020 and the exchange’s recent launch of an Indian technology development initiative in May.

Pravjit Tiwana, the Head of Asia-Pacific, emphasized, “India is undeniably a global hub for entrepreneurship and technological advancement. We are excited to establish Gemini’s presence in India as we continue our mission to unlock the next era of financial, creative, and personal freedom through crypto and Web3 innovation.”, reaffirming the exchange’s commitment to impacting the global crypto industry.

On the Flipside

- The Winklevoss twins have yet to respond to the allegations.

- Genesis filed its lawsuit against parent company DCG in September over an alleged unpaid $610 million debt.

- Gemini and Genesis faced charges from the SEC in January for unlawful sales of unregistered securities.

Why this matters

Cameron and Tyler Winklevoss’ withdrawals before Genesis Global’s bankruptcy raises questions of contradictions in the ongoing legal case and cast doubts on Gemini’s reputation as a trusted cryptocurrency exchange.

Read more on Genesis and DCG’s ongoing legal battles:

Genesis Sues Parent Company DCG over $610 Million Debt

Binance Co-founder Yi-He breaks silence on the exchange’s regulatory struggles:

“Do or Die:” Binance Co-Founder Makes Rallying Statement