The largest digital currency asset manager Grayscale Investments said institutional investors are interested in the world’s second-biggest digital coin.

As Michael Sonnenshein, managing director at Grayscale Investments told Bloomberg, Grayscale sees a growing new group of investors that are mostly or only interested in Ethereum (ETH).

According to him, Ethereum which is the most actively used blockchain network becomes more and more accepted as an asset class.

Over the course of 2020 we are seeing a new group of investors who are Ethereum first and in some cases Ethereum only. There is a growing conviction around Ethereum as an asset class.

Ethereum (ETH) trades at $595 at the time of publishing and is up about 300% year-to-date (YTD), according to CoinGecko. It’s price strongly increased in July during the DeFi (Decentralized Finance) boom when the whole dApp industry went wild.

Sponsored

Decentralized finance projects are mostly built on Ethereum and were on fire this summer. The total value locked on Ethereum network was breaking records.

Grayscale Ethereum Trust

Grayscale Ethereum Trust (ETHE) is the company’s second most popular cryptocurrency trust after the leading Bitcoin Trust, which has accumulated over $10 billion worth of BTC under its management until December 2020.

According to Grayscale, the Trust which provides investment exposure to the Ethereum processed $1,581.6 million worth of ETH and saw it’s one of the best performances this November as well.

Sponsored

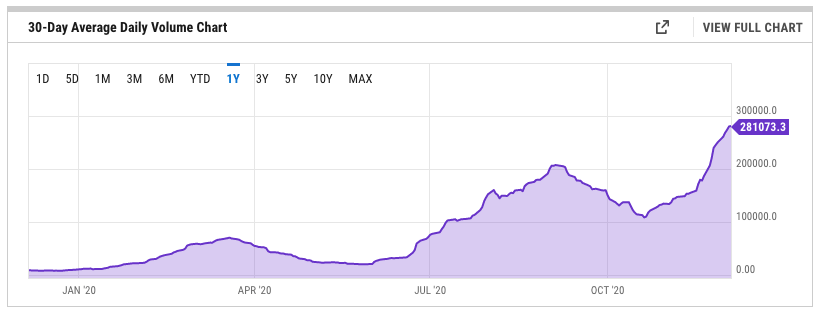

ETHE reached its all-time high trading volume within the past month, shows the statistics from YCharts. It’s 30-day average daily volume is over 281 million at the time of writing.

ETHE reached its all-time high trading volume within the past month, shows the statistics from YCharts. Its 30-day average daily volume is over 281 million at the time of writing.

Grayscale’s Ethereum Trust became a Securities and Exchange Commission (SEC) reporting company this October. The move is believed to increase ETHE’s transparency and liquidity. Meanwhile, it’s investors will be able to sell their assets after a 6-month lock-up, which previously lasted up to 12 months.