Chainlink, the decentralized oracle network surged up by over 63% during the past 7 days. The significant spurt of this weekend brought decentralized finance (DeFi) industry to the new record highs.

The hype of the DeFi boom doesn’t show signs of slowing down. The industry has been on fire for the past three months as the total value locked in DeFi increased fourfold since the beginning of June and the total market capitalization surpassing $11.5 billion.

According to the data of CoinGecko, the DeFi market capitalization is $11.69 billion at the time of publishing. The number includes the data of 100 top decentralized finance coins, Chainlink (LINK) being the main value generator with 44.4% DeFi market dominance.

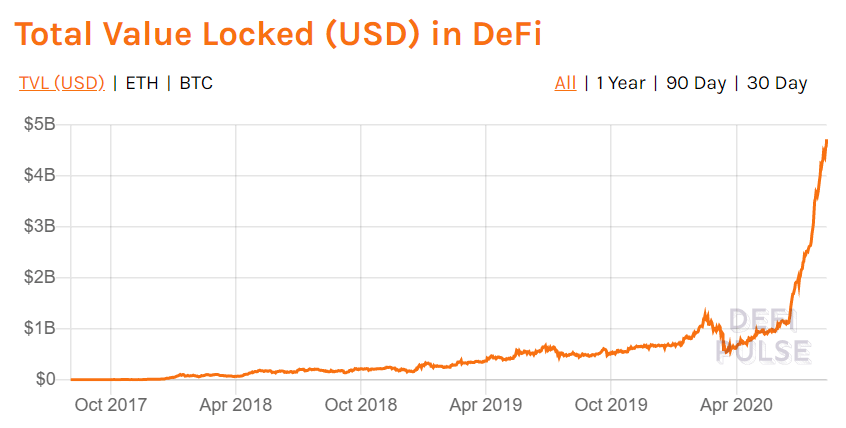

Meanwhile, the total value locked in the DeFi projects grew monumentally during this summer. The industry lost half of the total value locked in it due to the mid-March global market crash and accounted for around $500 million at the time. However, since then the total value locked in DeFi increased significantly and accounts over $4.72 billion at the time of publishing.

Sponsored

According to the data of DeFiPulse, the incredible spurt started in June, when the industry crossed a $1 billion milestone and has run rampant since then. The total value locked in the trending DeFi projects increased up by 4 times in just three months.

The role of Chainlink

Chainlink, the decentralized oracle network has been the major value generator for the DeFi industry lately. It’s native token LINK increased by more than 120% during the past 30 days, 64.5% growth alone recorded for the past 7 days.

The LINK increased by more than 50% from $9.55 to its an all-time high of $14.16 within Friday evening and Saturday night as shown in the data of CoinGecko. The coin respectively is the top DeFi project with over $5.1 billion market capitalization, far more surpassing its nearest competitor Maker with the $561 million market cap.

The surge resulted in Chainlink’s market capitalization crossing the $5.4 billion mark today. The impressive growth showed a nearly $1.6 billion increase in less than 48 hours. With current numbers LINK is one of the best performing DeFi assets, being the biggest DeFi project and the 6th among the Top-10 cryptocurrencies by market capitalization.

Sponsored

According to the data of Santiment, Chainlink’s active daily addresses also hit the new records of 22.6k t this weekend.

Although the impressive bull run on might be explained by the number of partnerships and integrations that the company announced recently, the cryptocurrency market insiders suspect the massive short squeeze fueled the LINK’s price rally.

A short squeeze occurs when the asset price rises rapidly and the traders with short contracts are forced to quickly sell their borrowed assets to avoid even higher losses. Meanwhile, their efforts to sell as soon as possible only increase the upward pressure on asset prices.

One of the suspected short contract holders on Chainlink, the fake investment company Zeus Capital recently stepped into the spotlight with the persistent announcements blaming Chainlink of the pump and dump fraud.

The company however was soon disclosed by one of the Chainlink supporters to be the fake cover for another financial company with short positions on LINK.